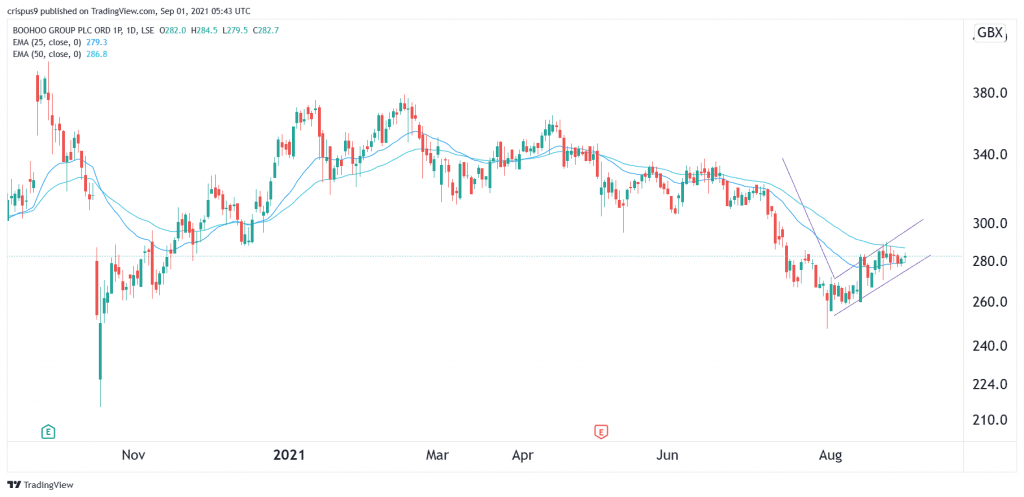

The Boohoo share price had a relatively strong month in August as demand for the stock held steady. In total, the BOO stock price jumped by about 6% in August and is currently trading at 282p. This price is still about 34% below the highest level this year.

Boohoo has been under pressure

Boohoo is a fast-growing e-commerce company that offers fast-fashion products like dresses, tops, blazers, and shoes and accessories. While the company makes most of its money from women, its men brands are seeing some strong growth lately.

After recording a strong growth in the past few years, Boohoo has recently faced some key headwinds. For example, the company is facing intense competition from fast-growing companies like Shein. It is also facing the challenge of manufacturing as it cleans its image following the sweatshop scandal. Indeed, the firm is currently sourcing for a new PR company to help build its image.

Still, there are some positives about Boohoo. First, the company recently attracted the attention of T.Rowe Price, the giant American fund manager. The fund is now one of the biggest holders of the company’s shares.

Second, while Boohoo has faced challenges, its organic growth is still relatively strong. Recent results showed that the company’s business experienced substantial growth in the first half of the year. This trend will likely continue in the future.

Third, Boohoo recently bought digital assets of Debenhams, which was once a high-flying retailer. While the company faced substantial challenges, its e-commerce brands delivered substantial returns. Therefore, these returns will likely provide more growth to the company.

Fourth, Boohoo is set to benefit from its US expansion. The region’s sales have been rising by more than 40%. Therefore, with the company’s strong brand, there is a possibility that it will take a market share from some existing US e-commerce fast-fashion companies.

Looking ahead, in September, the Boohoo share price will react to the company’s interim results that will come on September 30th.

Boohoo share price forecast

The daily chart shows that the Boohoo share price has staged a recovery in the past few weeks. However, a closer look shows that this recovery is part of the formation of a bearish flag pattern. In price action analysis, a bearish flag pattern is usually a sign that the price will break out lower soon. The price is also between the 25-day and 50-day moving averages.

Therefore, the stock will likely break out lower in September as bears target the key support at 250p, which was the lowest level in July. However, a move above 300p will invalidate the bearish view.