- Nvidia stock slips as Huawei launches a rival AI chip. Can NVDA defend key levels and maintain its AI leadership ahead of earnings season?

Nvidia stock price (NASDAQ: NVDA) tumbled today after reports that China’s Huawei has successfully launched a next-generation AI chip. The report stoked fears of rising competition in the booming artificial intelligence sector.

After leading the global AI hardware market for nearly two years, Nvidia faces a serious challenge from Huawei, a development that could reshape the industry’s future.

China’s Huawei Sparks Rivalry Threatening Nvidia Stock Price

Huawei’s newly developed AI chip is designed to rival Nvidia’s premium products. It targets AI cloud infrastructure and advanced machine learning applications.

The timing is critical: U.S. export restrictions have severely limited Nvidia’s ability to sell its AI chips, like the A100 and H100, to Chinese companies.

Huawei’s entry into the high-end AI chip market raises the stakes, as major Chinese tech giants like Alibaba, among others, could shift demand toward local alternatives.

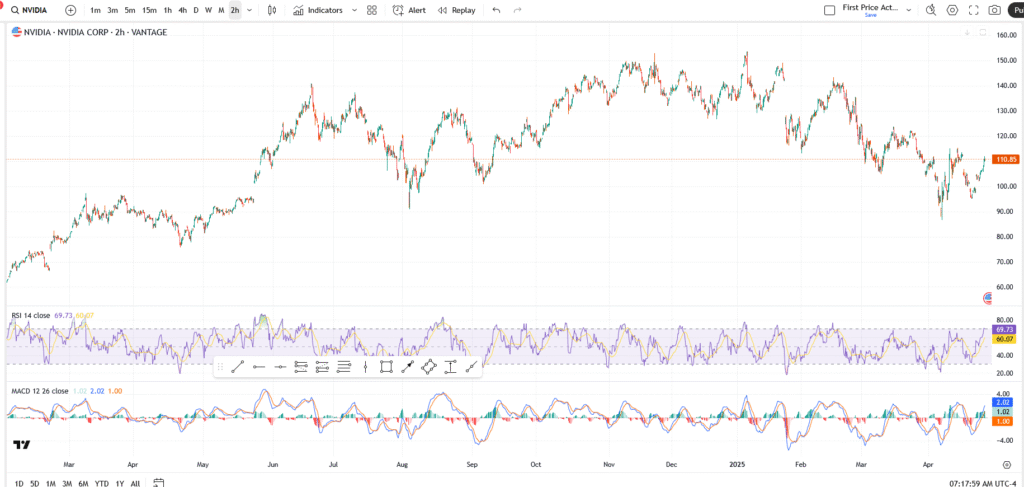

Nvidia Stock Price Analysis: Key Levels to Watch

- NVDA last traded around $110.85, down nearly 2% intraday.

- Immediate support sits at $110.00 — a psychological level that has acted as a buyer’s line for the past two sessions.

- Deeper support lies at $105.00, with $100.00 being the critical line that must hold to avoid a broader correction.

A decisive break below $110.00 could accelerate selling toward $105.00, especially if sentiment around Huawei’s advances continues to build.

Will Nvidia Weather the Huawei Storm?

Despite today’s selloff, most analysts argue that Nvidia’s leadership position remains intact. Nvidia still boasts unmatched advantages in software ecosystems and deep partnerships across global cloud providers.

As earnings season nears, Nvidia will need to convince investors that its lead in AI technology is still strong, or risk losing ground to new rivals.