- Silver Price Prediction: In this article, we present to you the XAG/USD forecasts for 2026, 2030, 2040 and beyond

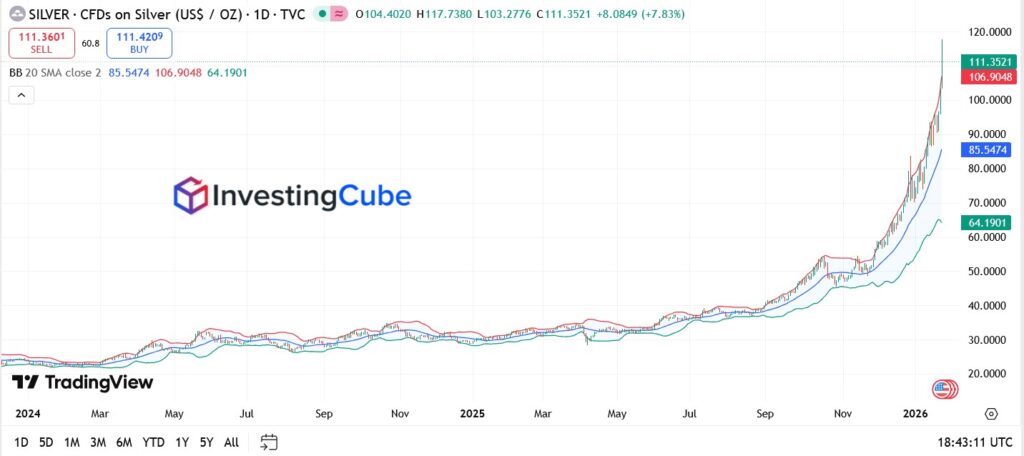

Silver Price Forecast: XAG/USD Breaks to Fresh All-Time High Above $114 in January 2026

Silver(XAUUSG) has surged to fresh all-time highs in January 2026, extending one of the most powerful rallies in the precious metals complex. XAG/USD is currently trading at $114.28 per ounce as of writing , marking a new record as investors moved aggressively into safe-haven assets at the start of the week. Spot silver rose to $109 an ounce on January 26,reflecting a sharp continuation of the uptrend that began accelerating in late 2025.

Silver prices rose 147% in 2025, exceeding gains recorded by gold. It took 105 ounces of silver to buy one ounce of gold last April, its now around 50. The surge in silver prices is largely driven by the same forces supporting gold, notably its role as a safe-haven asset.

Gold and Silver Surge as Greenland Tariff Tensions Drive Safe-Haven Demand

Silver’s breakout has unfolded alongside another surge in gold, as investors digest renewed geopolitical risk tied to U.S.–Europe relations. Gold prices climbed toward record highs above $5,000 per ounce, with XAU/USD attracting strong inflows as risk appetite faded.

According to CNBC, the rally across precious metals intensified after U.S. President Donald Trump announced plans to impose escalating tariffs on goods from several European countries unless the United States is allowed to proceed with the purchase of Greenland. The proposal has raised fears of a tit-for-tat trade war, prompting investors to rotate out of equities and into traditional stores of value.

CNBC reported that as gold and silver pushed to fresh highs on Monday January 19 2026, European equities, particularly autos and luxury stocks, sold off sharply as markets priced in the potential impact of new tariffs starting in February.

Why Silver Is Outperforming Gold in This Risk Cycle

While gold continues to anchor the precious metals complex, silver’s gains have become increasingly outsized due to its dual identity as both a monetary and industrial metal. Investors who were already heavily positioned in gold following last year’s rally have increasingly turned to silver as a relative-value play.

Market commentary cited by CNBC highlights that silver benefits not only from fear-driven demand but also from long-term structural themes such as electrification, solar energy, and electronics. This combination has made silver especially responsive during periods when macro uncertainty and real-asset demand rise simultaneously.

Other precious metals have followed higher as well. Platinum and palladium posted gains, while copper prices remained supported by infrastructure and data-center investment trends, though those moves were driven more by long-term fundamentals than immediate geopolitics.

Silver Technical Picture: Price Discovery Above $90 Keeps Momentum Intact

From a technical perspective, silver remains deep in price-discovery mode. On the daily chart, XAG/USD has extended its vertical advance above $110, printing fresh record highs near $117 before settling around $111. Price is holding well above the rising 20-day moving average, with momentum indicators still confirming trend strength rather than exhaustion.

