- Discover how the gold prices reacted to fed's decision and the key market movers that may affect the gold price. Check gold technical analysis

In the Asian trading session on Thursday, the gold prices rose due to the Federal Reserve’s warning regarding the economy, which led traders to seek safe havens. This was despite the speculations about the US-China trade deal limiting the precious metal.

We see some positive movements in the markets today, in response to what US President Donald Trump said that he would announce a major trade deal on Thursday. However, the traders are attracting some dip-buyers to lower prices of gold. Below, we will mention the technical analysis for Daily Gold prices.

Gold fell sharply on Wednesday after the US-China talks confirmed that they would take place this week. However, it seems that they are unlikely to reach a deal. especially due to neither the US nor China is showing any willingness to stop putting tariffs on each other’s goods.

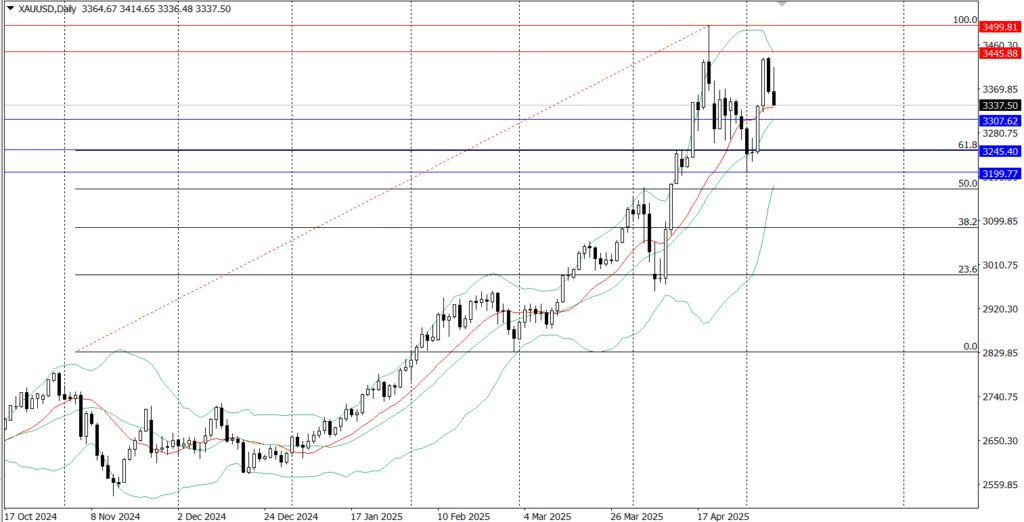

The Gold Technical analysis on the Daily timeframe:

From a technical perspective, gold finds some buying power around $3,260; however, this level used to be a resistance but is now acting as support. And this may be a good sign to see the Gold prices reach the second resistance level at $3,445. If the price can break out above this level, we could see the all-time high level at $3,500. (Gold Price Forecast for 2025, 2027, 2030 and Beyond)

On the flip side, the levels around $3,465- $3460 look like a strong support, so any clear break under these levels may open the door for the Gold prices to go down and reach the first support at $3,307, and under this one, we can go to $3,245

The Key Gold Market Movers:

1- President Donald Trump doesn’t plan to lower tariffs on China’s goods.

2- Geopolitical Tensions in Eastern Europe between Ukraine & Russia.

3- The arising conflict in the Middle East between Israel and Yemen and the threat of retaliation.

4- The Federal Reserve decision to keep the interest rate unchanged, as expected, and said the economic situation in the future is still unclear.

5- Trump is creating suspense as he said that he’ll announce a big trade deal today.

What you need to watch today:

1- The press Conference for US President Donald Trump at 2 PM London today.

2- The US jobless claims numbers. This will affect both the dollar and gold later today.

In the conclusion, traders are waiting to hear what Trump says at his press conference, and are also trading cautiously due to the mentioned movers above, which is why the gold prices are not rising much yet.