- Bitcoin accumulation accelerates as Michael Saylor buys more BTC, but dilution risks grow. What does the debate mean for investors?

Bitcoin accumulation has returned to the centre of market debate after Michael Saylor, the executive chairman of Strategy, announced another large Bitcoin purchase this week. The move reinforces his long-standing belief that Bitcoin is a superior long-term store of value, even as prices remain volatile and broader markets remain cautious.

Saylor Buys the Dip as Bitcoin Struggles to Regain Momentum

According to a report by Yahoo Finance, Michael Saylor’s company added nearly $1 billion worth of Bitcoin for a second consecutive week, reinforcing its aggressive accumulation strategy despite recent market volatility.

The filing shows the company acquired approximately $980.3 million in Bitcoin between December 8 and December 14, marking its largest weekly purchase since mid-year. In a statement shared on X, Saylor confirmed the purchase of 10,645 Bitcoin at an average price of around $92,100, lifting total holdings to over 671,000 BTC.

The move comes as Grayscale projects that Bitcoin could reach a new all-time high in the first half of 2026, citing improving regulatory clarity and rising institutional participation. The contrast between Saylor’s continued buying and ongoing short-term price weakness highlights a growing divide in the market, with long-term conviction clashing against near-term technical caution.

Why Shareholder Dilution Is Becoming the Biggest Risk in Michael Saylor’s Bitcoin Strategy

As Michael Saylor continues to ramp up Bitcoin purchases, investor focus is shifting toward how those buys are being financed. Strategy stock has traded in a narrow range as markets weigh rising Bitcoin exposure against the growing risk of shareholder dilution, with much of the accumulation funded through new share issuance rather than operating cash flow.

Although S&P recently reaffirmed Strategy’s B- credit rating and highlighted adequate liquidity, dilution concerns remain front and centre. With the stock’s premium to its Bitcoin holdings compressing, investors are increasingly sensitive to additional capital raises, making dilution risk a key factor shaping sentiment alongside Bitcoin price movements.

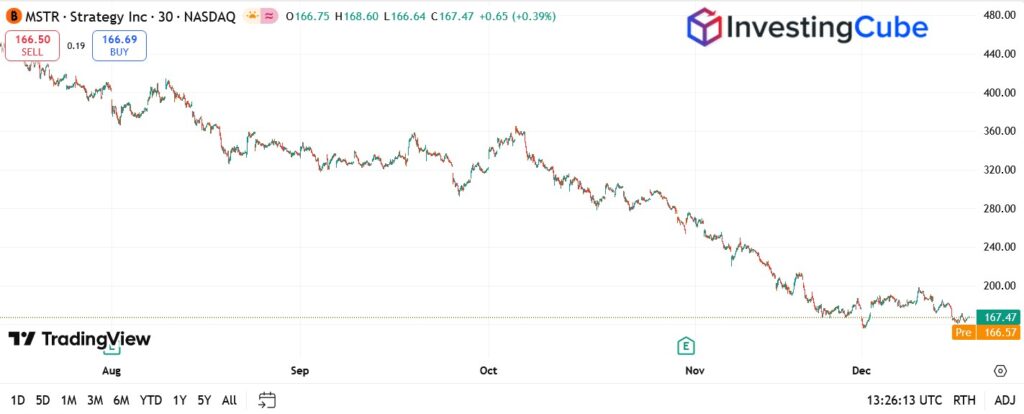

Strategy Inc. Stock Price Analysis: Shares Consolidate After Prolonged Downtrend

The MSTR daily chart shows Strategy shares trading around the $167 area, consolidating after a prolonged downtrend from the November highs above $300. Price action remains rangebound, with repeated failures to reclaim the $180–$200 zone, suggesting sellers still control rallies while buyers are defending a short-term base near recent lows.

What the Bitcoin Accumulation vs Dilution Debate Means for Investors

The renewed focus on accumulation versus dilution underscores how Bitcoin is maturing as an asset class. The conversation is no longer just about price targets, but about how exposure is built and who bears the risk.

In my view, Saylor’s strategy represents one of the clearest expressions of long-term Bitcoin conviction in the public markets. At the same time, the dilution debate is valid and should not be dismissed. For investors, the key question is whether Bitcoin’s future upside justifies the financial engineering required to accelerate exposure today.

As Bitcoin heads toward 2026, this balance between belief and balance-sheet discipline may become one of the defining themes of the cycle.

Strategy Inc is viewed as a high-risk, high-reward stock, with sentiment closely tied to Bitcoin’s price and the company’s capital strategy rather than traditional fundamentals.

MicroStrategy remains a speculative buy for long-term Bitcoin bulls, but investors should be aware of dilution and leverage risks linked to ongoing BTC accumulation.

MicroStrategy stock could see strong upside in 2026 if Bitcoin enters a sustained bull cycle, but gains are not guaranteed due to dilution risk, leverage, and ongoing dependence on BTC price movements.