The former breakout zone around $100 has now flipped into a key psychological and structural support area, while the sharp expansion in Bollinger Bands highlights accelerating volatility consistent with trend continuation. As long as silver remains supported above the $100–$103 region, any pullbacks are likely to be corrective consolidations rather than the start of a broader reversal.

The next major psychological milestone for traders is the $100 per ounce level, which increasingly features in market discussions as long as safe-haven flows remain elevated.

Silver and Gold Outlook for 2026

The silver price outlook for 2026 remains constructive after XAG/USD broke to fresh all-time highs above $94 in January. As long as geopolitical risk, trade tensions linked to the U.S. and Europe, and safe-haven demand persist, silver is likely to stay supported above the $90 level. Holding this zone keeps the $100 per ounce psychological target in focus later in 2026, though volatility is expected.

Gold’s outlook into 2026 is similarly positive but steadier. XAU/USD near record highs around $5,000 continues to benefit from central bank demand, reserve diversification, and declining confidence in fiscal discipline. While gold may consolidate at times, it remains the anchor of the precious metals complex, with silver positioned to outperform during periods of rising risk and momentum.

Overall, the precious metals outlook for 2026 favors strength in both gold and silver, with silver’s dual role as a monetary and industrial metal keeping upside risks dominant as long as global uncertainty remains elevated.

This article was originally published in 2023 and is frequently updated to reflect the latest silver price action and technical analysis.

What Is Silver?

Silver belongs to a category of metals considered very precious due to its wide range of uses and its preference as a store of value. Human civilizations have used Gold and Silver as primary means to exchange and store value for thousands of years. Furthermore, silver is used in several industrial processes. As a result, the price of silver has always remained tied to economic activity worldwide.

The XAG/USD tracks the price of Silver in terms of the United States dollar. Therefore, the pair generally shows an inverse correlation to the strength or weakness of the greenback.

Silver Price (XAG/USD) Latest News and Market Developments

The Silver Institute’s World Silver Survey and Metals Focus Silver report that silver saw its fifth year of shortage in 2025. The silver in London and Shanghai hit nearly a decade low. The rise of AI and green tech pushed industrial demand past 700 million ounces for the first time. Building AI data centers and installing lots of solar panels turned silver into a key resource, not just a metal.

Mine production went up 2% to a seven-year high of 844 million ounces. Still, the market had its fifth shortage, which the Silver Institute estimates at about 200 million ounces. Global demand went down 4% to 1.12 billion ounces, but industrial use hit records because of AI and the move to green energy, plus solar and electronics. Yahoo Finance mentioned this. Supply stayed tight, traditional sources made less, and sanctions caused problems, making the shortages worse.

Silver Price 2025 Roundup

Silver had a record year in 2025, outperforming gold with its best showing since 1979. Starting around $30, silver prices climbed throughout the summer, breaking past resistance to reach $75–$84 by the end of December. This 165% rally happened because of high industrial demand and strong investor interest.

As gold crossed the historic $3,000 threshold early in the year, investors pivoted to silver, which was seen as significantly undervalued. The gold-to-silver ratio dropped from about 90:1 in 2024 to roughly 62:1 by the end of the year 2025. The Federal Reserve’s late-year interest rate cuts made holding non-yielding assets more attractive, pushing prices higher in December.

Why Silver Prices Are Surging Toward Multi-Year Highs

Silver’s latest rally is being driven by a combination of tightening supply and accelerating industrial demand. The global market has been running a structural deficit for several years, with consumption repeatedly outpacing what miners and recyclers can deliver. This imbalance is now reaching a pressure point, forcing major exchanges to draw down inventories at the fastest pace seen in more than a decade.

Unlike gold, silver sits at the intersection of precious-metal demand and industrial usage, giving it two major engines of growth. That dual nature is helping amplify the current breakout, especially as broader macro themes continue to favor hard assets.

Silver Demand Outlook: How Solar and EV Growth Are Driving Prices

A key pillar behind silver’s strength is the surge in industrial consumption. Solar panel manufacturers, electric-vehicle producers, semiconductor firms, and 5G network developers continue to expand capacity, all of which require significant amounts of silver due to its unmatched conductivity.

This demand is structural, not cyclical. Even if broader economic activity slows, long-term commitments to renewable energy, grid upgrades, and electrification remain intact. That is why silver has outperformed gold this year, with industrial buyers absorbing dips faster than in previous cycles.

