The rupee found its footing again on Tuesday, pressing USD/INR lower after last week’s push to fresh highs. Optimism around U.S. tariff relief and New Delhi’s latest tax breaks lifted sentiment, though the pair is still trading above key supports, keeping traders alert to a possible reversal.

What’s Driving USD/INR This Week?

Rupee strength is being driven more by policy headlines than by pure flows. Reports that Washington may dial back tariff risks have taken pressure off emerging-market currencies, and India’s tax relief measures injected confidence into growth expectations at home. Those two themes encouraged inflows into Indian equities and bonds, keeping demand for the rupee steady.

But this isn’t a one-way trade. Dollar resilience globally is still a counterweight. With the Federal Reserve showing no rush to cut rates, U.S. yields remain sticky, and that keeps USD/INR from unraveling too quickly. In short, the rupee has the story, but the dollar still controls the tempo.

USD/INR Technical Outlook Today

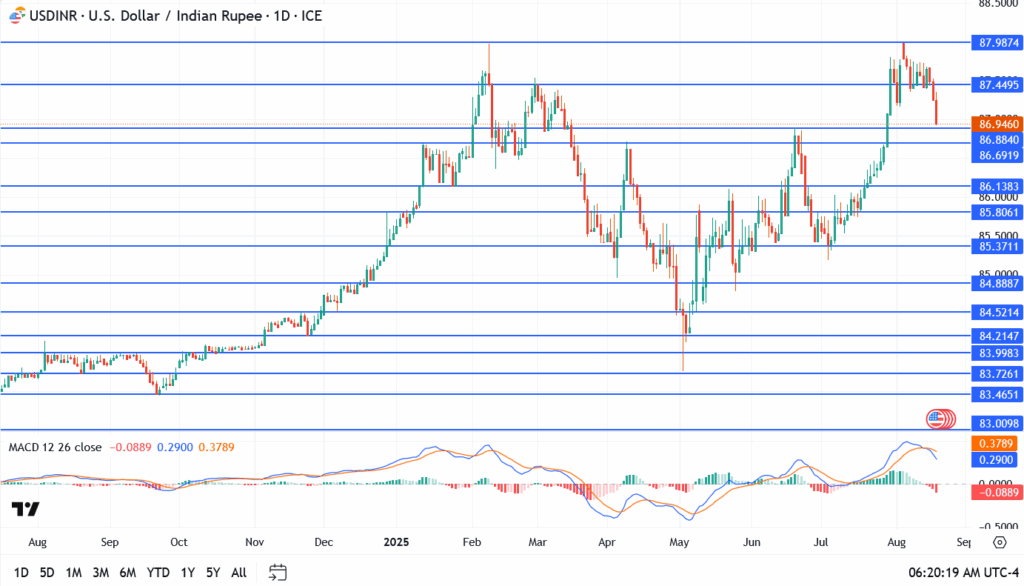

- Current price: 86.94

- Resistance: 87.45, then 87.98

- Support: 86.69, then 86.13

The pair eased after rejecting 87.98, now resting just above support at 86.94. A close under 86.69 would set up a deeper retracement toward 86.13, where dip buyers are likely waiting. Reclaiming 87.45 flips the script, putting 87.98 back on the radar.

Momentum indicators are cooling, with the MACD line drifting lower, a sign the market could consolidate before choosing a fresh leg.

Outlook: Rupee’s Gains Tested

The rupee’s latest bounce has the right backdrop, easing tariff risks, tax support, and equity inflows. Still, the dollar’s global grip can’t be dismissed. If U.S. yields stay elevated, the pair may struggle to sustain below 86.69. Conversely, any fresh bout of dollar buying would quickly revive pressure on the 87.98 ceiling.

For now, traders are treating this as a range play rather than a trend shift. Rupee bulls have momentum on their side, but the bigger battle with the dollar isn’t finished yet.