The recovery move on the EUR/USD following the break of the falling wedge pattern on 25 August appears to have been truncated. This follows the release of downbeat economic data from the Eurozone on Tuesday and the rise in US long-term bond yields, which is ongoing for the third straight session.

On Tuesday, the data from the ZEW survey showed that the economic sentiment index fell from 42.7 to 31.1; a figure which was lower than analysts had predicted (35.3). The German ZEW sentiment index also fell hard, dropping off from 40.4 to 26.5 (consensus of 30.2), setting the tone for a reversal of recent gains made by the single currency ahead of the European Central Bank’s meeting on Thursday.

ECB policymakers remain divided over the issue of whether or not to scale back the PEPP program. Robert Holzmann is advocating for an earlier normalization of monetary policy, but Boštjan Vasle is seeking continuance of the accommodative policy to counteract any future fresh waves of the coronavirus in the EU.

The EUR/USD is trading 0.21% lower as of writing.

EUR/USD Outlook

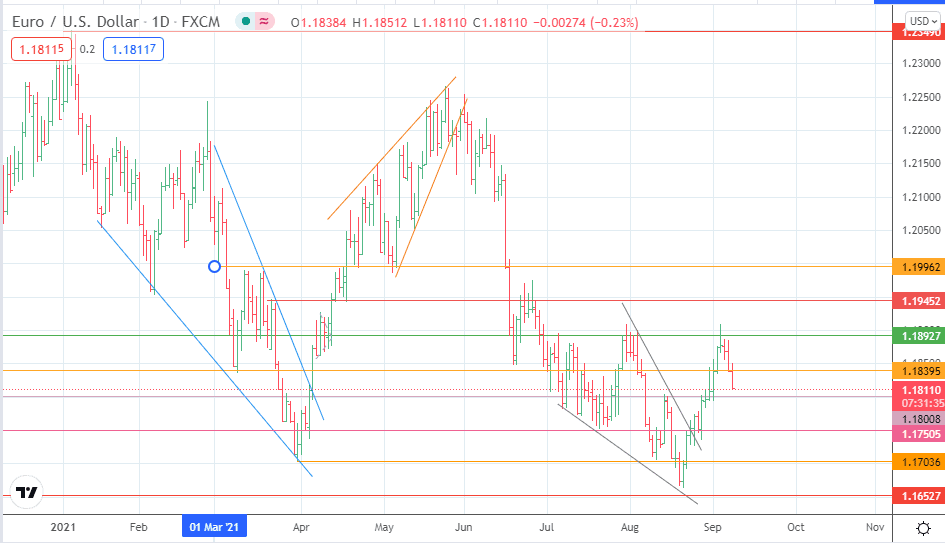

The pair has broken below the 1.18395 support, targeting 1.18008. If this support is taken out, 1.17505 and 1.17036 become the new targets to the south.

On the flip side, bulls require a recovery beyond 1.18927 for the bullish reversal from 20 August to continue. If a bounce from lower support levels is achieved, this reversal continuance will seek new upside barriers at 1.19452 and 1.19962 in the near term.

EUR/USD Daily Chart