- November crypto outlook: Bitcoin, Ethereum, and XRP slip early but history hints at a rebound. See what traders expect next.

There has been a noticeable cooling in crypto markets this week, with traders showing reduced risk appetite amid shifting global sentiment. The Top 3 cryptocurrencies, Bitcoin (BTC), Ripple (XRP), and Ethereum (ETH), have all come under pressure, extending declines from earlier highs.

It’s been one of those weeks where momentum feels uncertain. Prices aren’t collapsing, but the energy that fueled recent rallies has clearly eased. Even so, these three coins remain the ones to watch as the market resets and prepares for the next move heading into November.

Bitcoin Price Prediction: ETF Flows Slow After Fed’s Hawkish Tone

Bitcoin slipped around 5% this week, trading near $109,000 on Friday. The move followed a slowdown in U.S. ETF demand, which had been one of the biggest drivers of Bitcoin’s surge earlier in the year.

Comments from Fed Chair Jerome Powell also added pressure after he suggested rates could stay higher for longer to fight inflation, a stance that often cools demand for risk assets like crypto.

According to CoinDesk, ETF inflows have been flattening for nearly two weeks, signaling that institutional buying is temporarily easing. Despite this, Bitcoin remains up more than 40% in 2025, showing resilience even as traders take profits.

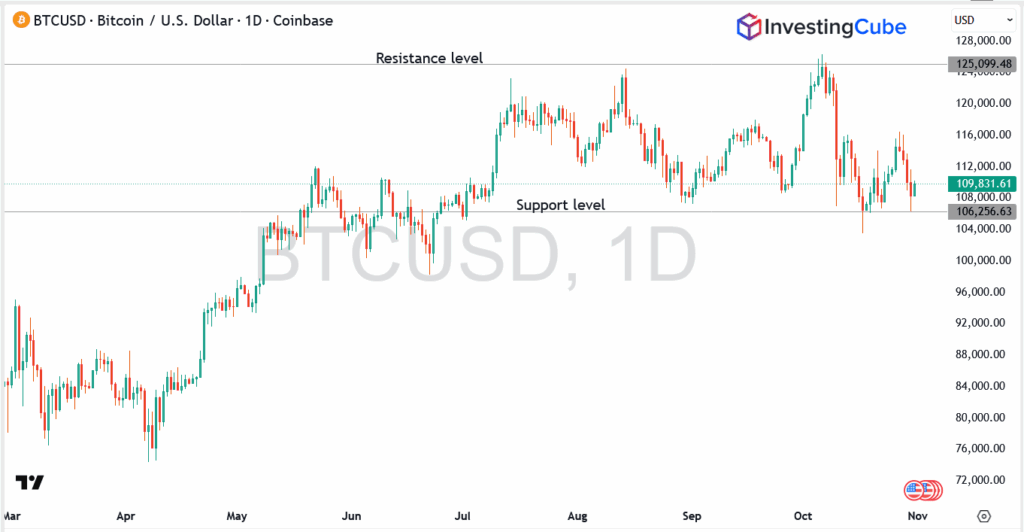

BTC/USD Daily Chart Analysis

- Current Price: $109,830

- Support Zone: $106,200 – $108,000, holding as the key demand area since early October.

- Resistance Zone: $125,000 – $126,000, coinciding with the recent all-time high region.

- Trend: Sideways consolidation with lower highs; bulls still defending structure despite softer momentum.

Bitcoin November Forecast: Why BTC Could Turn Green This Month

From a trader’s standpoint, this pullback feels more like a breather than a breakdown. Bitcoin’s price action has stayed surprisingly orderly despite softer ETF demand and Powell’s hawkish comments. The market isn’t panicking, it’s waiting.

Historically, November has been Bitcoin’s strongest month, turning green in 14 of the past 15 years with an average return close to 18%. That kind of track record doesn’t guarantee a repeat, but it builds confidence.

I beleive that as long as BTC holds above $106K, the structure remains bullish. The setup hints that we might see a grind back toward $120K–$125K before the month is over.

