- Rigetti Computing Inc under analyst focus after Jefferies initiates coverage. What does the quantum stock’s valuation debate mean?

Rigetti Computing Inc. is back in the spotlight after Jefferies initiated coverage with a Hold rating and a $30 price target, reigniting debate over how the market should value early-stage quantum computing companies.

The initiation comes at a critical point for Rigetti, whose shares have cooled from their recent highs but remain well above earlier 2025 levels. Rather than triggering a sharp sell-off, the Jefferies call has sharpened investor focus on timelines, execution risk, and whether quantum enthusiasm has moved ahead of commercial reality.

How Wall Street Analysts Are Rating Rigetti Stock Right Now

Rigetti has seen a wide range of analyst actions over the past two months, underscoring the valuation uncertainty surrounding quantum computing stocks.

In December, Mizuho initiated coverage with an Outperform rating and a $50 target, highlighting optimism around long-term quantum adoption. Earlier in November, Benchmark reaffirmed a Buy rating but cut its target from $50 to $40, reflecting more conservative expectations.

This spread of views illustrates a market still searching for the right framework to price quantum progress.

The average one-year price target from seven analysts stands at $35.34, with estimates ranging from $20 to $51.

What Does the Valuation Debate Mean for Rigetti Investors?

For investors, the message is clear: Rigetti sits in a high-conviction, high-uncertainty zone. The stock is no longer being driven by headlines alone, but by expectations around delivery, timing, and proof of real-world adoption. Confidence going forward will depend less on price targets and more on whether the company can demonstrate steady progress toward scalable use cases.

This sets up a more selective phase for the stock. Long-term believers may view current levels as a chance to stay positioned in a transformative technology, while shorter-term traders are likely to remain cautious until clearer execution signals emerge. In this environment, patience and risk tolerance matter just as much as belief in quantum’s future.

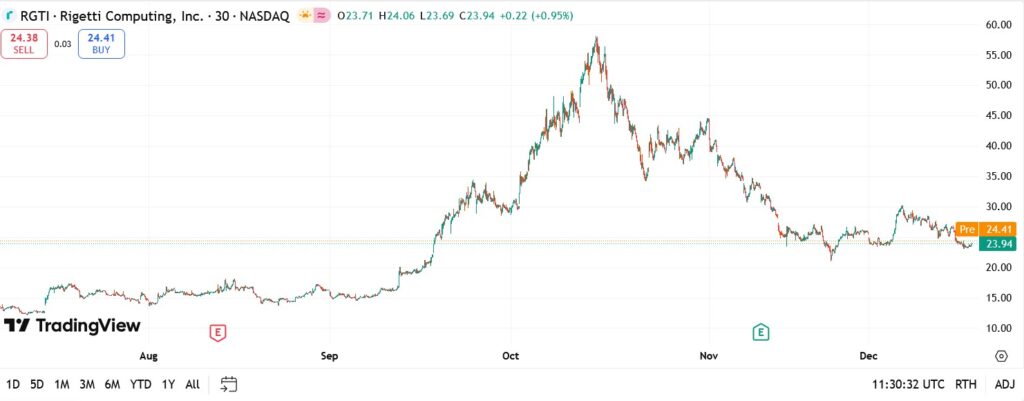

Rigetti Computing Stock Chart Analysis Today

The daily chart shows Rigetti Computing Inc trading in a consolidation range after pulling back from its recent peak above the mid-$50s. Price is currently holding in the low-to-mid $20s, where buying interest has started to stabilise the move.

The sharp rally earlier in the quarter has clearly cooled, but the structure does not show capitulation. Instead, the stock appears to be digesting gains, with momentum flattening as investors wait for the next catalyst.

Is Rigetti Computing Inc a Long-Term Quantum Opportunity or a High-Risk Trade?

Rigetti occupies a rare position as a publicly listed, vertically integrated quantum computing firm. Its development of multi-chip quantum processors and cloud-based access platform gives it strategic relevance, but also exposes it to long development cycles and funding sensitivity.

In my view, the Jefferies initiation does not mark an inflection toward weakness, but rather a transition from excitement to scrutiny. The stock appears to be entering a phase where progress, partnerships, and discipline will matter more than momentum.

Until clearer commercial traction emerges, Rigetti is likely to remain volatile, attractive to long-term believers in quantum computing, but demanding patience from investors seeking near-term certainty.

Earlier this year, in January, I had projected that Rigetti Computing Inc could trade above the $20 level by year-end, a scenario that has now materialised as investor focus shifts from speculation to execution.

Rigetti Computing develops full-stack quantum computing systems, including quantum processors, cloud-based access, and integrated quantum-classical infrastructure.

Rigetti is considered a high-risk, long-term investment tied to the future adoption of quantum computing, with returns dependent on successful commercialisation and execution milestones.

Rigetti stands out for designing its own quantum chips and operating a vertically integrated platform, rather than focusing only on software or research partnerships.