- Summary:

- The Nasdaq 100 index has crashed this week as the sector rotation from growth to value intensifies. Time to buy the dip?

The Nasdaq 100 index has crashed this week as the sector rotation from growth to value intensifies. The index and the QQQ stock price erased more than 500 points on Wednesday after the latest Fed minutes. It is trading at $15,770, which is about 5% below the highest level this year. It has crashed to the lowest point since December 22.

The Nasdaq 100 index is made up of the biggest technology companies in the world like Microsoft, Tesla, and Alphabet. The index is often seen as being riskier than other indices because of this concentration of risky assets.

Therefore, it is often more sensitive to the Federal Reserve than the Dow Jones and the S&P 500 index. This explains why it has outperformed the two indices in the past two years. During this period, the Federal Reserve has left interest rates at a record low and added over $4 trillion to its balance sheet.

The main reason why the Nasdaq 100 index has crashed this week is that there is a sector rotation going on. Investors are moving from momentum stocks to value ones. As Jim Cramer explained, they are moving from companies like Okta that most people don’t understand to value ones like Deere that have tangible products.

Still, there are reasons to be optimistic. For one, while interest rates are expected to keep rising, history shows that they will remain at their historic lows. Also, many growth stocks will likely have strong results this year. Most importantly, growth stocks like PayPal and Block have become dirt cheap in the past few months.

Nasdaq 100 index forecast

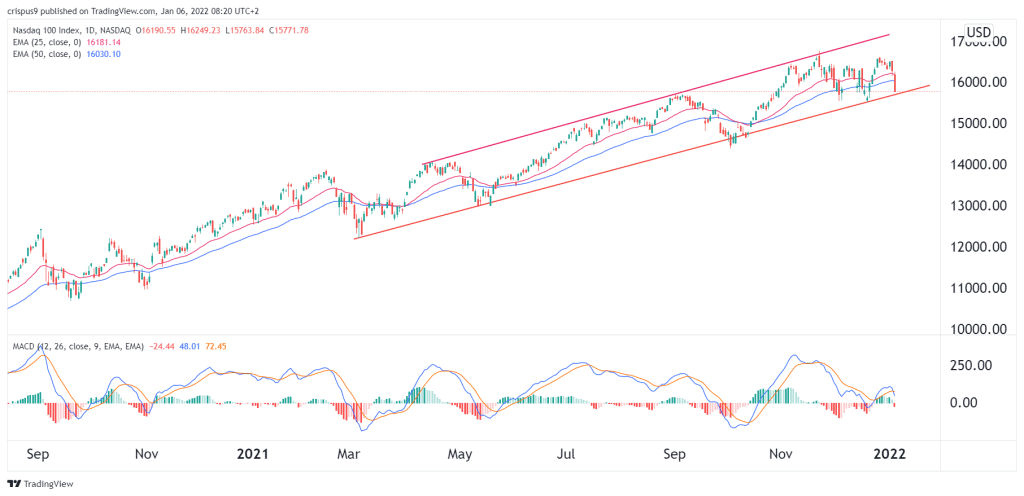

The daily chart shows that the Nasdaq 100 index has been in an overall bullish trend in the past few months. As a result, the index has formed an ascending channel that is shown in red. Most importantly, it is approaching the lower side of this channel. It has also moved slightly below the 25-day and 50-day moving averages.

Therefore, there is still hope that the NDX index will bounce back as investors buy the dip. If this happens, they will target the upper side of the channel at $16,588. A drop below the lower side of the channel will invalidate the bullish view.