The US dollar index (DXY) has made a spectacular recovery helped by the rising tensions between Western countries and Russia. The index has also risen as investors wait for the latest interest rate decision by the Federal Reserve.

Tensions have been building in the past few years because of Russia’s activities near the Ukrainian border. On Tuesday, the US reached a deal with the European Union on the type and scale of financial sanctions that they will place on Russia if it invades Ukraine.

One suggestion is that the countries will block Russia from the Swift system, which will make it difficult to send and receive money from Russia. Also, there are concerns about barring Russian banks from the financial system.

However, analysts warn that Russia has a stronger hand because of the significant amount of natural gas that it sends to Europe.

Later today, the dollar index will react to the latest Fed decision. Analysts expect that the Fed will leave interest rates unchanged and point to three to four interest rate hikes later this year. Besides, the US inflation has surged while the unemployment rate has dropped.

Dollar index forecast

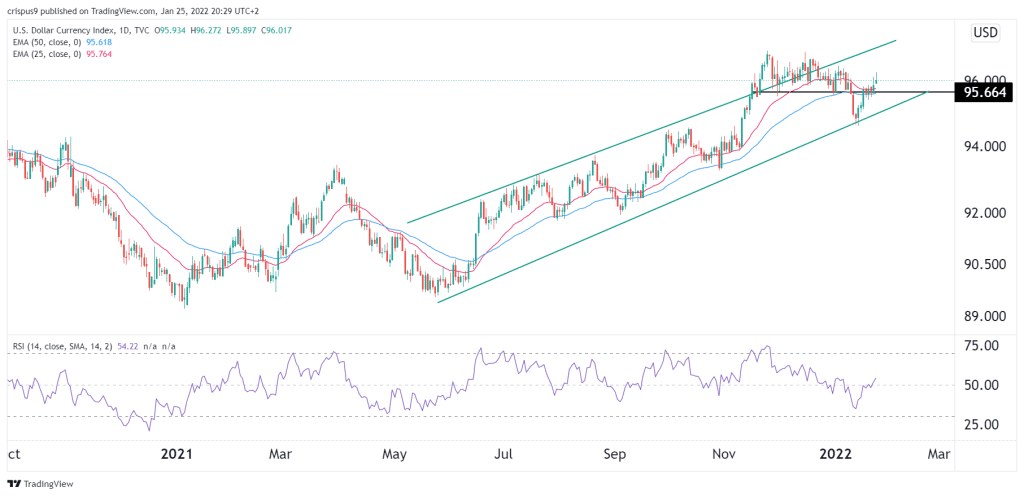

The daily chart shows that the DXY index has been in a strong bullish trend in the past few months. The index has risen by over 7% from its lowest level in 2021. Most recently, it has risen by more than 1% from its lowest level this month. As a result, it has moved above the important support at $95.66. It is also between the ascending channel shown in green.

Therefore, the dollar index will likely keep rising as bulls target the upper side of the ascending channel at about $96.80. This view will be invalidated if the price moves below the support at $95.50.