Ethereum Price Forecast: Profit-Taking Builds Near $3,800 Support

Ethereum (ETH) followed the same pattern, slipping nearly 8% this week to trade around $3,830. The token faced rejection at $4,230 as traders locked in gains and liquidity rotated out of altcoins.

CoinDesk data showed a dip in institutional activity, but analysts said this correction is largely technical. Ethereum’s role in DeFi and Layer-2 scaling remains strong, keeping longer-term sentiment intact.

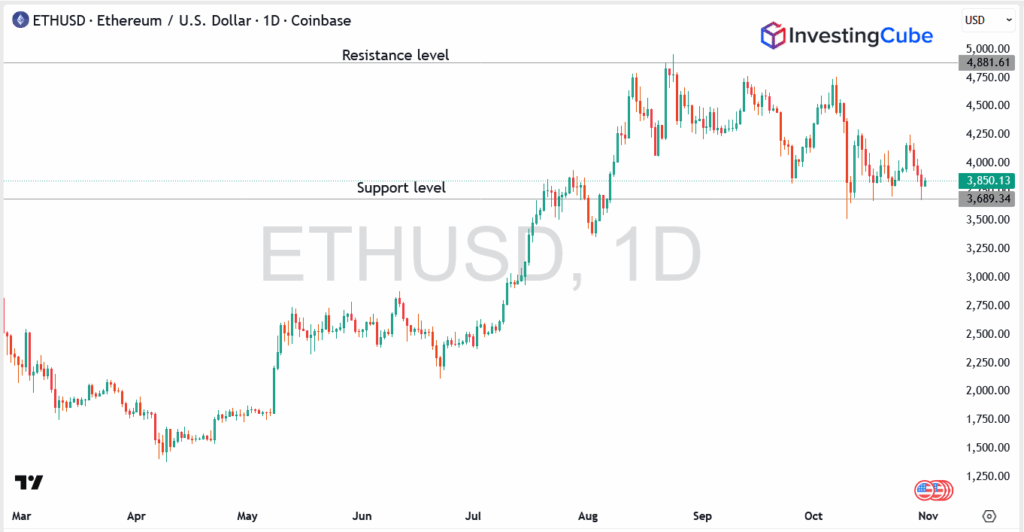

ETH/USD Daily Chart Analysis

- Current Price: $3,850

- Key Support: $3,680 – $3,700 zone, marking the lower boundary of the recent consolidation range.

- Major Resistance: $4,230 – $4,250 area, aligned with the October swing highs.

- Trend: Short-term consolidation within a broader bullish structure; buyers defending support after recent profit-taking.

Ethereum Price Prediction: Can ETH Turn Green This November?

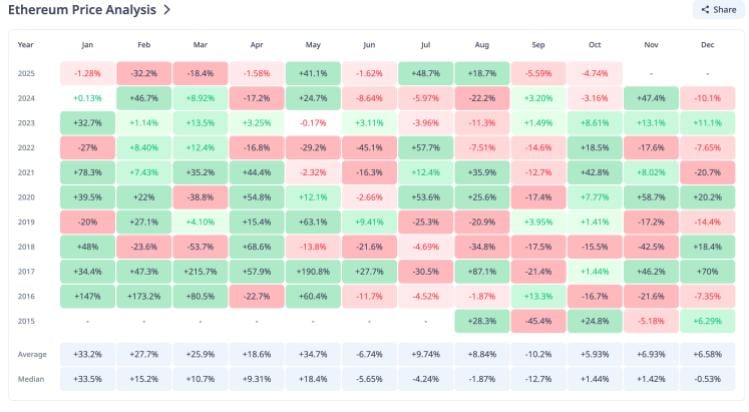

Looking back at the last ten years, Ethereum’s November record is split right down the middle, five green months, five red. But when ETH does rise, it tends to do so in style, posting double-digit gains that outweigh the losing streaks.

On average, November has delivered a 6.9% return, with a median gain around 1.4%, suggesting that the bias leans slightly bullish even in uncertain setups.

