- How is the Gold price affected by the US rating downgrade? Check the technical analysis for the XAUUSD on the daily time frame.

The gold price attracted some sellers after reaching an uptick to the $3250 area in the asian session today. XAUUSD currently trades near its daily lower range in response to the surprising downgrade of the US government’s credit rating. The Us fixed income markets faced a wave of selling, and pushing the US Treasurey bond yeilds sharply higher and weighing on the gold.

Adding to this, the optimism announcement of the US-China trade deal and the hope for more us trade deals with other countries, limiting the gains of the safe-haven commodity despite other factors limiting losses as well.

Main Gold Price Movers:

- On Friday, Moody’s decided to lower the US’s sovereign credit rating from “Aaa” to “Aa1”, which indicates their concern about the U.S.’s ability to manage its debt. Moody’s said that the main reason for this downgrading is the growing national debt, which reflects concerns about the long-term fiscal health of the United States.

- This decision of downgrading may come as a House panel approved President Trump’s tax cut bill, so this bill potentially adds trillions to the national debt, which aligns with Moody’s stated concerns.

- On the other hand, on Sunday, U.S. Treasury Secretary Scott Bessent said to CNN news that the U.S president may impose tariffs at the rate he threatened last month on trading partners that don’t negotiate in good faith on trade deals. This may affect the Gold prices and cap its uptick at the start of a new week.

- The data released last week of the US consumer price index and the producer price index pointed to signs of easing inflationary pressure, Meanwhile, the disappointing US retail sales data increased the possibility that the us economy will experience a slow growth rate.

- Geopolitically, it seems that there has been no progress in the latest round of talks between Israel and Hamas.

- On Sunday, Ukraine said Russia attacked with a record number of drones, which raises the geopolitical risks.

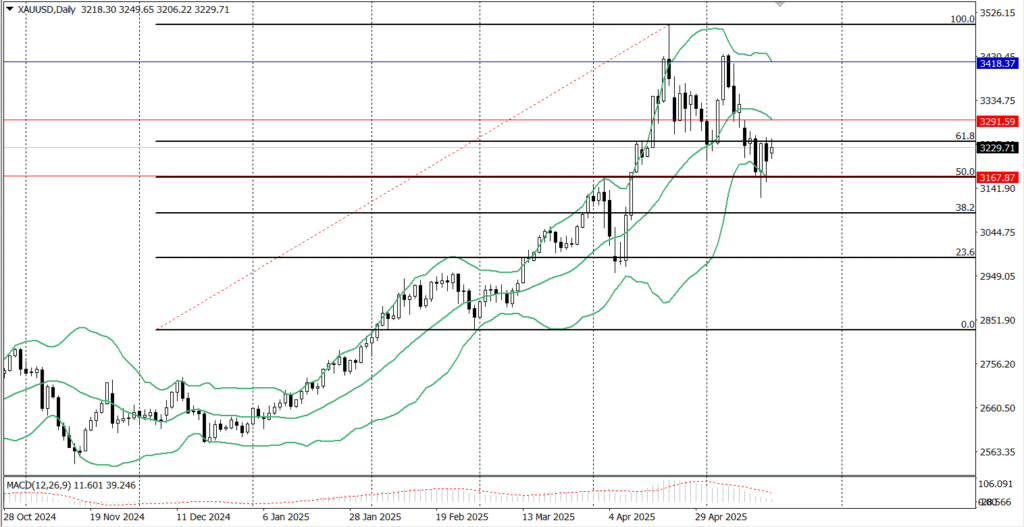

Gold Price Prediction: Technical levels of XAUUSD

From the technical perspective, gold prices are struggling to move back above the $3290 level, which is now acting as strong resistance. So any clear breakout above this level will support the gold to go up again, reaching higher levels, such as $3330 and then $3350.

On the flip side, if the price can not keep its power above the $3200 level, this may push the price downward to lower levels near the $3178- 3177 area.