- Yes Bank share price prediction: SMBC's 20% stake deal ignites a sharp breakout, pushing YESBANK above key resistance. Is ₹24.36 next target?

Yes Bank’s shares rallied over 4% today to trade at ₹20.92. This fresh momentum comes in the wake of Japan’s Sumitomo Mitsui Banking Corporation (SMBC) acquiring a 20% stake in the private lender, a move widely seen as a strategic turning point for the long-beleaguered bank.

What’s Driving the Yes Bank Rally?

There’s more than one reason Yes Bank is suddenly back in the spotlight.

First, the big headline: Japan’s Sumitomo Mitsui Banking Corporation (SMBC) is officially taking a 20% stake in the bank, a move reportedly valued at over ₹9,000 crore. For many investors, this isn’t just capital, it’s a vote of confidence in Yes Bank’s turnaround narrative.

The timing couldn’t be better. Foreign institutional investors, who’ve largely stayed cautious, appear to be rotating back into Indian banking stocks, and this deal adds fuel to the fire.

Then there’s the technical story. After months of struggling to break past ₹19.22, the stock finally did and with authority. That breakout, combined with a volume surge that doubled the 20-day average, signals one thing: this isn’t a fluke. Bigger players are stepping in.

Yes Bank Technical Analysis: Can Bulls Sustain It?

The chart structure has shifted decisively in favour of the bulls. Here’s what stands out:

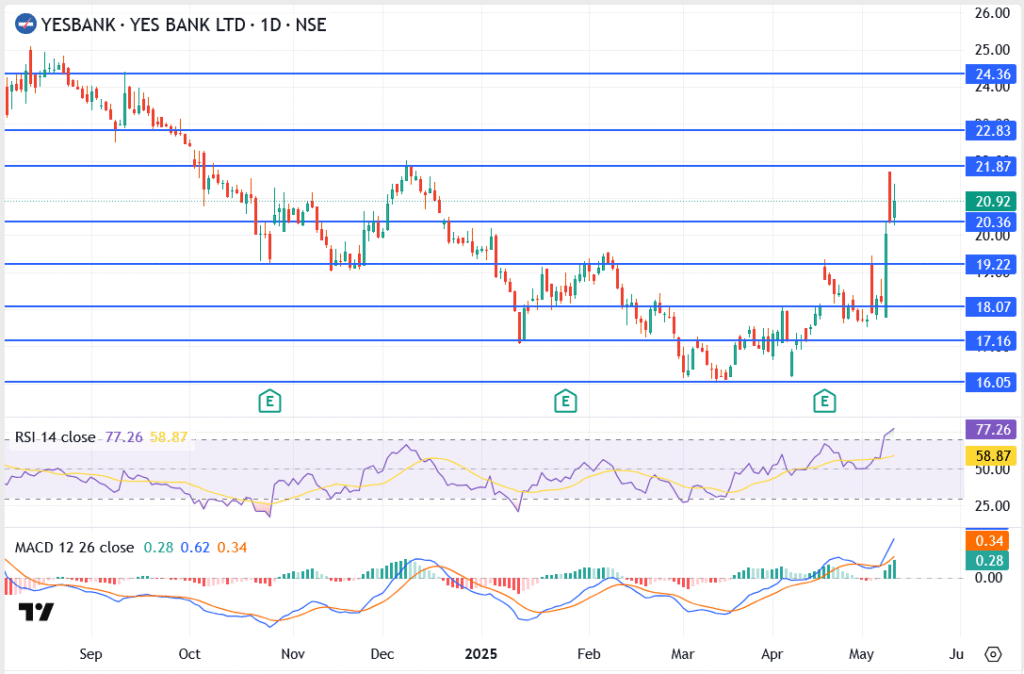

- Support breached at ₹19.22, triggering a vertical breakout

- Price sliced above ₹20.36, confirming short-term trend shift

- Next key resistance at ₹21.87 – currently being tested

- If breached, next levels are ₹22.83 and ₹24.36

- RSI at 77.26 – overbought but not unusual during breakout phases

- MACD confirms bullish strength, showing a widening histogram and crossover

This isn’t just speculative froth. The structure now mirrors early-stage accumulation breakouts seen in 2021.

Conclusion

The 20% stake acquisition by SMBC has done more than lift sentiment; it has potentially changed the story. Yes, the Bank’s share price is now reacting to concrete institutional backing, not just retail chatter.

If bulls manage to hold above ₹20.36, the next upside wave could stretch toward ₹24.36, a level not seen since early 2023.