- Geopolitical risk premiums are now a major driver of commodity pricing and market volatility.

- Data and scenario comparisons show how tensions elevate prices while easing risks can stabilize markets.

- Professionals view geopolitical risk as a structural factor shaping markets, sectors, and investor behavior.

Geopolitical tensions are a key factor influencing the commodity markets. It causes chain disruptions, in turn leading to price volatility, and shifts investors’ demand towards safe-haven assets. Geopolitical risk premiums can affect different commodities in different ways. It depends on the commodity’s nature and its relationship to the geopolitical shock.

It’s not always affected badly on commodity markets, as some countries could benefit from this rephasing caused by geopolitical shocks. For Instance, Indermit Gill, the World Bank Group’s Chief Economist and Senior Vice President for Development Economics, said:

Higher commodity prices have been a boon for many developing economies, two-thirds of which are commodity exporters

Why Geopolitics Is Becoming a Core Price Driver in 2025?

In light of rising geopolitical tensions, commodity markets are being reshaped, affecting prices of assets such as gold, silver, and crude oil. Geopolitics affect the supply and demand dynamics, which increases price volatility. The year 2025 is a clear example of how geopolitics has become a key price driver. Find below two examples of ongoing geopolitics that influence commodity markets like energy and metals:

- Middle East Conflicts: The ongoing conflicts in the Middle East affect energy markets, influencing crude oil and natural gas prices. It keeps geopolitical risk premiums on energy commodities. For example, Goldman Sachs estimates a roughly $10 per barrel geopolitical premium on Brent crude due to the ongoing tensions in the Middle East.

On the other hand, the International Monetary Fund warns that geopolitical equity prices are reducing now by about 0.3% on average. The IMF highlights that in extreme casescan cause drops many times larger, raising risk premiums across all risky assets.

IMF also expected that Gold prices would remain about 150% higher than average in the five years preceding the COVID-19 pandemic. - U.S.-China Trade Tensions: The ongoing conflict between the United States and China, regarding U.S. tariffs on Chinese goods and China’s retaliatory measures, and export restrictions on rare earth elements. This conflict significantly influences demand for industrial metals like copper, steel, and aluminum. In turn, price volatility surges.

Charts Speak | Historical Geopolitical Shocks and How They Drive Prices?

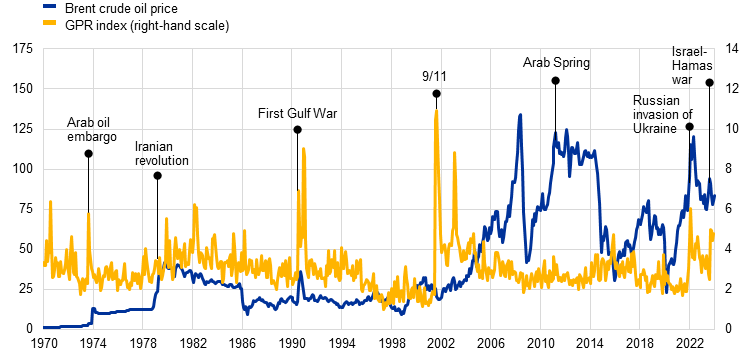

Geopolitical tensions always act as an immediate catalyst for commodity price volatility. Historically, geopolitical tensions have caused significant price volatility in safe-haven assets, such as gold and silver. Events such as wars, sanctions, and supply chain disruptions typically trigger demand and supply shortages for safe-haven assets. These events are pushing prices sharply higher. Find below historical examples showing how geopolitics affected price volatility:

