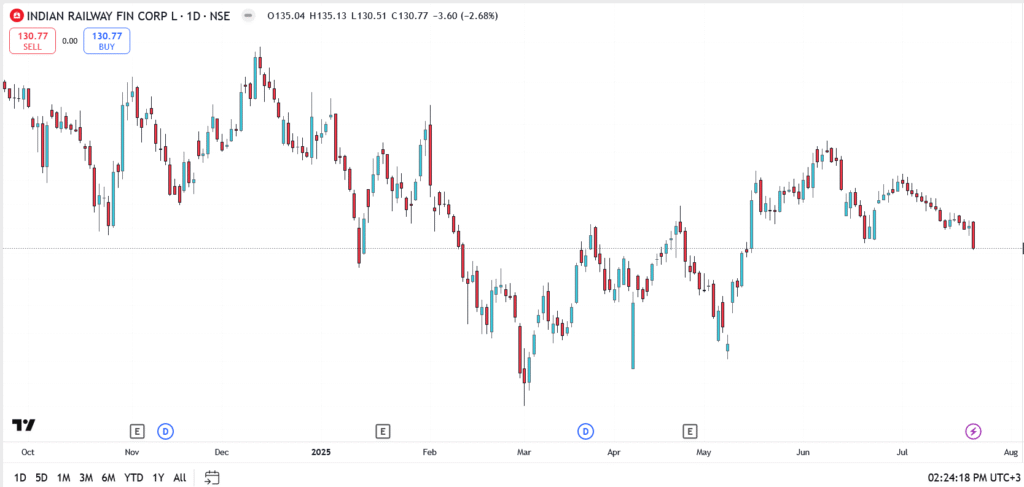

Indian Railway Finance Corporation (NSE: IRFC) fell over 2.6% to ₹130.77 today. The dip follows exchange notices issued by the NSE and BSE over board compliance issues tied to the March 2025 quarter. With the company awaiting key appointments from the Ministry of Railways, market participants appear uneasy ahead of IRFC’s Q1 FY26 earnings.

This comes just hours after Economic Times highlighted IRFC’s sharp multi-year rally, a 551% rise over three years, and raised the question of whether it’s time for a deeper correction. Today’s price action suggests that the stock’s momentum may be fading, at least in the short term.

IRFC Seeks Waiver After NSE, BSE Raise Red Flag

IRFC confirmed receiving notices from both stock exchanges over non-compliance with board and committee composition norms, citing the absence of Independent Directors. In response, the firm has formally requested a waiver, arguing that appointments are handled by the Ministry of Railways, not the company itself.

The issue isn’t new. IRFC pointed out that similar fines had previously been waived under the same circumstances, and has submitted the matter to its board for further escalation.

IRFC Share Price Technical Outlook

- Current price: ₹130.77

- High of day: ₹135.13

- Resistance zones: ₹135.20, ₹140.00

- Support zones: ₹129.00, ₹125.50

Final Take: Caution Builds as Q1 Results Near

With IRFC’s earnings expected soon, today’s price action reflects more than just a regulatory hiccup, it’s about confidence. The market has started to question how long the stock can defy governance concerns and still trade near its highs.

If Q1 numbers disappoint or the board issues linger, a deeper correction toward the ₹120–₹125 range is possible. Until there’s clarity from the Ministry or a positive surprise in earnings, traders may remain on edge.