- Silver (XAG/USD) holds above $49.00 as traders weigh U.S. political progress, weak dollar, and steady industrial demand.

[InvestingCube, 10 November 2025] Silver (XAG/USD) continues to hover over the $49/oz level is it pulls off two days of wins due to traders, assessing the news regarding politics and trade coming out of the United States, as global risk moods improve with a Senate bill passed in the U.S to continue working towards a reopening of the government.

It continued to show strength due to factors including a weaker greenback (US$), as demand from industry also appears to be fairly steady. However, with the sentiment swing towards optimism, investors could find that strength from silver is hard to maintain.

Fundamentals & Market Sentiment

In the Asian session on Monday, the green metal threads around $49.20/oz adding another day of modest gains. This comes on the back on the Senate hearings that were able to adjourn after parting proceedings on a bill to reopen the government amongst other things restore exports of subsidized medical supply to those in need which helped reduce fears of a prolonged shutdown.

The political gain in Washington gave risk appetite a short shot in the arm, but the safe haven instruments, including silver, came under like pressure due to the interest in the equity and other sectors. However, the (short term) dollar index (DXY) fell further aiding the metals bid as commodities traded in dollars became cheaper for those outside U.S. lines.

In a further boost to outlook the Ministry of Commerce of China came out with an announcement that they would be lifting the export ban impose on a raft of “dual” strategy material such as gallium, germanium and antimony until 37 November 2026. This news is an indication of a tightening in the trade barriers between the two superpowers, but the obverse is that the immediate save haven premium of gold and silver is slightly diminished.

However, overall for the year that silver has been one of the performing struts in the commodities basket due to the demand from industry from the metal being employed in solar cells, computers, and electronics whilst the tightness of the supply chain continues.

Reversal Risks & Short-Term Outlook

All in all though, whilst the gains appear strong at present, there are signs of exhaustion along the way.

- Improving global sentiment could lessen the urgency required for a safe haven response.

- Profit-taking may emerge as prices get to the $50 handle and the overhead or resistance zones.

- A rapid return of the equities could weaken the momentum of silver, or rising tide of macro data, which is better than the expectations.

However, the general structural story that present remains buoyantly strong supply deficits down the track through 2025 (at least). There still remains the strong demand for goods from the grey and white metals in industry, which continue to support the bullish story for longer-term. Silver is a “monetary industrial hybrid asset” and benefits both fully from transition towards a clean energy outlook, while still being greedily coveted as a hedging instrument against inflation.

Technical Structure & Analysis

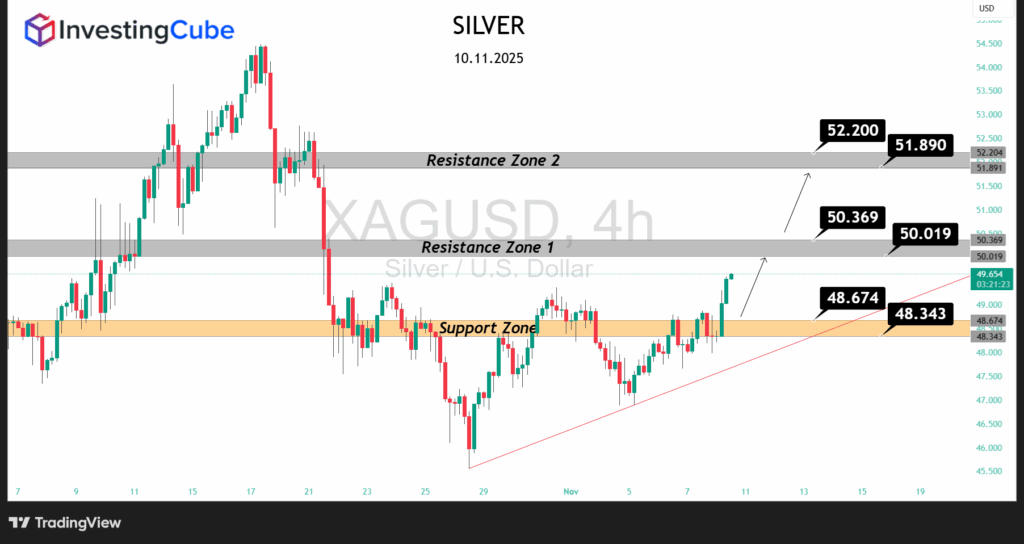

The silver price is continuing to climb higher following the rising trendline from late October and as of this writing resides around the $49.50 mark.

- Support Zone (Key Demand Area)

The main support is located in the zone around $48.34 – $48.67 which is highlighted in orange on the chart. This has been an area where buyers have been attracted times after time over the past session and is encouraged by the rising trendline. Provided that price remains above $48.34, the bullish structure in the short-term remains intact. - Resistance Zone 1 (First Supply Area)

The first overhead resistance zone is situated in between the values of $50.02 – $50.37. This is the immediate upside target for the move high, and any failure here could trigger a stall in the current activity or corrective pullback into the $48.00. A clean 4-hour close beyond $50.37 would indicate that the buyers are willing to lift price higher. - Resistance Zone 2 (Major Supply / Extension Target)

Next up the second resistance zone is marked between $51.89 – $52.20. This area is in accordance with previous swing high and wider supply area, and these likely to act as a strong barrier until the first retest. Only on a sustained break about $52.20 could the door be opened for a more extensive rally in the longer-term, and invalidate most near term downside reversal narratives.

Overall, price action is currently mid-range between those noted support zones at $48.34 – $48.67, and between the first resistance zones at $50.02 – $50.37. The rising trend line enhance the bullish bias, but the greater upside potential diminishes further as the market approaches the $50.00+ region.

Summary

The key takeaway, that silver’s underlying status remaining above $49.00 indicates that underlying demand info still firmly in place, notwithstanding an improved overall risk sensitivity.

While it is true that a short-term corrective market cannot be dismissed, especially if price fails to break and hold above the noted $50.02 – $50.37 resistance band — the longer term structural setup caused by restrictive supply and underlying strong industrial demand still favors the bulls.

In the shorter timeframe, $48.34 – $48.67 is now the area to watch for as far as floors are concerned whilst a definitive break above the $50.37 level would again mean the focus is likely to be moved more towards the $51.89 – $52.20 zones. Until one side or the other gives way however, traders can expect choppy trendless trading biased to fundamentals (headlines) within this expanding range.

Frequently Asked Questions

The lower dollar and continued industrial demand overcame the slight wave of positive “risk-on” sentiment from positive movement on the U.S. government funding deal and improving trade connotations at global levels.

Yes, if the dollar continues in a subdued phase, and price can break and hold about $50.37, if this possible that price could continue on its current upward path into the $51.89 – $52.20 resistance zone. Otherwise there may be seen a failure around $50.00 marked area which again could trigger another bout of consolidation or pullback.

This manifest itself through a stronger resurgence of the dollar, stronger than expected headline numbers from U.S. citings, and/or and evidently clear shift in a global markets toward a risk-on attitude which could provide a basis for profit-taking, thus sending the XAU/USD price back again towards the $48.34 – $48.7 support zone, or again toward the rising trend line below, if selling accelerates.