Rigetti Computing (NASDAQ: RGTI) traded higher on Wednesday pre-market after delivering a Q2 update that showed both technical progress and early signs of commercial momentum. The stock was last seen at $16.22, up nearly 2%, as traders weighed the company’s latest advancements in quantum processor performance against its still-early revenue base.

In order to make quantum processors practical outside of controlled laboratory settings, the company demonstrated quantifiable gains in qubit stability and error correction. Rigetti management believes that these improvements place it in a better position to compete for high-value contracts like advanced research, financial modeling, and military.

Rigetti Computing’s Q2 results pointed to tangible progress on its hardware roadmap, with notable strides in qubit stability and error correction. These are not just technical footnotes; they’re the kind of advancements that move quantum processors closer to functioning reliably in real-world environments. Management believes these gains could strengthen its hand in securing high-value contracts, particularly in defense simulations, complex financial modeling, and cutting-edge research projects.

The research agreements and pilot programs increased quarterly revenue over the previous year. The company’s long-term strategy is still centered on growing beyond specialized deployments and into larger commercial markets, even if it is still in the pre-scale stage.

The market’s initial reaction was upbeat. Rigetti’s shares, which have been prone to sharp swings on company news, edged higher as traders bet that technical credibility is slowly translating into a stronger business case. Broader sector sentiment is helping, inflows into AI and semiconductor funds have persisted despite a recent cooling in the wider tech rally.

These results come at a time when the quantum computing race is tightening, with heavyweight tech firms and deep-pocketed startups competing for the same strategic contracts. For Rigetti, the latest performance gains could be the differentiator that keeps it in the running against much larger rivals.

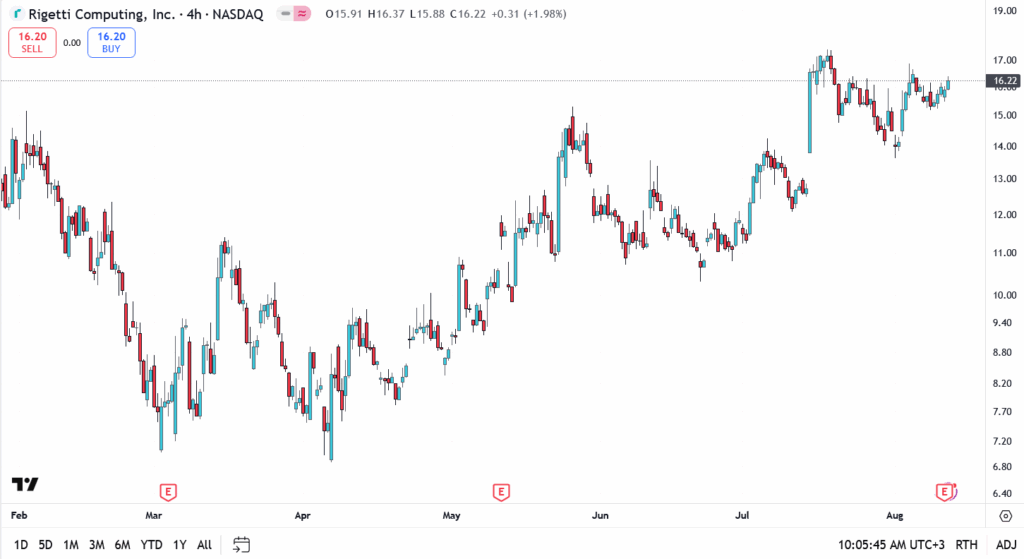

Rigetti Computing Share Price Technical Analysis

- Current price: $16.22

- Resistance levels: $16.90 and $17.65

- Support zones: $15.40, then $14.20

On the 4-hour chart, Rigetti has broken above the recent $15.50–$16.50 consolidation zone, with momentum indicators leaning bullish. A sustained break above $16.90 could trigger a run toward $17.65, while failure to hold $15.40 may open the way for a pullback toward $14.20.

Outlook

Earnings have given Rigetti’s bulls a fresh reason to engage. The company’s progress in reducing error rates and increasing qubit stability is narrowing the gap between experimental prototypes and commercial-ready systems. If buying pressure carries the stock past $17 in the coming sessions, the July highs could be back in play before month-end.

For now, the post-earnings momentum suggests Rigetti is entering the next phase of its story, one where execution, not just innovation, will dictate its place in the quantum race.