The EUR to GBP forecast shows that the momentum continues to lie with the Euro. This comes as the EUR/GBP pair posted its third straight winning session, gaining 0.31% on the day. The price move also completes the bullish flag pattern on the daily chart, pointing the way towards a further advance if the bulls continue pushing past various resistance barriers.

Fundamentally speaking, the EUR to GBP forecast continues to draw tailwinds from the expectations of an aggressive rate tightening cycle by the European Central Bank in response to rising Eurozone inflation and the weaker fundamentals of the UK economy, which shows a negative balance of trade and a bleeding retail sector.

The IG Client Sentiment index shows that traders are net-long the EUR to GBP pair for the first time since 26 April, while the number of traders who were net short on the EUR/GBP fell 5.22%.

The pair comes under focus as the Bank of England declares its latest interest rate decision on Thursday 5 May. The markets are expecting a 25 bps rate hike by the BoE. The trade play for the EUR/GBP pair would be based on whether the bank delivers according to the market expectation (mostly priced in), or exceeds expectations on both ends.

EUR to GBP Forecast

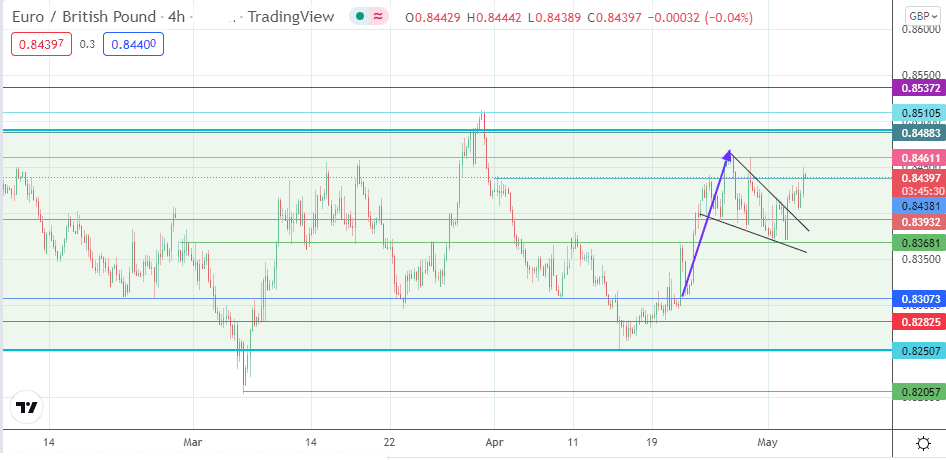

The rectangle pattern showcasing the high-low range of price action remains intact. Within the range, the bullish flag points to a potential move towards the 0.84883 resistance to pursue the measured move. This requires a break of the 0.84381 barrier (1/25 April highs) and the 0.84611 resistance (17 March and 28 April highs). Beyond the rectangle’s border, a breakout move from there targets 0.85105 (30 March 2022) before 0.85372 enters the picture.

On the flip side, rejection at the 0.84381 resistance truncates the measured move and opens the door for a potential pullback towards 0.83932, where the bullish flag’s upper border lies. A breakdown at this level targets 0.83681 before a deeper leg down towards 0.83073 (22 March and 8 April lows) if the correction is extensive. The rectangle’s lower border at 0.82507 (14 April low) only comes under threat if the price action declines below 0.82825.

EUR/GBP: 4-Hour Chart

Follow Eno on Twitter.