Crude Oil prices are trading flat for the day after the release of the weekly oil market report published by the US Energy Information Administration (EIA). Crude oil price jumped to the highest level in a week at $57.62 following the release, but soon the positive impact of the EIA data faded away and the crude oil price went down 1.3% at $56.40 making new daily low. The EIA weekly report showed that commercial crude oil inventories decreased by 10.8 million barrels in the week ending July 19 compared to analysts’ expectation for a decline of 4 million barrels.

Crude Oil price was trading higher from the start of the week amid increasing tensions in the Middle East that continue to threaten the world’s transport of crude oil. Last week, Iran seized two British oil tankers in the Strait of Hormuz and the UK is now weighing options of responding to the latest act of aggression by Iran. This seizure follows a series of skirmishes between both countries in recent weeks in the Middle East.

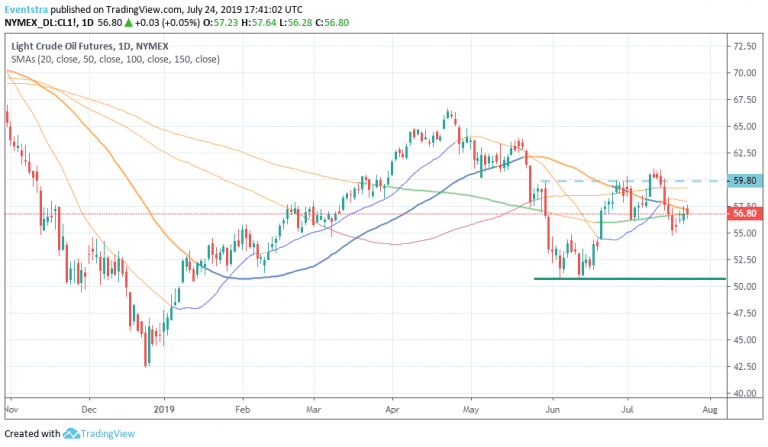

On the technical side crude oil is trading 0.04 percent lower at $56.74 making the daily high at 57.64 but failed to hold the gains and retreated lower breaching the 50 day moving average at 57.15. If the price breaks convincingly and close above the 50 day moving average, the way to 57.94 the 20 day moving average will be open. On the downside crude oil immediate support stands at 56.75 the 150 day moving average while more bids will emerge at 55.12 the low from July 19th. The technical picture is neutral for black gold and the failure today to cash out the bullish inventories news from EIA is a negative sign.Don’t miss a beat! Follow us on Twitter.