Brent crude oil price is attempting to bounce back ahead of the upcoming Biden’s trip to Saudi Arabia. The XBR/USD price is trading at 104.64, which is substantially above last week’s low of 97.10. This price remains substantially lower than this year’s high of over $136. Similarly, the WTI oil price is trading at $103.84, which is much higher than where it was last week.

Recession fears

Brent and other commodities have pulled back substantially in the past few days as investors worry about the rising risks of a recession and the strong US dollar. Economists believe that the extremely hawkish Federal Reserve will push the American economy into a recession.

Fed’s Jerome Powell has warned about the elevated risks that his policies could accidentally push the economy in that direction. Still, demand remains substantially higher considering that China is offering a new stimulus while the US labor market is tightening.

The performance of crude oil is in line with that of other commodity prices. For example, copper, often seen as a barometer for commodities, has declined to the lowest level in months. Similarly, iron ore and the Bloomberg Commodity Index have had a major pullback lately. As such, some analysts believe that the recent commodities supercycle is ending.

Brent crude oil price is also struggling as Joe Biden prepares for his upcoming trip to Saudi Arabia. He is expected to press the crown prince, who he called a pariah, to boost oil prices. It is unclear whether Saudi will agree now that it is leaning more toward China and Russia.

Brent crude oil price forecast

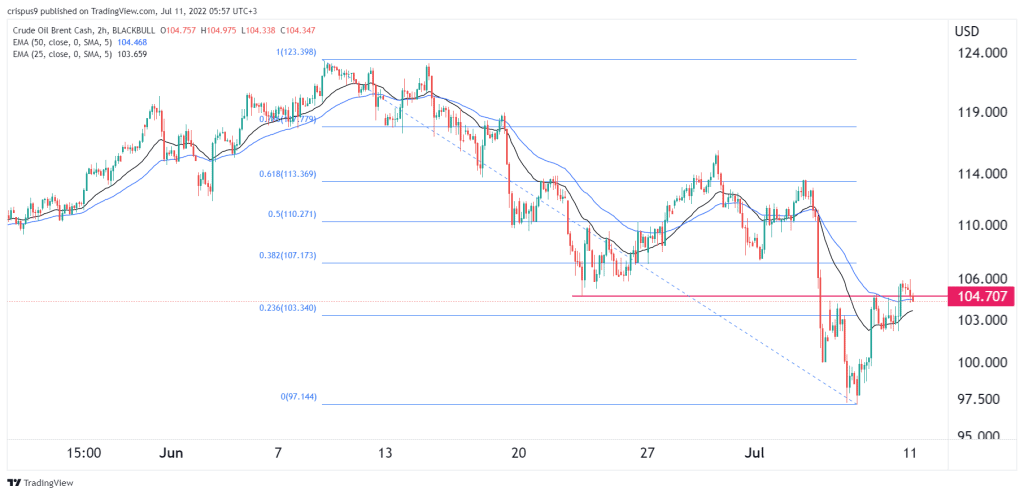

In my last oil price outlook, I pointed to the fact that oil had formed a double-bottom and predicted that a comeback was likely. This view was accurate as the price has risen sharply. Turning to the two-hour chart, we see that the price of crude oil declined sharply last week as worries of a recession remained.

Now, it has made a slow comeback and moved to the important resistance at $104.70, which was the lowest point on June 22nd. It is also between the 38.2% and 23.6% Fibonacci Retracement level. The price has also crossed the 25-period and 40-period moving averages.

Therefore, there is a likelihood that the Brent crude oil price will keep rising as bulls target the 50% Fibonacci retracement level at $110. A drop below the support at $102 will invalidate the bullish view.