- Nvidia stock hits fresh highs, Meta secures clean energy deals to fuel data centers, and TSMC issues $10B in new stock to hedge FX risk.

Wall Street bulls are still charging as three powerhouse stocks make headlines: Nvidia just became the world’s most valuable company, Meta is ramping up clean energy to feed its AI ambitions, and TSMC is moving billions to shield against FX volatility. Here’s what traders need to know.

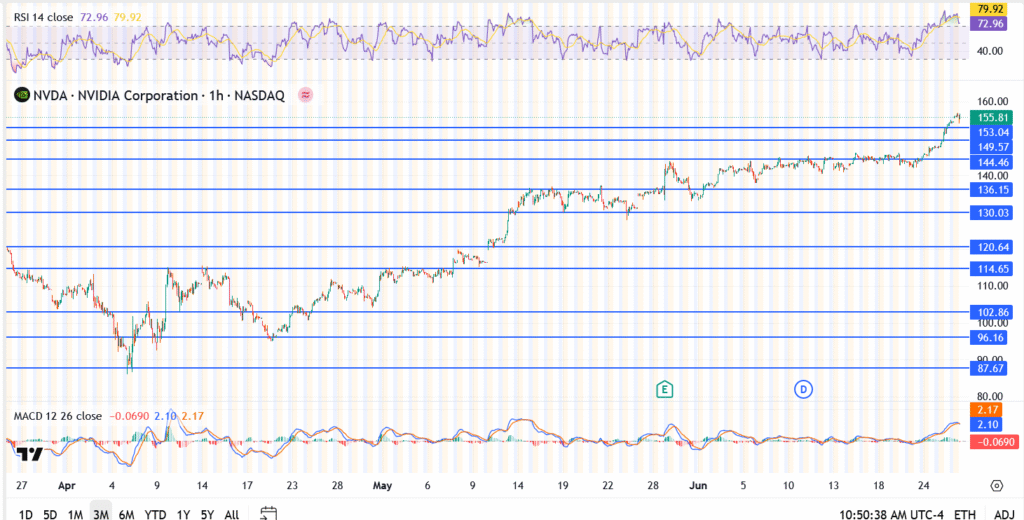

Nvidia Stock Forecast: AI Reign Fuels Breakout Above $155

Nvidia (NASDAQ: NVDA) surged 4.3 percent to hit $154.31, marking a fresh all-time high. The rally adds to a staggering $1.5 trillion in market cap gains since April, propelling Nvidia past Microsoft as the world’s most valuable publicly traded company.

Investors believe Nvidia CEO Jensen Huang when he says the AI revolution is only getting started. There is no indication that demand from cloud giants like Microsoft, Amazon, and Meta will slow down. Furthermore, at just 31.5 times expected earnings, which is less than its 10-year average, NVDA’s value is still comparatively grounded.

Nvidia Chart Analysis

- Current price: $155.81

- Resistance: $160.00, then blue-sky territory

- Support zones: $153.04, then $149.57

With RSI now above 72 and MACD showing firm bullish separation, momentum remains strong. If NVDA breaks $160, there’s room for another leg higher.

