Aviva’s share price is on a six-trading-session bullish streak, and the trend is looking likely to continue in the next few sessions. Currently trading at 402p, Aviva’s share price is also looking highly likely to finish the session with a gain of at least a percentage point.

Why is Aviva Bullish?

One of the reasons that Aviva has become bullish in the past few days is that investors fear a recession has been quelled. According to Michael Grady, head of investment strategy and chief economist at Aviva Investors, current market conditions have become extremely challenging in the financial markets. Therefore, he indicated they preferred to be modestly underweight duration, with upside inflation risks outweighing recession risks.

Aviva investors also put the risk of recession at close to 50 per cent. However, the risk assessment also noted that the absence of major imbalances and excesses that have been observed in previous recessions means that the economy will be able to rebound quickly. This has also quelled many investors’ fears about a complete meltdown, according to Aviva Investors, Aviva’s global asset management arm.

Aviva Share Price Prediction

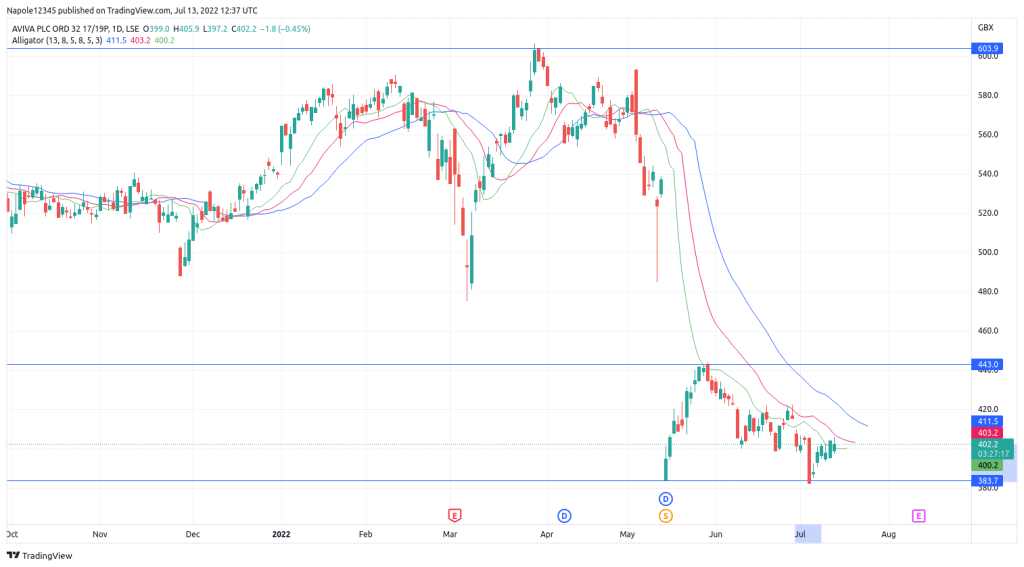

The current bounce of the Aviva share price is not just due to quelled investors’ fears. Recently, the prices hit an important demand zone of 383p. The result has been an aggressive bullish move that has caused the price to surge by over 5 per cent in six trading sessions.

The momentum of the bullish move also looks strong enough. Therefore, there is a high likelihood that we will see the prices continue to rise until it hits the 443 supply zone. However, should the prices reverse and hit the 383p price level again, then my bullish analysis will be invalidated. It will also mean a continued push to the downside.

Aviva Daily Chart