- Silver's double role as a safe haven asset and industrial metal have given it an edge over gold

- The global transition to green energy has sparked a sharp uptick in the demand for silver, which might extend well past 2026

- There has also been a sharp demand for silver in the ETF market in the last month

The silver market has experienced a sharp and sustained uptrend since mid-November, pushing prices to levels not seen in over a decade. We discuss what’s behind this powerful rally, as observed in recent market data, and assess the odds of sustaining the uptrend amidst mixed signals from fundamental and macroeconomic forces.

Why Silver Price is Rallying

The main reason is that there’s not enough silver to meet demand. The Silver Institute said the shortage will continue in 2025, as consumption is more than what mines produce. Most silver comes from mining other metals, so just because silver prices go up, it doesn’t mean more silver will be mined. At the same time, industries need a lot more silver. Over half of the silver used worldwide is for industrial uses. Companies can’t easily find replacements for silver in important tech. Also, the transition to green energy is a big factor, as silver is needed for solar panels.

Investment flows amplify this. Holdings in silver ETFs like iShares SLV surged by 18 million ounces in the past month, per Bloomberg data. Investors are jumping on silver because it moves even faster than gold, especially with the Fed cutting rates back in December, which pushedthe dollar weake index to 98.4. Geopolitical uncertainty and de-dollarization trends further entice, with COMEX net longs hitting multi-year highs, as CFTC commitments reveal.

Will Silver Price Hit $70 Before the Year Ends?

Because of how strong this increase has been, it’s natural to wonder if silver price can reach $70 before the end of the year. While the recent price action has been amazing, such a big jump in such a short time would take a really big push. Most expert predictions for the next 6-12 months, like those from Citigroup and Bank of America, who think it will reach $65 per ounce by 2026, suggest a slower, but still positive, path.

What Are the Risks?

While the outlook is overwhelmingly positive, no asset move is without risks. The primary risk to the silver price comes from its high industrial demand component. A sharper-than-expected global economic slowdown, particularly in manufacturing and electronics, could significantly dampen industrial consumption, pulling prices lower.

Secondly, companies are always trying to find substitutes or use less silver. High silver prices encourage solar panel and electronics companies to use less silver per unit or to replace it with cheaper materials like copper or aluminum in some cases. If these efforts succeed rapidly, it could reduce future demand.

Silver Price Prediction

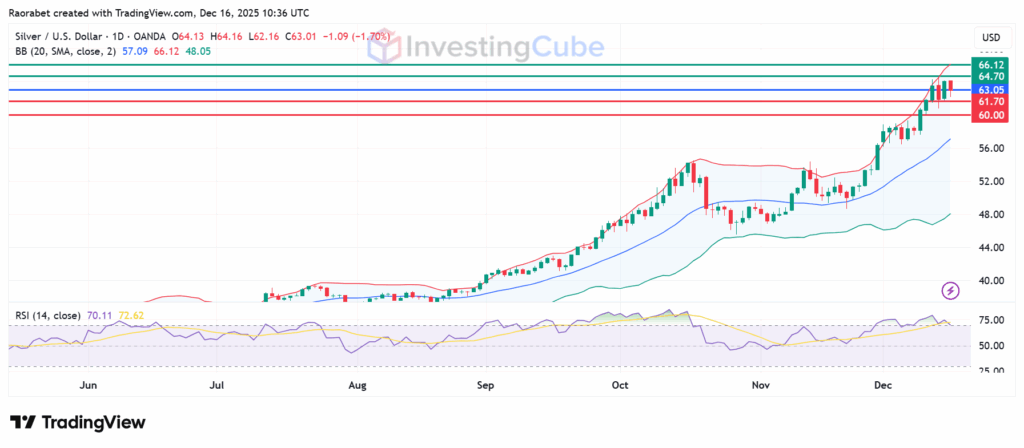

The Relative Strength Index (RSI) at 70 shows that buyers are in control, but the overbought levels suggest a drop is coming soon. The next resistance is likely at $64.70, just above the record highs. Breaking above that level could trigger a stronger rise to test the level corresponding to the upper Bollinger Band at $66.12 per ounce. Support is around $61.70 with the second target likely at $60.

Silver price daily chart on December 16, 2025 with key resistance and support levels. Created on TradingView

The main reason is that demand for physical silver is greater than what’s being mined. This has been going on for years, mostly because industries use so much silver.

It’s not likely. It’s going up fast, but hitting $70 this year is a tough ask. Most analysts predict that it will keep rising, but at a slower, steady pace.

A big concern is if the world’s economy slows down faster than expected. Since industries use a lot of silver, a recession would cut demand and send prices down.