- Discover the fundamental factors affecting the Brent Crude oil prices with a technical outlook amid the waited meeting for OPEC+.

During the European session, the Brent crude oil exchange rate was relatively bullish, opening up from the $63.76 price on Tuesday to its current trading at $63.90 at the time of writing.

The OPEC+ meeting is scheduled later on Wednesday. The market is anticipating no change in their policy of increasing output. So the price gains were capped in response to the anticipated OPEC+ decision.

On the other hand, the threats made by Trump to a new sanctions on Russia, supported the price to open higher than yesterday’s closing because these sanctions may put the Russian energy flows at risk.

OPEC+ will meet again next week and is likely to agree to increase output further, which will be a headwind for crude prices. Additionally, if the ongoing Iranian and US talks add barrels to the possible US deal.

However, the Iranian and us fifth round of talks, which took place last week in Rome, signaled limited progress, and there were many points of disagreement that were hard to breach, especially Iran’s uranium enrichment. Therefore, the market is trying to assist in these actions to price in the Brent crude oil.

The Technical Outlook for Brent Crude Oil:

The Brent crude oil is under the pressure of risks associated with the further sanctions against Russia, and is also waiting for the OPEC+ decision, besides the ongoing Iranian-US talks.

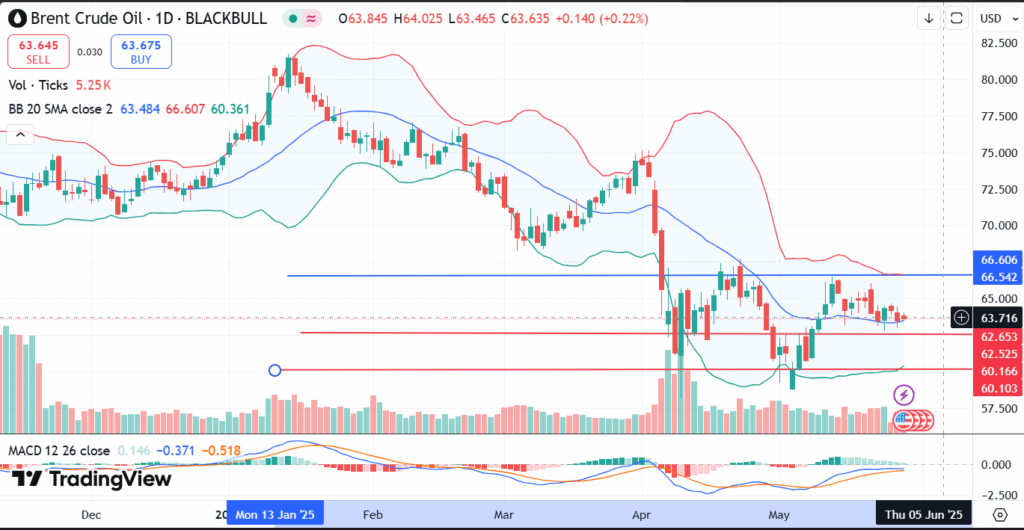

From the technical perspective on the daily time frame, the Brent crude oil is now trading under pressure of the resistance level at $66.54, and trading now at $63.71. The bearish outlook for Brent crude oil is highly recommended. Any clear daily close below $63 flat may open the way to reach lower support levels towards $62.65 and then $60.16.

On the flip side, if the price breaks out the resistance level at $65.00, this will open the door to reach higher levels towards 66.56, which is strong resistance, and any break above it may allow the price to go up, but this scenario is not highly recommended amid the fundmental factors mentioned above.

You can also check Crude Oil Price Struggles amid Geopolitical Tensions