- The Uniswap price bounced 30% after tagging our $13 price target, which could provide an attractive selling opportunity.

The Uniswap price bounced 30% after tagging our $13 price target, which could provide an attractive selling opportunity.

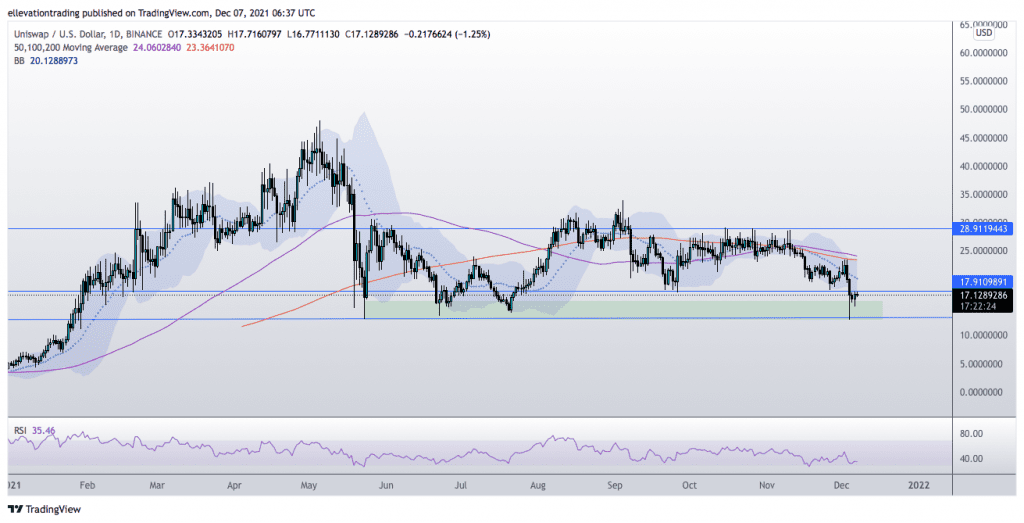

Uniswap (UNI) dropped almost 40% in three days after we warned that downside pressure could force the price from $20 down to $13. The sharp decline came as Bitcoin succumbed to heavy selling after losing the $51,500 support level early Saturday. BTC’s flash-crash to $42k liquidated $2 billion of leveraged long positions, triggering a wave of selling in altcoins. As a result, the UNI token crashed to an 11-month low of $12.69 (-35%) before bouncing to $17.20. However, the rally faces considerable obstacles, which may prove unscalable in the current climate.

UNI Price Forecast

The daily chart shows the Uniswap price bounced after testing the significant $13.00 support level (May through July lows). But despite the bounce, UNI is struggling to clear the resistance at the September lows at around $18.00.

In my view, the failure to advance past $18.00 suggests sellers are lurking above the market. On that basis, the rally may soon reverse, targeting the $13.00 support once more.

If Uniswap ends today below $18.00, I expect it to continue lower towards $13.00. Furthermore, considering the poor performance, the price may extend below $13.00. However, a close above $18.00 flips the outlook from bearish to neutral, invalidating the pessimistic view.

Uniswap Price Chart (Daily)

For more market insights, follow Elliott on Twitter.