USDJPY started the Asian session higher but as we progress into the European session the pair faces selling pressure down to 107.02 as traders will closely follow the discussions in G20 meeting later this week for developments in China – USA trade war tensions. The USD weakness will continue to drive the pair’s momentum as traders wait later today the speech by Fed Chair Powell for a clue about FED’s next move.

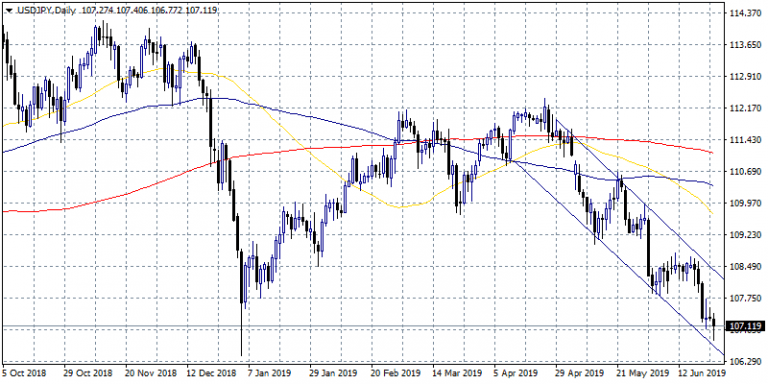

The pair during the previous week broke below the key 200 and 100 hour moving (the red and blue line in our USDJPY hourly chart) and now the bears are in control. The down trend channel controls the price move for the moment. Immediate support for the pair stands at 107.00 round figure while extra support will be met at recent low down at 106.70. On the upside first resistance stands at 107.33 the 50 hour moving average while a break above can drive prices up to 107.55 the 100 hour moving average. The Bearish momentum is still intact and any strong upticks for the pair should considered as selling opportunity.