- The XLM price is inching higher as buyers return to the struggling cryptocurrency market. However, it's too early to call it a comeback.

The XLM price is inching higher as buyers return to the struggling cryptocurrency market. However, it’s too early to call it a comeback.

Stellar Lumens (XLM) underperformed the broader market on the way down this month, losing over 30% from December 5th through December 15th. Furthermore, as the crypto market turns higher, XLM is underperforming on the way up. Despite many altcoins gaining 30%+ in the last week, Stellar has appreciated by just 3.3%. As a result, Stellar Lumens has fallen behind newer rivals and now ranks as the 26th most valuable cryptocurrency behind TRON.

The crypto market as a whole is turning higher, led by Bitcoin, which is closing in on the psychological $50,000 level. BTC’s reversal has spurred widespread altcoin buying as investors position for a potential strong close to 2021. However, the XLM price is failing to respond appropriately. Furthermore, several significant resistance levels block the path higher.

Stellar Price Analysis

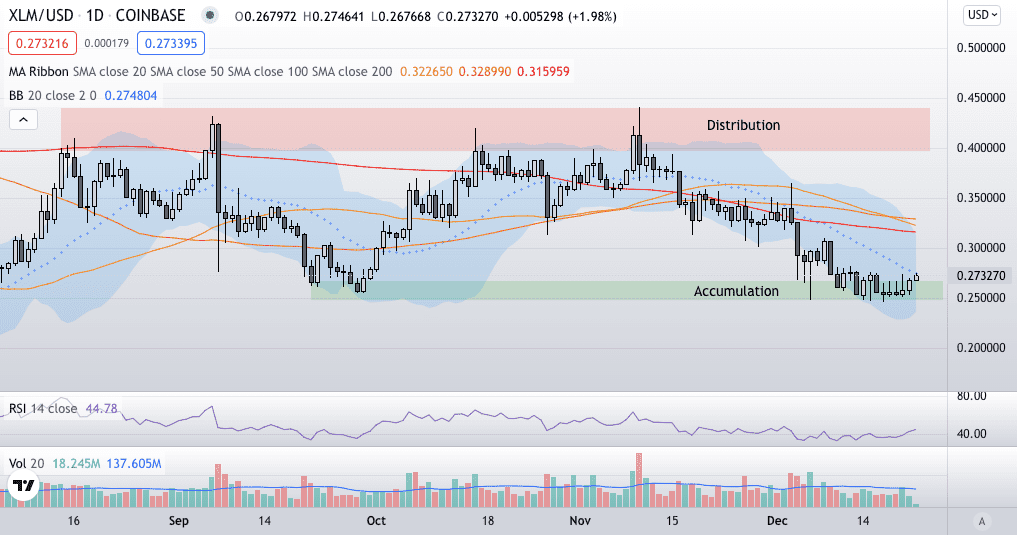

The daily chart shows the XLM price is climbing above the ‘accumulation zone’ of $0.250-$0.2700. Currently, the price is struggling to clear 20-DMA at $0.274 (mid-point of the Bollinger Bands). Decisive clearance of $0.274 should trigger an extension towards the cluster of moving averages between $0.315-$0.329.

I consider the 50, 100 and 200-DMA’s at $0.322, $0.329 and $0.316, respectively, considerable resistance. Furthermore, the top Bollinger band at $0.313 adds to the confluent resistance above the market.

Considering Stellars’ poor relative performance, XLM should struggle to punch through the overhead resistance. However, as long as XLM stays above $0.250, the immediate outlook is cautiously bullish. Although, I expect limited upside unless the broader market advances substantially.

XLM Price Chart (Daily)

For more market insights, follow Elliott on Twitter.