Jio Financial Services is back in the spotlight after the company’s board greenlit a ₹15,825 crore capital raise via a preferential issue, a move that signals Mukesh Ambani’s growing intent to expand his footprint in financial services. The announcement, confirmed late Wednesday, comes with another big reveal: Ambani plans to increase his stake beyond the 51% threshold, consolidating control of the NBFC giant.

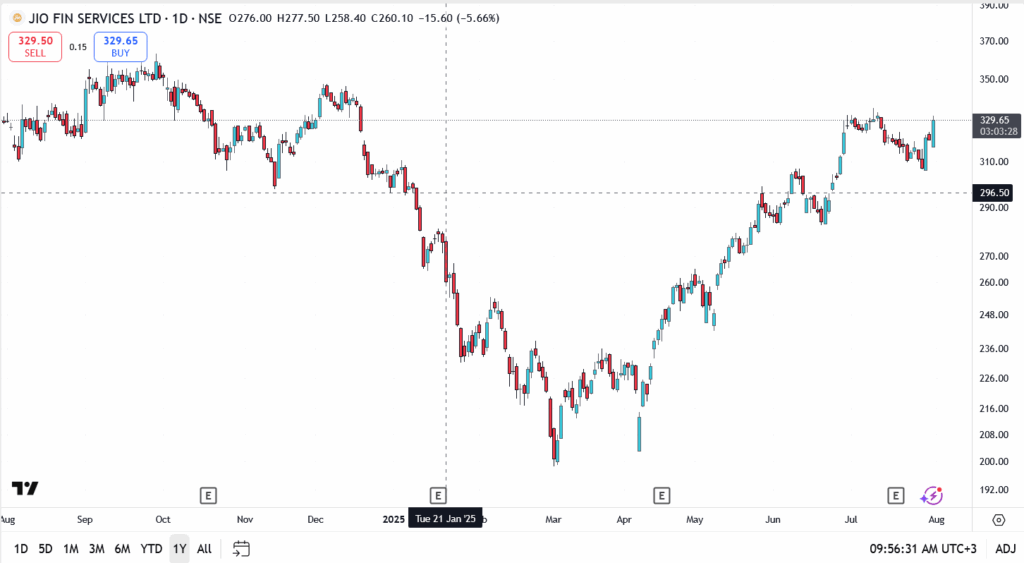

Investors didn’t wait long to react. Jio Financial opened with strong momentum on Thursday, with shares climbing to ₹329.65 before paring gains. This follows weeks of sideways movement and a failed breakout attempt earlier this month, making today’s rally feel like the first real attempt at a trend shift.

According to reports, the capital will be deployed toward expanding Jio Financial’s lending, insurance, and asset management verticals, three spaces the group has been quietly laying groundwork in over the past year. With Reliance already holding digital infrastructure and a consumer base, Jio’s financial arm is uniquely positioned to scale fast once funding falls into place.

Jio Financial Stock Outlook

- Current price: ₹329.65

- Resistance: ₹333.00 and ₹350.00

- Support zones: ₹312.00, then ₹296.50

Today’s bullish candle comes after a 5-day tight range and is now testing its June swing high near ₹330. A breakout with volume above ₹333 could unlock further upside, while failure to hold above ₹312 might drag the stock back into consolidation.

Conclusion

The board’s move is clearly strategic. At ₹15,825 crore, the fundraise isn’t just about growth, it’s also about anchoring long-term shareholder confidence ahead of a possible financial services push into lending and digital banking.

For traders, the breakout above ₹330 is now the key level to watch. If the momentum holds and volumes confirm, Jio Financial could be setting up for a fresh leg higher, and Ambani’s intent might be just the catalyst it needs.

This article was originally published on InvestingCube.com. Republishing without permission is prohibited.