- Crude Oil has risen for two days on supply strains, but the EIA report may decide if the rally can extend or lose momentum.

Crude Oil prices pushed higher for a second day on Wednesday, supported by fresh concerns over supply disruptions. Brent settled near $67.90, while WTI traded at $63.69, adding to Tuesday’s solid advance. For now, the story is simple: the market is leaning bullish, but traders know the real test comes with tonight’s EIA inventory report.

Supply Worries Continue to Dominate

The recent rally is not about booming demand, it is about tightening supply, Kurdish exports to Turkey remain locked in limbo, keeping 230,000 barrels per day off the market. In Venezuela, Chevron faces new exports limits, meaning only half of its 240,000 barrels per day output can actually leave for the U.S. With flows squeezed from multiple directions, it’s no surprise crude oil price prediction remains tilted to the upside.

All eyes on the EIA

API data this week showed a hefty 3.82-million-barrel draw in crude stocks and a drop in gasoline, while distillates edged higher. The question is whether EIA numbers will back that up. If the government data confirms the drawdown, bulls may find more fuel to push prices higher. But if EIA surprises with a build in crude or gasoline, it could take the steam out of the rally. For anyone watching crude oil price prediction closely, this report is the one to trade around.

Technical Picture

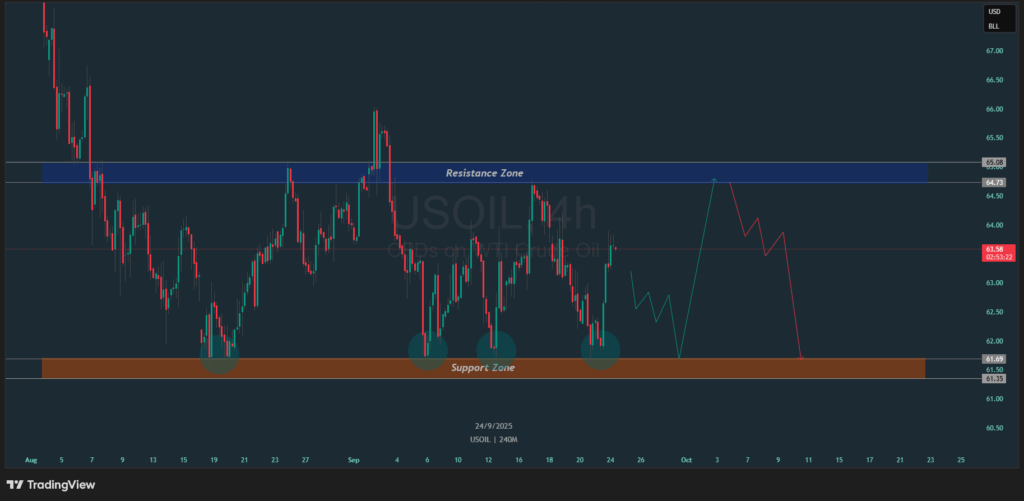

On the H4 chart, WTI Crude Oil is currently oscillating between a Resistance Zone around $64.70 – $65.10 and a Support Zone near $61.35 – $61.70. Price action has repeatedly tested the support area, holding firm so far. A push into resistance could trigger selling pressure, with downside risk back toward the $61.50 zone if sellers take control. Conversely, a clean breakout above $65.10 would open the way for further upside momentum. Until then, the structure suggests range-bound trading with a bearish tilt unless resistance gives away.

Outlook

For now, the bias remains cautiously bullish on supply tightness, but technically the market is trapped between well-defined zones. The next move rests on the EIA report and the fate of Kurdish exports. Confirmation of shrinking inventories could spark a breakout higher, while a surprise build may push prices back toward the support band.

The upcoming U.S. EIA inventory report.

Because it is driven by supply disruptions, not stronger demand.

Resistance at $64.70 – $65.10 and support at $61.35 – $61.70.