On-chain data provider Santiment claims that large-scale whale accumulation of LINK tokens is ongoing, altering Chainlink price predictions in the market. Santiment says that 64 whale addresses added 1.89% of LINK token supply into their wallets, which takes their holdings to 18% of the total circulating supply.

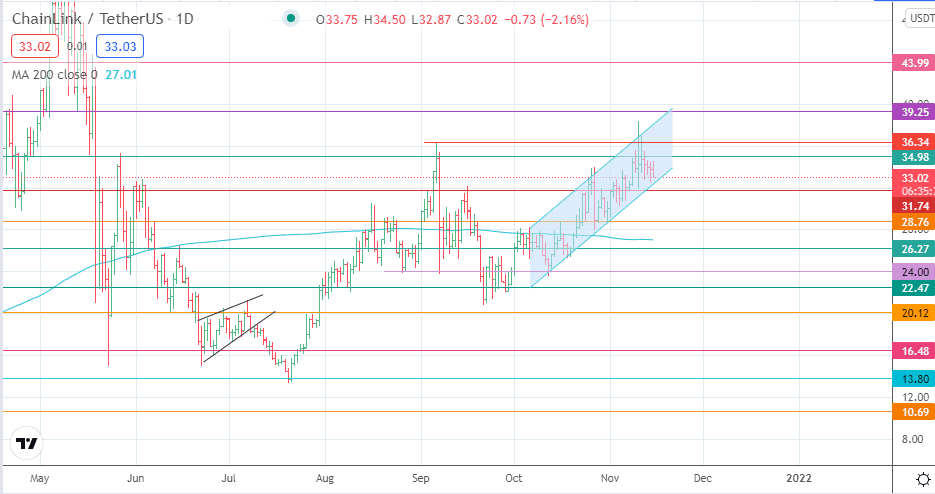

Chainlink (LINK/USDT) is currently trading lower on the day by 2.16%. Still, this move is probably an extension of the decline towards the channel’s lower border, which serves as the immediate support for the price action.

Whale accumulation usually comes when public participants are selling, and this is typically the move that precedes a strong price appreciation.

Chainlink Price Prediction

Monday’s decline is targeting the channel’s trendline. If the price bounces off this level, we could see a return to the 34.98 resistance. 36.34 is the barrier located above this level, and if the price takes out 34.98 and 36.34, we could see the previous low of 13 May at 39.25 come into the picture.

On the flip side, a decline below the channel’s trendline and the 31.74 support is required to continue the correction from the uptrend move of 20 September to 10 November. This brings the 28.76 support level into the picture. The 200-day moving average and the 26.27 price support are the bear’s downside targets if the price decline is extensive.

LINK/USDT: Daily Chart

Follow Eno on Twitter.