The EUR/USD is slightly higher on the day after the European Central Bank (ECB) opted to leave its key interest rates unchanged as expected. The ECB also announced it would cut down on its Pandemic Emergency Purchase Program (PEPP) from Q4 2021.

The ECB views the current rise in inflation (showcased by last week’s data) as transitory. It has adopted an outlook of optimistic caution for the Eurozone economy.

The ECB has delivered on market expectations, leaving the EUR/USD without a lot of volatility on the day. The EUR/USD is up 0.19% on the day.

EUR/USD Outlook

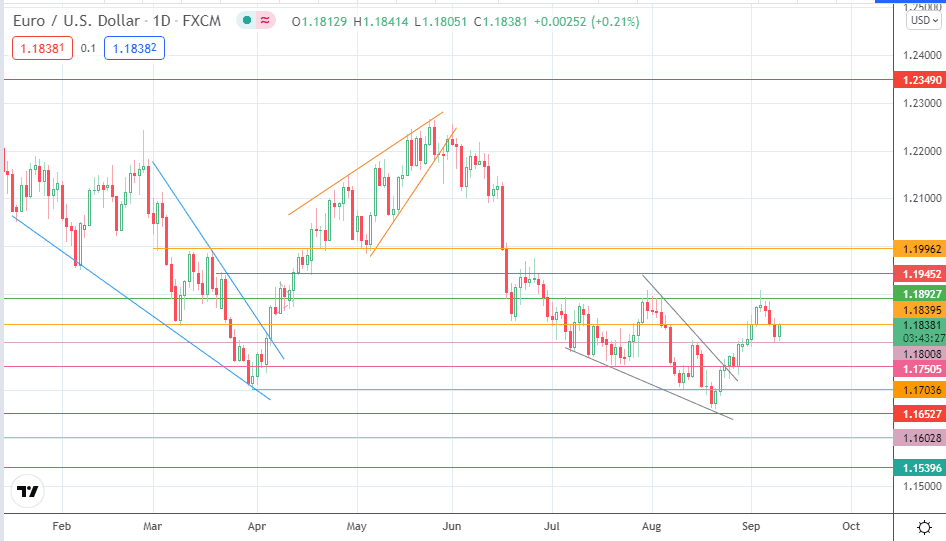

The pair now trades in a range with the 1.18395 resistance as the ceiling and 1.18008 as the floor. A breakdown of this floor allows the week’s correction to continue, targeting 1.17505 initially. 1.17036 and 1.16527 are additional targets to the south if the corrective decline is extensive.

On the flip side, bulls would be seeking a break of the range’s ceiling at 1.18395, which opens the door for price action to aim at the 1.18927 resistance. If this resistance is uncapped, the breakout from the falling wedge continues, intending to make 1.19962 the completion point of the measured move. This move requires bulls to take out 1.19452 (13 April and 28 June highs).

EUR/USD (Daily) Chart

Follow Eno on Twitter.