- Even after losing half its value, the ADA price is still too high and could soon be valued in cents rather than dollars.

Even after losing half its value, the ADA price is still too high and could soon be valued in cents rather than dollars.

On Wednesday, Cardano (ADA) is on life-support at $1.365 (-1.10%), clinging to a ‘must-hold’ level. The layer-1’s (L1) native ADA token continues to underperform the market in general and lags behind rivals like Solana and Avalanche.

Undoubtedly, the biggest headwind for the Cardano price has been the network’s slow progress following the Alonzo upgrade in September. Despite enabling smart contract functionality, Cardano has failed to attract high-profile projects, leaving the ADA token lacking a bullish catalyst. Subsequently, the price has been trending lower for three months and is now on the verge of breaking down.

Cardano Price Analysis

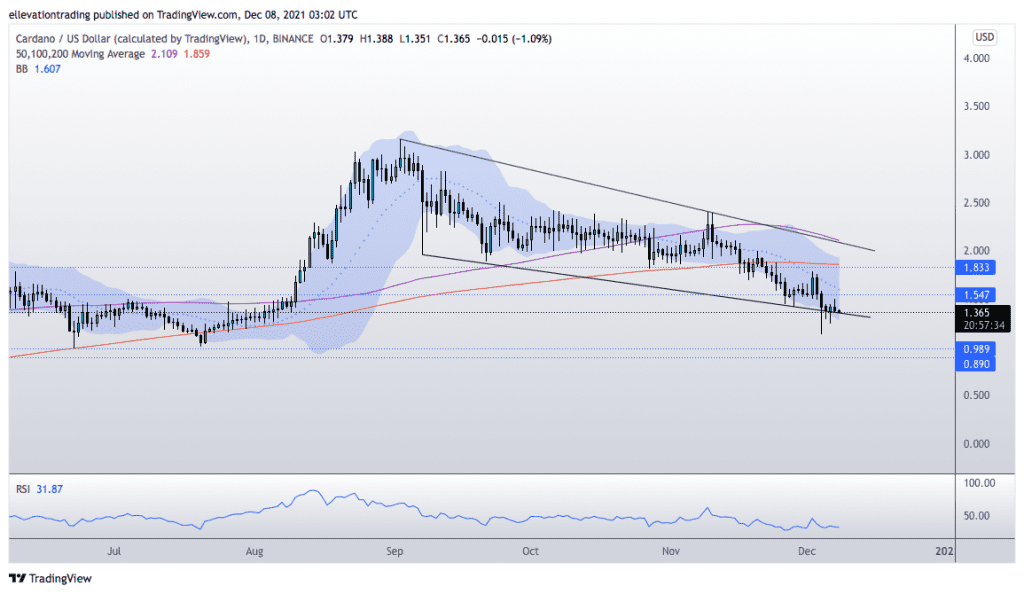

The daily chart shows that the ADA price has been flirting with trend support (now at $1.355) for the last four days. In my opinion, a daily close below the trend could force longs to capitulate. And whilst my previous report on Nov 24th forecast a $1.00 price target, I now feel that Cardano could go even lower if the cryptocurrency market continues to see risk-aversion.

In my opinion, a broader sell-off could drive ADA down to the April low at $0.890, erasing eight months of gains. However, the immediate bearish view relies on ADA breaking below the descending trendline. On that basis, a close above $1.355 averts the immediate danger. However, until Cardano makes significant progress, it should continue to lose value.

In contrast, a close above the 200-DMA at $1.859 would suggest the ADA token has turned the corner, invalidating my bearish outlook.

ADA Price Chart (Daily)

For more market insights, follow Elliott on Twitter.