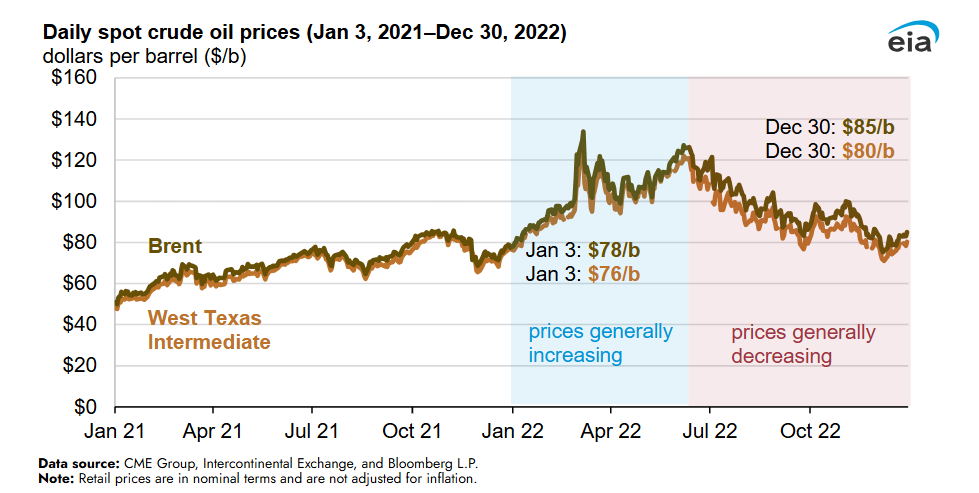

- Russia-Ukraine war in 2022: During this war, commodity prices jumped significantly. The front-month price of both Brent and West Texas Intermediate crude oil has increased to more than $100 per barrel.

- Gold prices in February 2022 initially spiked to % $2,070, due to the Russia-Ukraine war matching the COVID high. Gold prices surged by 14% while palladium 52% where Russia controls 40% of the supply, it soared by 80% in days. Nickel trading was suspended on the LME because prices more than doubled in hours due to the war.

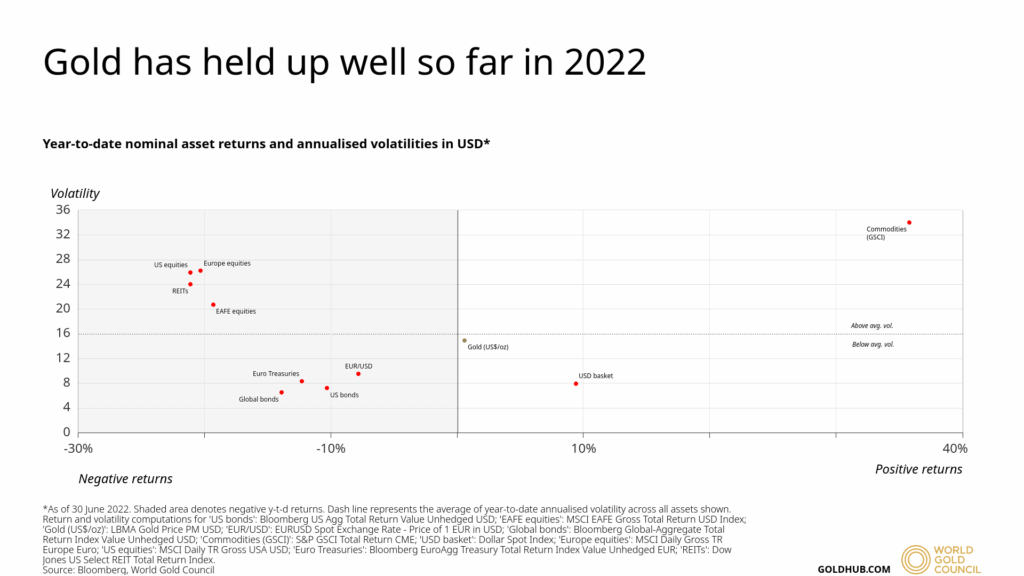

The Gold World Council chart shows that during the Russia-Ukraine war in 2022, gold performance generated positive returns while most major assets, such as the US equities and global bonds, recorded sharp losses.

