- Discover the top movers in the Hang Seng for 2025, along with technical outlooks and insights into Chinese stock performance.

During yesterday’s Asian trading session, the Hang Seng index reached its highest level since November 2021 at $25,724. This jump was likely because of the fear of missing out (FOMO) among investors.

But it closed lower yesterday at $25,496.55. Today, the HSI opened higher at 25,660.65, rose 164 points, which is 0.64%. Then, the Hang Seng index dropped below the resistance level of $25,400 and remains struggling to stay above this level as investors adjust their portfolios.

In this article, we will review how Chinese stocks are performing, highlight the top Hang Seng index movers this year, and provide the technical outlook for the HSI with key levels to watch.

Hang Seng Index | Chinese Stocks Performance & Key Drivers:

- In the past few months, the Hang Seng index has held steady performance due to the fear of missing out among investors.

- Moreover, in response to the excess savings, estimated at $23 million, the Chinese stocks outperformed.

- The collapse in the real estate industry and limited options for investment are driving most investors toward the stock markets.

- According to Bloomberg, the outstanding amount of margin trades in the local stock markets rose to 2.28 trillion yuan, which is a record high.

- The Chinese stock market surged as investors’ confidence in the growing economy boosted risk appetite to accumulate stocks.

- Moreover, strong expectations that China will play a leading role in emerging technologies such as artificial intelligence (AI) signal further growth.

- With these positive signals in mind, the benchmark Shanghai composite index opened higher by 0.19% at 3,865.

- Chinese President Xi Jinping said today that the world was facing a choice of “Peace or war,” and “dialogue or confrontation,” during a military parade. U.S. President Donald Trump posed on Truth Social. He urged China’s leader to acknowledge America’s role in increasing China’s freedom. He also accused Beijing of working against the U.S.

- This speech weakened the sentiment, so at the time of writing, the Shanghai Composite lost 1.16%, the Hang Seng index lost 0.60%, and the Shenzhen Component lost 0.65%.

- Defense stocks fell after the parade, and technology stocks also dropped: East Money -4.4%, Cambricon Technologies -5.1% and ZTE Corp -2%.

Hang Seng Index | Top Movers for 2025:

- The Worst Performers:

- Meituan: -33%, revenue increased by 11%, but profits slumped by almost 100%, facing high competition from JD and Alibaba.

- JD.com: -10%, core business slowing, spending heavily on marketing its food delivery business.

- Li Auto: Flat, impacted by competition and aggressive price wars, BYD’s recent results highlighted sector challenges.

- The Best Performers:

- Sino Biopharmaceutical: +100%

- CSPC Pharmaceutical:+100%

- Chow Tai Fook Jewellery: +100%

- JD Health: +100%

- WUXI AppTech: +100%, recovered despite pressure from U.S. sanctions.

- Alibaba: +66%, significant rebound this year.

The Hang Seng Technical Outlook:

