- Cardano has been on the rise this week, but is still down by more than 35% in the last month.

- On-chain data shows substantial whale accumulation, which provides significant support.

- Much still depends on market bellwether Bitcoin and Cardano network development.

Cardano’s native token, ADA, has begun to stabilize after plunging to one-year lows around $0.41 earlier this month. Over the past five days, it has climbed approximately 5%, reaching $0.4315, a modest but encouraging uptick amid broader market volatility. Nonetheless, ADA price is still down by 35% in the last month.

Tracing the Recent Price Dip and Rebound

ADA price dropped to $0.413 on November 26, a 13.3% drop for the week, because of network problems and less interest in altcoins. Bitcoin’s strong position made things worse, with ADA down over 30% since the start of the year. But things have changed in the last five days. On November 27, it went up 3.5%, with trading volumes reaching $617 million, which suggests people are interested again.

This looks like a typical capitulation situation, where prices bounce back after being oversold. If you own ADA, this might be a welcome change, especially with its market valuation holding steady at $15.48 billion.

On-Chain Metrics Signal ADA Price Resilience

What truly underpins this recovery? On-chain data reveals a network quietly gaining traction. Santiment reports a surge in whale accumulation, with large holders netting 348 million ADA below $0.50 since early November.

The number of daily active addresses is up 8% from last week, around 45,000, and transaction counts are up 15.7% in Q3. Transfer volumes are quiet at $150 million per day, but liquidity is stabilizing. Plus, the total value locked (TVL) in DeFi has hit a three-year high of $320 million, thanks to new dApp integrations.

These metrics point to some underlying strength. Whale buying is balancing out worries from smaller investors, and rising TVL means developers are sticking around. Exchange flows are neutral, with some outflows suggesting people are taking profits. If activity on the network increases, the price rise could be real. If not, low volumes might limit gains.

Sustainable Rally or Deeper Correction Ahead?

So, is it worth holding ADA through this? If Bitcoin stays above $90,000, analysts are cautiously optimistic and think it might reach $0.50 to $0.65 by the end of the year. Whale purchases and TVL growth show that on-chain resilience is strong, which supports the idea of endurance and could even outpace slower rivals. Yet risks persist: persistent network delays could erode sentiment, and a Bitcoin pullback might drag ADA price lower, amid weakening metrics.

In addition, the forthcoming launch of the Midnight sidechain will bring privacy features to Cardano that will enable development of dApps that focus on safeguarding sensitive data. That could increase utility of ADA and help boost the demand and price.

Cardano Price Chart

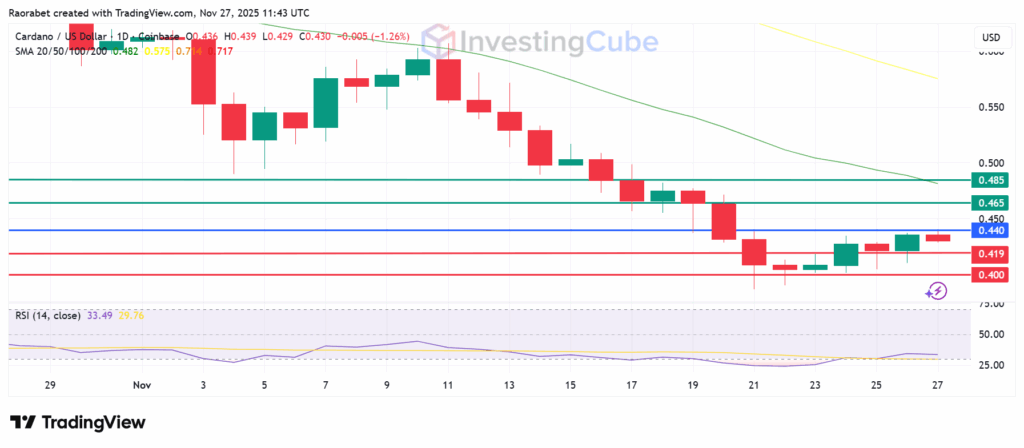

ADA price is trading around $0.430 on the daily chart, which is below the 20, 50, 100 and 200 SMA, affirming the downside momentum. The pivot mark is at $0.440 and the coin will likely find its initial support at $0.419, with the second one likely at the psychological $0.400.

On the upside, the RSI at 33 is near oversold territory, creating a basis for some gains. Initial resistance will likely be at $0.465. If the price breaches that barrier, the resulting momentum could send the action higher to test $0.485, above the 20-day SMA.

ADA/USD daily chart on November 27, 2025 with support and resistance levels. Created on TradingView

The upcoming launch of Midnight, a privacy-focused sidechain, in December is anticipated to be a major catalyst. Its success in boosting Total Value Locked (TVL) and adoption is crucial for sustainable growth.

On-chain data shows that major players, especially whales, are buying up lots of ADA while prices are low. This implies they think it’s a good deal right now.

Whale activity is up, TVL reached a three-year high of $320M, active addresses rose 8% week-over-week, and transaction numbers increased 15.7% quarter-over-quarter, which points to solid fundamental strength.