The USD/CAD price has come under pressure in the past few weeks as investors reflect on the actions of the Federal Reserve and the Bank of Canada (BoC). As a result, the pair dropped to a low of 1.2805, the lowest level since June 13th of this year. Moreover, it has dropped by over 3% from its highest point in July.

USD/CAD latest news

The USD/CAD price has dropped as the US dollar index has retreated. After soaring to a multi-decade high of $109.30 in July, the index has retreated to about $106. This decline happened as investors started focusing on the future of the current Fed intervention.

Analysts believe the Fed will continue hiking interest rates and implementing its quantitative tightening program this year. These interventions are necessary as the Fed fights to lower inflation, which has risen to the highest point in over three decades. The bank hiked interest rates by 0.75% this week.

However, most analysts believe that the bank will then embrace a more dovish tone in 2023 in a bid to salvage an economy that higher rates and inflation will batter. Indeed, recent data shows that the American economy is struggling.

For example, data published on Thursday revealed that the economy contracted by 0.9% in the second quarter. This contraction was lower than the previous decline of 1.6%. However, it also signalled that the US economy moved into a recession.

Other flash numbers have been a bit weak. For example, numbers delivered this week showed that the country’s new, pending, and existing home sales tumbled sharply last month. In addition, building permits and housing starts have all declined sharply as the cost of borrowing has surged.

Therefore, with the economy in stagflation, the USD/CAD pair has dropped because analysts expect that the Fed will start going slow on rate hikes.

US inflation has peaked.

Most importantly, flash numbers reveal that inflation will likely sort itself out. For example, after peaking at over $5 in June, gasoline prices have dropped to about $4.3. This is notable since the gas price is the biggest part of US inflation.

The price of other commodities has also declined. For example, companies like Rio Tinto and Anglo American reported weak results because of the falling prices of products like iron ore and copper. This is a sign that the global economy is weakening, which will lead to lower prices.

Most importantly, the cost of ocean shipping has also dipped, meaning that it will likely affect the soaring inflation. In addition, other key drivers of inflation in the US, like automobiles and food, have also started falling.

For example, in June, Target said that its high inventories will push it to provide more discounts to users. This month, Walmart shocked the market when it warned that it would start offering buyers discounts.

Bank of Canada tightening.

The USD/CAD price has also declined because of the recent actions by the Bank of Canada (BoC). Like other major central banks, the BoC has embraced a more hawkish tone in a bid to fight the soaring inflation.

Last week’s data revealed that Canada’s inflation surged to 8.1%, the highest level in over three decades. As well, it increased by 0.7% from a year earlier. Like in the United States, gasoline prices were the biggest contributor to the country’s inflation. It has risen by over 55% in the past few months.

This month, the Bank of Canada surprised the market when it delivered a supersized 1% rate hike. This was the biggest rate hike among G10 countries.

USD/CAD chart analysis

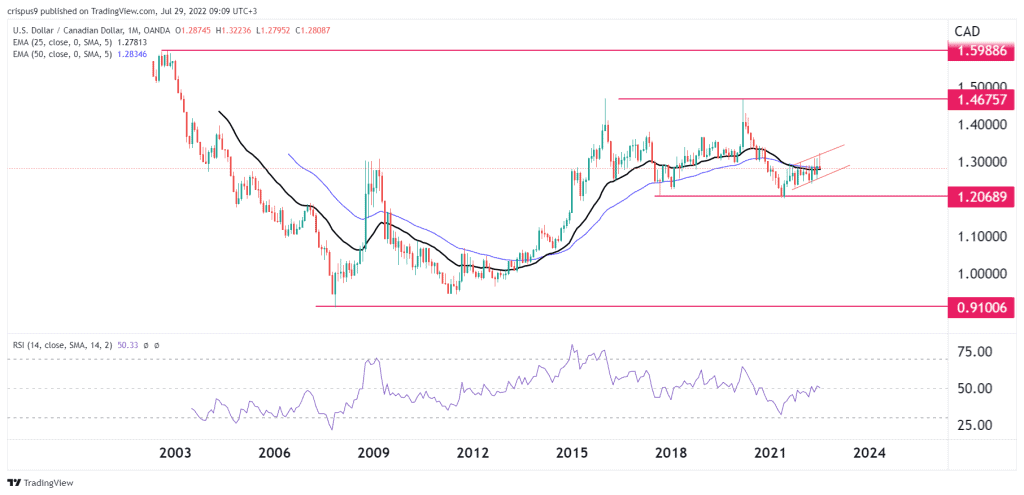

The monthly chart shows that the USD/CAD price soared to an all-time high of 1.5988 in 2002. The pair then slashed to a record low of 0.9100 during the Global Financial Crisis (GFC). It has been attempting to rebound since then. The pair formed a double-top pattern at 1.4675 between 2016 and 2020.

Therefore, the long-term USD/CAD forecast is bearish since it has formed both a double-top and a rising wedge pattern.