From my perspective, this month feels like one of those slow burners. The market’s quiet, traders are cautious, and that’s usually when Ethereum catches everyone off guard. If history rhymes, a clean break above $4,000 could trigger a sharp move higher before month-end.

XRP Price Prediction: Bears Push Token Below $2.50 Support Zone

Ripple’s XRP was the weakest of the top three, falling nearly 7% to hover around $2.47. Bears broke through the $2.50 support, driving the token toward $2.35, a level that has acted as a floor several times this quarter.

CoinDesk reported that fading momentum and thinner volumes triggered the decline, though Ripple’s central bank partnerships and CBDC pilots continue to underpin long-term value.

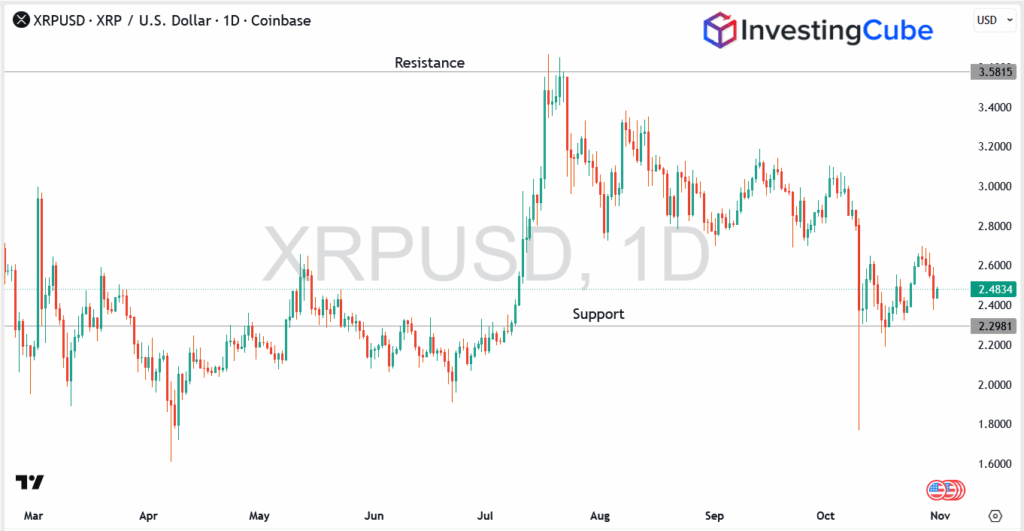

XRP Daily Chart Analysis

- Current Price: $2.48

- Key Support: $2.30 – $2.32 zone, repeatedly tested since September.

- Immediate Resistance: $2.65 – $2.70 (50-day EMA area).

- Trend: Sideways-to-bearish bias after rejection near $2.60.

XRP Price Prediction: November’s History Points to Big Swings

Looking at the last 12 years of data from CoinsKid below, November has been one of XRP’s most volatile months, with an average return of +47.67%. That’s second only to December, which historically posts the biggest gains.

Even though the performance is mixed (six green Novembers and six red), the green months tend to explode, like +281% in 2024 and +178% in 2020, easily outweighing bearish years.

In my view, this pattern shows that XRP thrives when momentum shifts, especially after heavy October corrections. If Bitcoin stays stable and Ripple news remains quiet, a moderate recovery toward $2.80–$3.00 isn’t out of the question this month.

Crypto Market Outlook: Can November Bring a Green Recovery?

After a volatile October, the crypto market is setting up for what could be a pivotal November. Historically, this month leans bullish for the top 3 cryptocurrencies, Bitcoin, Ethereum, and XRP, especially after sharp pullbacks.

Bitcoin’s record of 14 green Novembers out of 15 suggests the odds still favor a rebound, while Ethereum’s past double-digit November gains show that quiet markets can often precede powerful rallies. XRP’s data tells a similar story, when it turns green in November, it tends to surge hard.

From a broader view, sentiment is cautious but not broken. With inflation data, ETF flows, and Fed commentary still driving short-term moves, traders are watching for confirmation signals. If Bitcoin steadies near key support and risk appetite returns, November could easily flip from consolidation to recovery, setting up a strong close to 2025 for the top three cryptocurrencies.