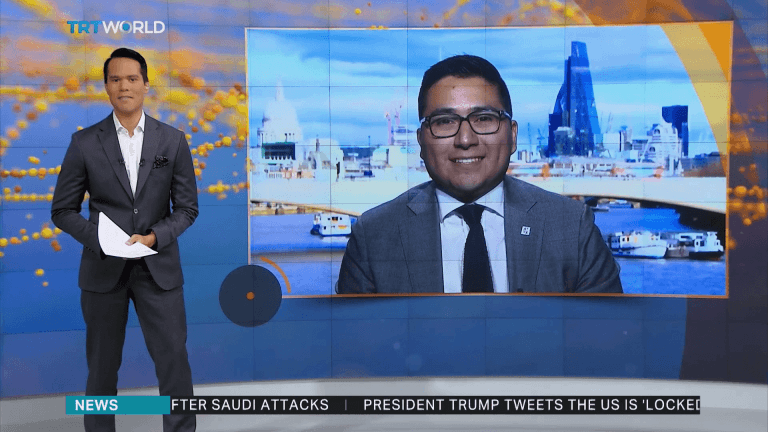

In a TV interview with TRT World, ATFX’s Chief Market Strategist, and also InvestingCube’s editor, Alejandro Zambrano, argues that commodity currency pairs such as the Canadian Dollar and Norwegian Krone could gain if typical correlations between the currency pairs and crude oil prices bounce back.

He also says that global stock market indices appear to underestimate the risks of a prolonged delay to Saudi Crude oil production. At the time of interview the S&P 500 was lower by 1% from last week’s high, despite surge of crude oil prices. From its August 25 low to last week’s high of 3023, the S&P 500 added a stellar 7.66%.

Zambrano projects a more negative development in the S&P 500 given the severity of the crude oil product cut, the risk of military escalation between the US and Iran, and last few week’s strong gains in the S&P 500.

In the interview, he also shares his view on the latest Brexit developments and the meeting between PM Boris Johnson and the European Commission President Jean-Claude Juncker.

Watch the video below for the complete interview.

Don’t miss a beat! Follow us on Telegram and Twitter.

[vc_video link=”https://youtu.be/VSVDL7cxdXQ”]