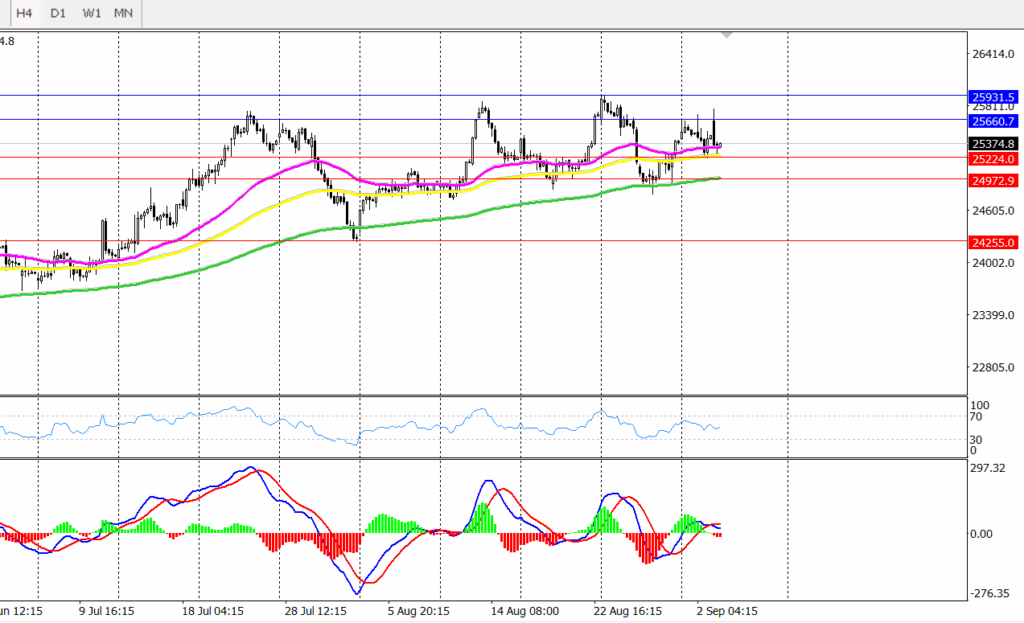

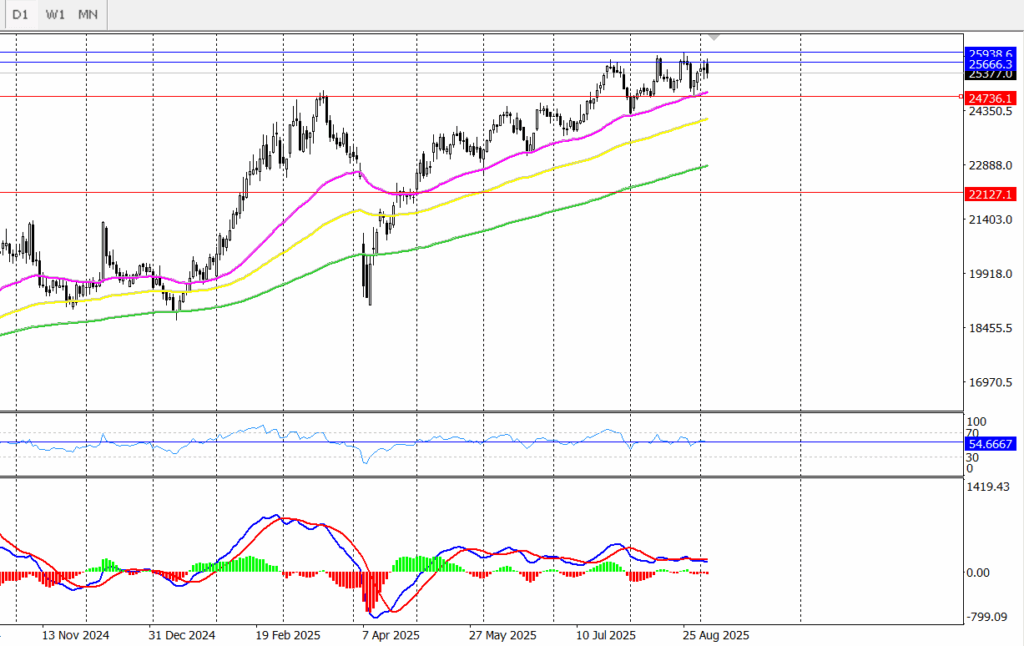

From a technical perspective, the Hang Seng Index has shown steady performance since May 2025, consolidating above the 50-day, 100-day, and 200-day moving averages on the daily chart since May 2,2025.

On the daily chart, the RSI is at the 50 mark, indicating no clear trend, as investors adjust their portfolios amid weakened sentiment. This comes along with initial MACD crossovers suggesting bearish momentum, though it is not confirmed yet.

A clear 4-hour close below the support level at $25,224 could pave the way for lower levels, as the HSI is struggling below the key resistance level of $25,400. On the bullish side, if the price can break out above $ 25,400 with a clear 4-hour close, it could rebound and reach the opening level at $25,660

We can say that the broad price prediction for the Hang Seng Index is bullish, but it may be time for profit-taking after a strong rally that has lasted for months.