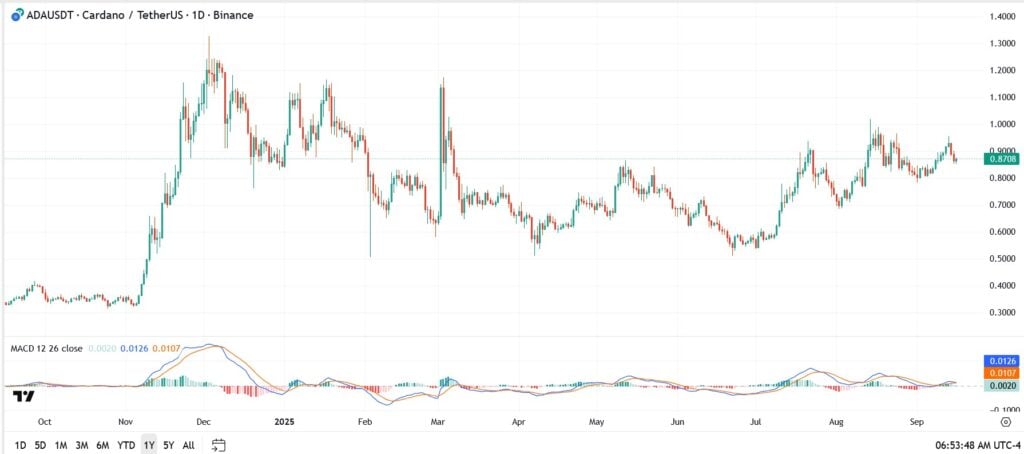

- Cardano at $0.87 as whales accumulate, but 2026 could bring sharp swings. Can ADA stay resilient as traders chase fast-moving PayFi tokens?

Cardano (ADA) has been trading quietly just under the $1 mark, holding its ground while the rest of the crypto market chases newer high-yield PayFi tokens. ADA is changing hands near $0.87 after pulling back from last week’s $0.93 test. It hasn’t broken out, but it hasn’t broken down either, and that says something in this market.

Despite the muted price action, ADA still commands a market cap of about $33 billion. It remains one of the biggest names in crypto, even if it’s no longer the headline-grabber it once was. What’s interesting is what’s happening beneath the surface. On September 13, whales scooped up over 20 million ADA in just 24 hours, mostly around the $0.86-$0.90 band. That’s the kind of quiet accumulation that often sets the stage for a bigger move.

Cardano’s Quiet Buildout Continues

Cardano has never been about hype. Its core strength has always been its research-driven design and low-energy Proof-of-Stake system. Around 70% of its supply is still locked in staking, showing the base isn’t going anywhere. Development is still moving: the Hydra scaling upgrade is being tested to lift transaction speeds, while Plutus smart contracts keep expanding the network’s DeFi footprint.

It’s not explosive, but it’s steady, and steady can be powerful when markets rotate.

ADA Price Levels to Watch

- Current price: $0.87

- Support: $0.82, then $0.75

- Resistance: $0.95-$0.97, then $1.15 and $1.25

Traders are watching the $0.82-$0.85 zone for dip entries. If that level holds, ADA could grind back toward $1. If it breaks, $0.75 is the next catch zone. Clearing $0.95 would shift sentiment quickly and open a path to $1.20-$1.40.

Cardano Price Outlook: What Could Happen by 2026

Where ADA goes from here depends on execution. If usage grows and Hydra rolls out smoothly, ADA could edge higher into the $1.40-$1.50 band by 2026. If adoption stalls, a drift back toward $0.70-$0.80 isn’t off the table. The upside now isn’t about moonshot, it’s about reliability. ADA is becoming the kind of asset investors hold for stability, not adrenaline.

ADA vs PayFi Tokens: The Battle for Investor Attention

While Cardano moves slowly, capital is flowing into PayFi projects like Remittix (RTX), which is targeting the $190 trillion global remittance market. Its early traction shows how fast attention can shift when traders smell momentum. ADA won’t move like that, and maybe it doesn’t have to.

For long-term holders, ADA remains the steady hand in a noisy market. For risk-chasers, PayFi is the new playground. The key may be blending both, using ADA as an anchor while betting small on faster-moving plays.

Cardano (ADA) FAQs

It can be. ADA isn’t moving fast, but it’s stable. If its network activity grows and Hydra launches smoothly, it could slowly climb.

Around $0.87. Support is close to $0.82, while $0.95 is the level bulls want to clear.

Because they move quicker. ADA is the slow, steady play. PayFi tokens are the high-risk, fast-reward side of the market.