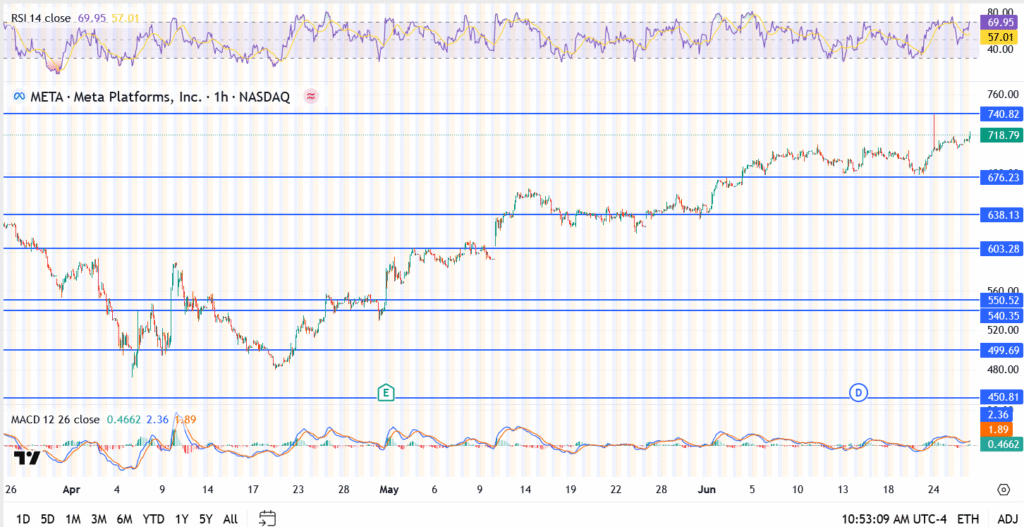

Meta Stock Forecast: Clean Energy Push Boosts AI Narrative

Meta Platforms (NASDAQ: META) is up nearly 3 percent this week as the company announced major new clean energy deals to power its AI-driven data centers. The stock is riding strong tailwinds from renewed tech optimism and infrastructure investment.

Analysts say Meta’s power strategy isn’t just ESG-driven; it’s foundational to scaling its next-gen LLMs and metaverse products. With RSI near 70 and MACD still bullish, technicals confirm that buyers are firmly in control.

Meta Chart Analysis

- Current price: $718.79

- Resistance: $740.82, then $760.00

- Support zones: $676.23, then $638.13

META looks poised to challenge its March high. Above $740, breakout buying could accelerate.

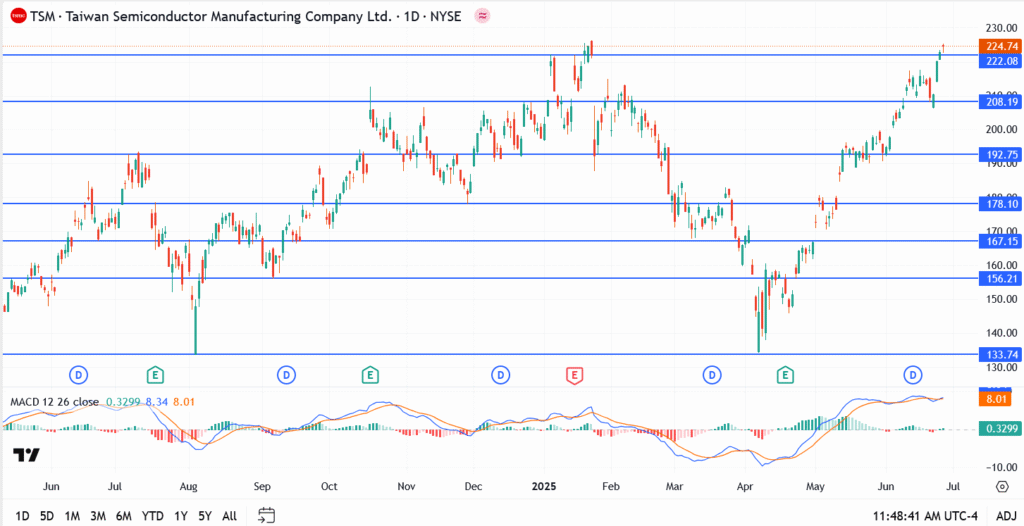

TSMC Stock Forecast: $10B FX Hedge Sparks Caution, Not Panic

Taiwan Semiconductor (NYSE: TSM) is making defensive moves, announcing a $10 billion stock issuance through its overseas unit. The goal? Offset FX risks tied to Taiwan dollar strength and maintain financial stability.

While not a growth catalyst, the news shows TSMC’s awareness of macro headwinds. The company remains a critical cog in the AI chip supply chain and continues to attract long-term institutional capital.

TSMC Price Outlook

- Current price: $224.74

- Resistance: $230.00, then blue-sky territory

- Support: $222.08, then $208.19

Traders may stay cautious in the short term, but TSM remains fundamentally strong. Expect dips to attract buyers if the broader chip rally holds.

Final Outlook

These three stocks aren’t just moving with the market, they’re shaping it. Nvidia’s relentless rally is rewriting valuation records, Meta is powering its AI future with real infrastructure bets, and TSMC is navigating global risks with strategic foresight.

While each stock tells a different story, they all echo the same message: tech leadership in 2025 belongs to those who think long-term, adapt fast, and stay one step ahead. For investors watching this space, the playbook is evolving, and it’s still a bull’s game to lose.