Despite the geopolitical uncertainty, gold maintained moderate volatility and acted as a stable safe-haven asset. This proves how geopolitical risk premiums can reshape commodity markets.

How Geopolitical Risk Could Sustain or Reverse Commodity Price Trends

- Scenario A: In case the geopolitical tensions and risks rise, it will lead to supply chain disruptions and sanctions. It could also cause restrictions on trade between countries, which could escalate the market uncertainty. In such cases, investors tend to shift their money toward safe-haven assets and raise risk premiums across key commodities such as gold and silver.

For instance, the ongoing war between Russia and Ukraine has disrupted energy routes, agricultural exports, and global logistics since 2022. The EU extended its broad restrictive measures until January 2026, including bans on seaborne crude oil, SWIFT cut-offs for key Russian banks, and export restrictions on dual-use goods.

Impact on Commodities: Gold prices rise as investors seek safe-haven assets, avoiding volatility risk. Oil prices increase due to supply concerns, sanctions, and transport disruptions. - Scenario B: When geopolitical risks begin to ease, markets shift to stability, and risk appetite slowly comes back, lowering the risk premium embedded in commodity prices. The ease in geopolitical tensions can be driven by diplomatic progress, trade normalization, a ceasefire, or reduced military escalation.

For example, the gradual US-China trade war easing comes after improved diplomatic communication reduced the US tariff pressure on Chinese goods.

Impact on Commodities: Gold demand softens as fear declines. Oil and industrial commodities stabilize as the market confidence improves.

Broader Impacts of Geopolitical Risk Premiums on Markets and Investments

- Impact on Global Economy: Rising geopolitical risk can reduce foreign investment inflows, increase outflows, and reduce cross-border trade of commodities. For instance, tensions in the Middle East or Eastern Europe can disrupt energy and agricultural supply chains, affecting global trade flows and prices. Additionally, US-India tensions caused Foreign Institutional Investors to sell their indian equities due to tensions with the US.

Investors globally adjust their portfolios according to the potential geopolitical shocks. This can lead to increased demand for safe-haven assets rather than riskier ones. During an increase (GRP) geopolitical risk premium, governments may change their policies by hiking interest rates and using a tighter monetary policy. They may spend more on defense, which can put pressure on public budgets. - Impact on Investors: During high GRP, investors tend to increase allocations to gold, US treasuries, or other safe-haven assets. Active traders and hedge funds can take advantage of short-term spikes that take place in commodities during uncertainty. While long-term investors, including asset managers, may be exposed to highly sensitive sectors to geopolitics, such as energy, defense, and shipping, they diversify their exposure to reduce risk

- Impact on Specific Sectors: The impact is not typical across all sectors. According to the European Central Bank, the vulnerability varies between different sectors and depending on firms’ geopolitical location and trade links.

- Vulnerable Sectors: Businesses related to transport, the aircraft industry, and specific areas of manufacturing, such as steel, are most vulnerable to geopolitical risk.

- Resilient Sectors: Some sectors, such as natural gas, fossil fuels, and defense, may even profit from geopolitical risk-related stress.

What Experts See in Today’s Geopolitical Risk Premiums

From a professional’s point of view, the current surge in geopolitical risk premiums is not just chaos; it’s a structural shift in how commodity markets are priced. The International Monetary Fund reported that the heightened tensions can hurt stock markets, increasing borrowing costs by governments, and pose risks to financial stability.

According to the World Bank Commoditiy Markets Outlook:

- Global commodity prices are expected to decline 12% in 2025 and an additional 5% in 2026.

- The World Bank notes that despite the expected decline in prices, the policy uncertainty is flagged as a major risk factor.

- The bank also warns that repeated swings in commodity prices could undermine long-term growth, especially in low-and middle-income countries, unless they strengthen institutional resilience.

- The World Bank notes that on the safe-haven assets, there continues to be strong demand for gold, attributing part of the rally to a geopolitical premium.