USD/CAD forecast 2023

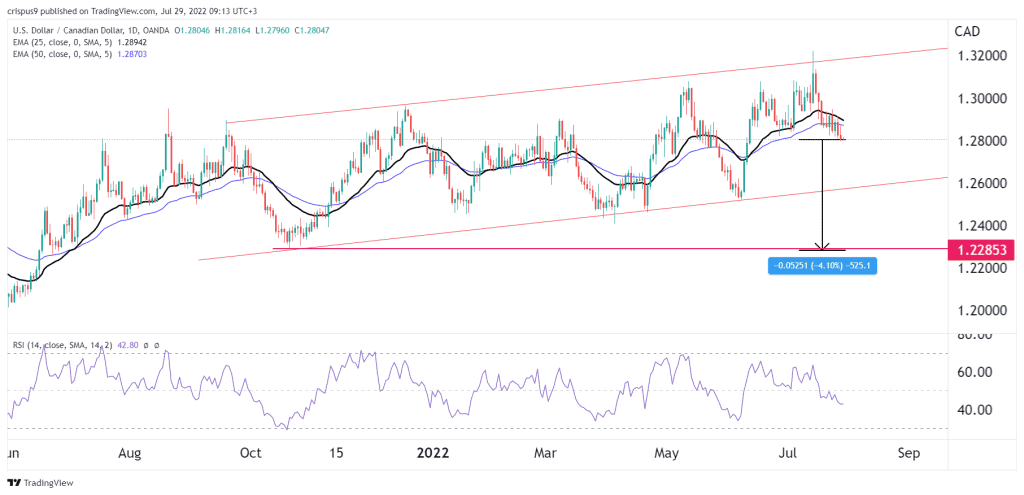

The USD to CAD exchange rate rose to a high of 1.3225 in 2021 as the US dollar strength continued. However, a closer look at the daily chart shows that it formed an ascending channel pattern that is shown in red. Now, it has moved to the middle of this pattern and crossed the 25-day and 50-day moving averages.

The pair’s Relative Strength Index (RSI) has moved below the neutral point. Therefore, the pair will likely continue falling in 2022 and 2023. If this happens, the next key level to watch in 2023 will be at 1.2285, which was the lowest level since October 2021.

USD/CAD forecast 2025

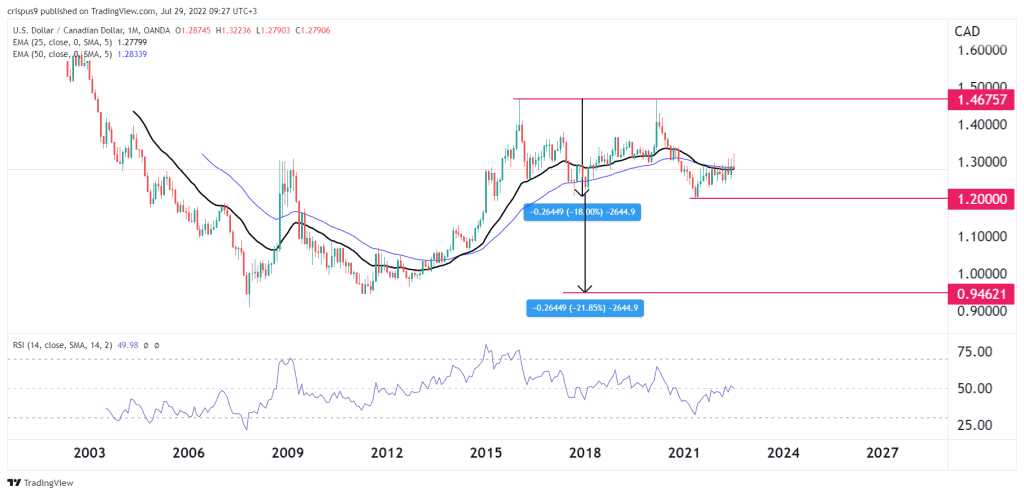

It is hard to predict the USD/CAD price by 2025. However, the weekly chart shows that the pair has formed a head and shoulders pattern. Historically, a H&S pattern is usually a bearish view. Therefore, we can conclude that the pair will be much lower than it is today. If this happens, the key level to watch by 2025 will be at 1.2000.

USD/CAD forecast 2030

While predicting where the USDCAD price will be in 2025, forecasting where it will be in 2030. A close look at the monthly chart, we see that the pair has formed a double-top pattern. Therefore, there is a possibility that the pair will have a bearish breakout.

Therefore, by measuring the distance between the double-top and the chin, we can estimate that the pair will continue falling. If this happens, the pair will likely continue falling to 0.9462. A move above the key resistance at 1.3250 will invalidate the bearish view.

Is USD/CAD a good buy?

It is hard to recommend buying the USD/CAD pair at this stage. However, the four-hour chart shows that the pair has formed a head and shoulders. Therefore, there is a likelihood that the pair will continue falling in the near and longer term.