- Spot silver surged over 5% today, hitting a new all-time high of $120.45 per ounce as investors flood into precious metals.

- The metal has skyrocketed more than 60% so far in 2026, drastically outperforming gold’s already impressive run.

- Global supply deficits are becoming acute, with cumulative shortfalls reaching nearly 820 million ounces as industrial demand competes with a retail safe-haven frenzy.

- Citigroup has aggressively raised its short-term price target, suggesting silver could hit $150 per ounce within the next three months.

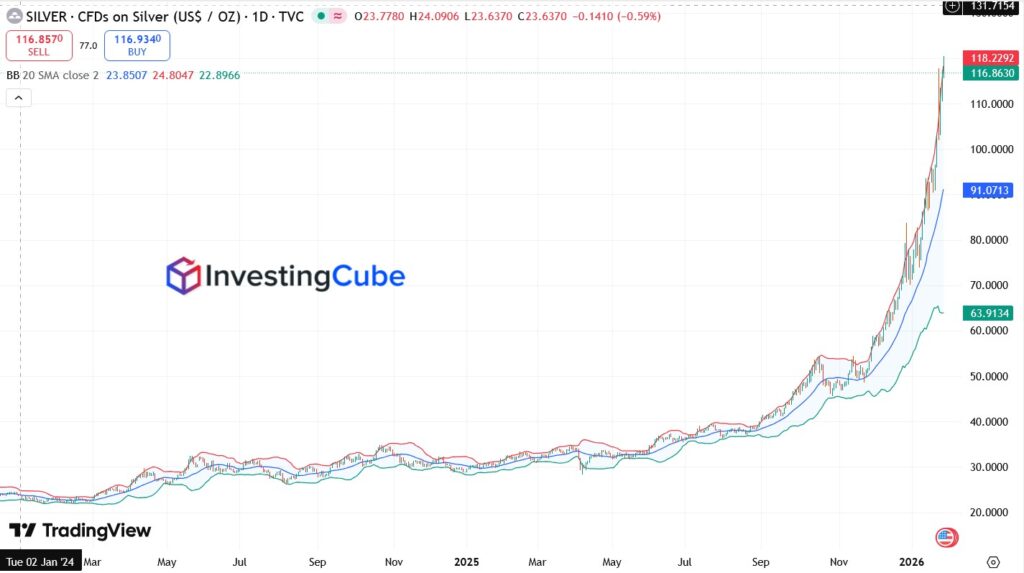

Silver prices reached a psychological milestone this Thursday, surpassing the $120 handle for the first time in history. The rally, which has seen silver jump from $90 to $120 in just over two weeks, is being fueled by a toxic mix of geopolitical instability, looming U.S. fiscal deadlines, and a structural supply crunch that is finally reaching a breaking point.

While gold has also captured headlines by nearing $5,600, silver is increasingly being viewed as “gold on steroids,” attracting investors looking for a high-beta alternative to traditional safe-haven assets.

Geopolitical Tensions and US Shutdown Risks Fuel 2026 Silver Surge

The immediate catalyst for today’s breakout is a surge in risk-aversion. Markets are bracing for a January 30 U.S. funding deadline that could trigger a partial government shutdown. Uncertainty is further compounded by President Trump’s recent announcement of new tariffs on South Korean imports, signaling a potential escalation in global trade frictions.

In the Middle East, escalating rhetoric between the U.S. and Iran has added a significant “war premium” to precious metals. Swissquote analysts have noted that the global order is shifting, and with trust in traditional currency shelters fraying, silver has become a primary beneficiary of this “flight to safety”.

CME Margin Hikes and China’s Export Constraints Tighten Global Supply

The speed of the rally has forced exchanges to take drastic risk-control measures. On Tuesday, the CME Group announced it is raising margins on silver futures to 11% of the notional value (up from 9%) to ensure adequate collateral coverage amid “wild volatility”. This follows a revolutionary shift earlier this month where the CME moved to a percentage-based margin system that scales automatically with price.

Simultaneously, the physical market is reeling from China’s export licensing regime, which has effectively blocked significant flows of silver from reaching the global market. With industrial demand from the solar, EV, and AI sectors now accounting for over half of total consumption, the “above-ground stocks” in global vaults are being drained at an unsustainable pace.

Silver Technical Outlook: Parabolic Move Tests $120 Pivot

From a technical standpoint, silver’s chart has turned vertical, which historically signals both extreme strength and the risk of a “snap-back”:

- Moving Averages: Silver is trading far above its 50-day and 200-day EMAs, with the gap between the price and its averages reflecting a market in a state of “over-extension”.

- Momentum: Relative strength indicators (RSI) are deep in overbought territory, but analysts at Standard Chartered note that “real market tightness” can keep prices elevated even when technicals appear stretched.

- Price Discovery: Having cleared the $117.70 previous peak, the path is technically open toward Citi’s $150 target, though a pullback to test the $110.00 psychological support would be a healthy development for the long-term trend.

Key Levels to Watch:

- Support: $117.00, followed by $110.00.

- Resistance: $120.45 (Current ATH), then $125.00.

Writer’s Trade Idea: I am cautious about chasing the price at current levels. My preferred strategy is to wait for a corrective dip toward $112–$114 to build long positions, targeting $135 with a stop-loss below $105.

Outlook: Is the Triple-Digit Silver Price the New Normal?

While some analysts, like IG’s Tony Sycamore, warn that a parabolic rally often precedes a “sharp air pocket,” the structural deficit suggests that any pullbacks may be shallow and short-lived. Citigroup’s Max Layton argues the rally will persist until silver looks “expensive relative to gold,” suggesting the current gold-to-silver ratio still has room to compress.

For now, silver remains the favorite of the 2026 commodities bull market, driven by a rare alignment of industrial scarcity and a global scramble for hard assets.

Silver FQAs

The deficit is a result of five consecutive years of undersupply. In 2026, the annual shortfall is expected to hit 200 million ounces due to soaring demand in solar photovoltaics and AI infrastructure, combined with China’s export constraints.

The CME raised margins to 11% (standard) and 12.1% (heightened risk) to protect the exchange from extreme price swings. This forces traders to provide more collateral, effectively limiting the amount of leverage used in the market.

Citigroup and several other major banks have lifted their targets to $150 for the next 0–3 months, citing “gold on steroids” characteristics where silver’s price movements amplify those of gold.