- Discover our comprehensive guide on silver price predictions, fundamental influences, technical outlooks, and frequently asked questions.

Amid rising concerns over the Federal Reserve’s monetary policy with an sooner cut in interest rates, the silver price appreciates as a safe-haven demand increases. Silver price recovers from its recent losses in the short term. During the Asian trading session, silver reached $38.80 per troy ounce.

Silver gains are supported by the rising concerns about the Federal Reserve’s independence after the announcement of the removal of Fed Governor Lisa Cook over alleged mortgage fraud by President Donald Trump, which increased the demand for safe-haven assets such as silver.

In this article, we will discuss the fundamental factors currently influencing silver price predictions, present the technical outlook for silver, and highlight the key levels traders should watch in both the short and long term. Finally, we will address the most frequently asked questions about silver prices.

Key Fundamental Factors influencing silver prices:

- Last Friday at the Jackson Hole symposium, Fed Chair Jerome Powell stated that job market risks were rising and inflation remained a threat, making the decision unstable. These words heighten the market’s anticipation of a rate cut in September, which in turn increases demand for safe-haven assets.

- Traders have to wait for the Q2 US Gross Domestic Product annualized and the July Personal Consumption Expenditures price index data. Since these data are the Fed’s preferred inflation gauge, good numbers would likely support cutting U.S interest rates.

- Additionally, the uncertainty comes from Trump’s tariffs, supporting silver prices as it’s a safe-haven asset. Trump warned that he will impose a 200% tariff on Chinese goods if Beijing refuses to supply magnets to the United States, according to Reuters. Moreover, Trump threatened “subsequent additional tariffs” and export restrictions on semiconductors and advanced technology in response to the taxes that hit American technology companies.

- Early Tuesday, Donald Trump posted on social media, saying that he was removing Fed governor Cook from her position as one of the Fed’s board of directors. This post increases the chances of earlier interest rate cuts as Trump is pushing to reduce borrowing costs. In turn, this supports the prices of metals, including silver.

According to the Silver Institute’s World Silver Survey 2025, the outlook for silver remains positive. Despite recent relief from CME-related concerns and silver’s exemption from reciprocal tariffs, ongoing uncertainty over US trade, tariff, and foreign policy, combined with worries about the US economy, supports expectations of further Fed rate cuts later this year.

Silver Price Prediction | Technical Outlook:

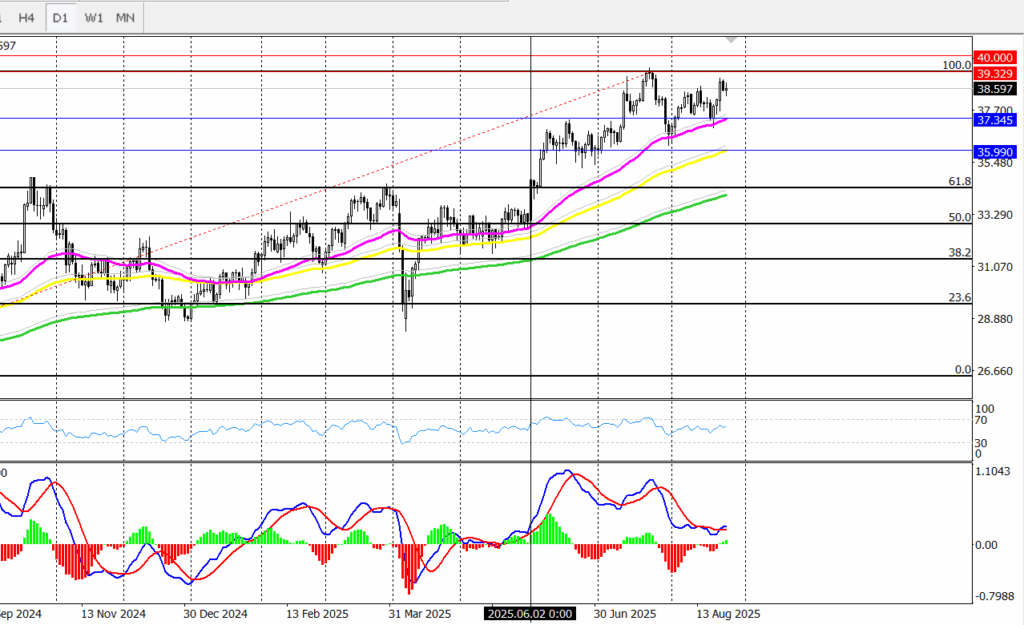

From a technical perspective, silver price action shows strong momentum for a continued uptrend. XAG/USD is rising toward $39.00, with today’s high at $38.83, near the key resistance level of $39.00. A clear 4-hour close above this level would likely push silver prices toward the psychological $40.00 mark.

Silver prices have consolidated above key levels, reinforcing their bullish sentiment. Based on the 200-day SMA, silver has been trading above $31.33 since April 2025. Since June 2025, prices have held above the 100-day SMA at $32.83, and since July 2025, they have remained above the 50-day SMA at $35.90. These levels have not been tested since April 2025, confirming a strong long-term bullish trend.

On the daily chart, the traditional MACD indicator shows a bullish crossover, signaling positive momentum. This aligns with the fundamental outlook, suggesting that silver prices could maintain a strong uptrend and remain positive.

All of these signs support the scenario that silver prices could reach higher levels, above $40, $45, or even the all-time high $50, during this year, fueled by risk-averse sentiment once the Federal Reserve cuts rates.

In the short term, silver may face an intraday price correction due to pressure from the resistance level at $39.38, according to Fibonacci retracement, with prices hovering between $37.38 and $39.38.

Silver spot prices surged by up to 30% in the first half of 2025. According to the gold-silver ratio of 87.42, which indicates that silver is undervalued, we are not far from the $100 mark for a silver ounce. Additionally, several experts expect silver prices could reach this level within the next two years. Check: Silver Price In 2025: Is the Best Yet to Come?

Silver is often perceived as undervalued for several reasons: its market volatility can deter some investors, it is seen as more closely tied to economic cycles than gold, and its intrinsic value is harder to determine due to its diverse industrial applications.

During the first half of 2025, silver gained strong momentum, which is expected to support further price increases. This momentum is driven by industrial demand for solar panels, electronics, and clean energy, as well as inflation and economic uncertainty. It’s a great investment opportunity to buy silver before its rally begins.