Silver Price Outlook: Key Levels and Drivers to Watch in 2026

Silver has now moved beyond a critical inflection point after breaking to fresh all-time highs above $94 in January 2026. Year-to-date performance continues to outpace gold, while strong industrial demand is helping absorb selling pressure during brief pullbacks.

With price now in clear price-discovery mode, attention has shifted from whether the rally is sustainable to how far momentum can carry it in the months ahead.

Key factors to monitor include:

- Whether silver can hold above the $90–$92 support zone, confirming the breakout

- The market’s reaction as prices approach the $100 psychological level

- Ongoing inventory trends across major exchanges

- Developments in solar, EV, and electrification demand

- Movements in the US dollar and Treasury yields, which remain key macro drivers

Silver’s combination of tight supply, structural industrial demand, and powerful technical momentum keeps the long-term outlook for 2026 constructive. The way the market behaves above former resistance will determine whether this rally extends deeper into new territory or enters a consolidation phase at elevated levels.

I predicted this in my last Silver price forecast. I also regularly update the price targets on my Twitter, where you are welcome to follow me..

Silver Price Prediction 2030

A great deal can change between now and 2030, but silver’s long-term outlook has strengthened materially following its breakout to fresh all-time highs above $94 in January 2026.

Looking toward 2030, silver’s long-term outlook remains constructive. If current macro trends persist, including sustained inflation pressure, strong industrial demand from solar and electrification, and recurring geopolitical risk, XAG/USD could realistically trade in the $120–$160 per ounce range by 2030.

This projection assumes periods of volatility and consolidation along the way, but with higher long-term lows as silver remains supported by both investment demand and structural supply constraints.

Silver Price Prediction 2040

While the Silver price prediction for 2040 is anybody’s guess, we can still consider a few different scenarios. If the US dollar remains the global reserve currency within the next two decades, Silver can comfortably trade above $150 by 2040.

Silver Price Prediction 2040

By 2040, silver’s price trajectory will likely be shaped by longer-term forces such as global energy transition, population growth, and the continued debasement of fiat currencies. If silver retains its dual role as a monetary hedge and an industrial metal, prices in the $200–$300 per ounce range are plausible over the next 15 years under a sustained high-inflation and high-demand scenario.

However, these projections remain highly sensitive to global monetary policy, technological substitution, and supply responses. While upside potential is significant, long-term investors should expect extended cycles of expansion and correction rather than a straight-line move higher.

Where To Buy Silver?

You can buy silver on brokers like ATFX, IG, TD Ameritrade, Interactive Brokers, Capital.com, Exness, etc. These brokers allow you to trade the XAG/USD pair by adding minimal margin. However, you must learn risk management before taking leveraged positions on any asset.

How To Trade Silver?

Nowadays, there are various ways to gain exposure to the volatility in precious metals. Holding silver physically involves additional costs. Therefore, investing in Silver CFDs or futures contracts is best via an online broker like eToro, Exness, TD Ameritrade, etc.

What Is the Spot Price of Silver?

The spot price of silver refers to the current market price for immediate delivery of physical silver, typically quoted per troy ounce. As of January 2026, the silver spot price is trading around $93–$94 per ounce, reflecting a sharp rally to fresh all-time highs.

Silver’s spot price is highly volatile and trades nearly 24 hours a day, following global market sessions as they open and close. The largest share of trading activity comes from major financial centers including the United States, the United Kingdom, Japan, and Hong Kong, where futures, spot, and OTC markets overlap.

Because silver is influenced by both investment demand and industrial usage, its spot price can react quickly to changes in macroeconomic conditions, currency movements, geopolitical risk, and shifts in supply and demand.

Silver Price Outlook: Final Takeaway for Traders

Silver has delivered a striking rebound in early 2025 after last year’s sharp pullback, driven by a resurgence in industrial demand and a renewed bid for safe-haven assets. XAG/USD has pushed above $80, and the bulls will likely be targeting $90 resistance zone next. A clean break above this band would bring the milestone $100 mark within reach, potentially signaling the start of another medium-term leg higher.

In my view, the market still feels underpriced relative to the structural supply deficit, but the next move will hinge heavily on macro conditions, especially the Federal Reserve’s policy tone and how inflation evolves through the first half of the year.

Silver reaching $100 is possible long term, but it would require sustained supply deficits, stronger industrial demand, and a major shift in global monetary conditions.

Silver has solid 5-year potential due to structural industrial demand, tightening supply, and its role as a hedge during economic uncertainty.

Most forecasts expect silver prices to trend higher as renewable energy growth, electronics demand, and supply shortages continue to support the market.