- China’s tightening of silver export controls is likely to tighten global supply, supporting higher prices in the near term.

- Market sentiment remains bullish, but broader economic and industrial demand factors will determine silver’s medium-term outlook.

Silver price advances by 2.31% or 1.78 points today. It builds on the previous day’s gain and follows its bullish momentum for the second straight day. Silver is expected to surge further, driven by China’s curbs on silver.

Three weeks ago, on December 15, when silver prices were trading around $63, my outlook anticipated that prices would reach the $70 level. That is where we stand now. This surge in silver prices is driven by China’s restrictions on white metal exports.

This article examines the key factors influencing the silver price, including China’s restrictions on silver and the technical outlook for the white metal.

What Are China’s Curbs on Silver and Why Does It Matter?

Due to the supply shortage of silver, China is set to tighten controls on silver exports. Last October was the first time that China’s Commerce Ministry announced the new measures to strengthen oversight of rare metals. The first announcement was made on the same day U.S. President Donald Trump and Chinese President Xi Jinping met in South Korea. On that day, Beijing agreed to a one-year pause on rare earth export controls, while the U.S. rolled back tariffs.

By early December 2025, China listed 44 specific companies allowed to export silver under the new measures for 2026 and 2027. The new rules for 2026 restrict tungsten and antimony exports. They also apply to materials dominated by China’s supply chain and widely used in advanced technologies.

Such Chinese export controls will transform the white metal from an ordinary metal to a strategic material, aligning its export controls with the regulatory framework used for rare earths.

Why It Matters!

With these tightened controls, silver is expected to surge this year, and 100$ per ounce is not far off. Moreover, these controls have been criticized by Tesla CEO Elon Musk, who tweeted on the X platform:

This is not good, Silver is needed in many industrial processes

Silver export restrictions could pose a risk to advanced technology sectors, which require significant amounts of silver in their manufacturing. The restrictions came from China, the world’s largest silver producer, which also holds the largest silver reserves. During the first 11 months of 2025, China exported more than 4,600 tons of silver, which is far more than the 220 tons of imports during the same period.

According to CNBC, two Chinese companies have started offering physical silver at $8 above the market price. Meanwhile, Indian buyers are offering $10 above the market price. This behavior confirms a shortage in silver supply and indicates a high probability of a surge in silver prices. Silver prices have surged nearly 140% during 2025, outpacing gold, which has risen nearly 64% over the same period.

The Technical Outlook for Silver:

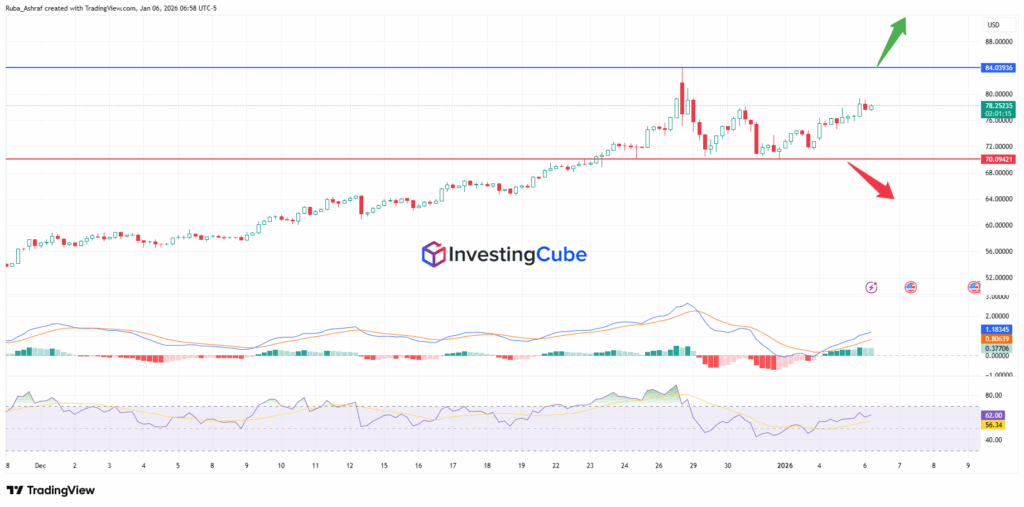

The silver trading chart shows that the price is currently trading between the key support of $70 and the key resistance level of $84. A clear daily close above 78 would indicate sustaining bullish momentum, paving the way to reach 80$. A break above $84 would require a clear daily close above it to confirm the uptrend continuation.

On the downside, a drop below 70 with a decisive close would signal that sellers are taking control and potentially open the way for further declines. The MACD suggests that bullish momentum is gaining strength. Meanwhile, the RSI is currently around 62, indicating that the market is bullish but not yet overbought. It left room for further upside.

The overall long-term outlook remains bullish, suggesting that dips could be seen as buying opportunities within the broader upward trend.

Silver prices are influenced by industrial demand, investor sentiment, and macroeconomic factors like inflation and currency strength.

China’s export controls can tighten global supply, potentially pushing silver prices higher.

Yes, silver is often used as a hedge during economic or geopolitical uncertainty due to its safe-haven appeal.