- Discover the technical prediction for the gold prices amid the ongoing geopolitical tensions between Iran and Israel

Gold price places a little bit of losses on the intraday during the first half of the European session, but now the XAUUSD streaks to a nearly two-month peak touched earlier this Monday. On the other hand, the high risk appetite towards the equity markets undermines demand for gold, while the mix of factors holding back the bearish traders from placing aggressive bets and assist the gold to hold comfortably above the $3,400 level.

The escalating geopolitical tensions in the Middle East, limiting the market optimism. The anticipation that the Federal Reserve would lower borrowing costs is rising, weakening the US Dollar near a three-week low, supporting gold prices.

Geopolitical risks updates and Gold Prices (XAUUSD):

- Israel and Iran launched new attacks on Sunday, killing and wounding civilians and raising fears of a wider regional conflict. The strikes between them continued into Monday.

- Trump said that he hoped Israel and Iran could reach an agreement, but said that some countries sometimes have to fight first.

Gold is the safe-haven asset favored by investors during geopolitical tensions and economic uncertainty. The XAUUSD remains above the $3,400 accordingly.

Anticipating the Federal Reserve Bank decision:

It’s widely expected that the Federal Reserve Bank would keep the interest rates unchanged; however, traders have been pricing in the possibility that the Fed would change them during 2025, according to the Fed saying before that they will remain the interest rates unchanged for the near term amid softer US inflation and signs of a cooling economy.

Gold price prediction will influence the near-term USD price dynamics and have some impact on the XAUUSD. Any further escalation of geopolitical tensions in the Middle East might continue to support the yellow metal.

The technical outlook for the Gold-XAUUSD:

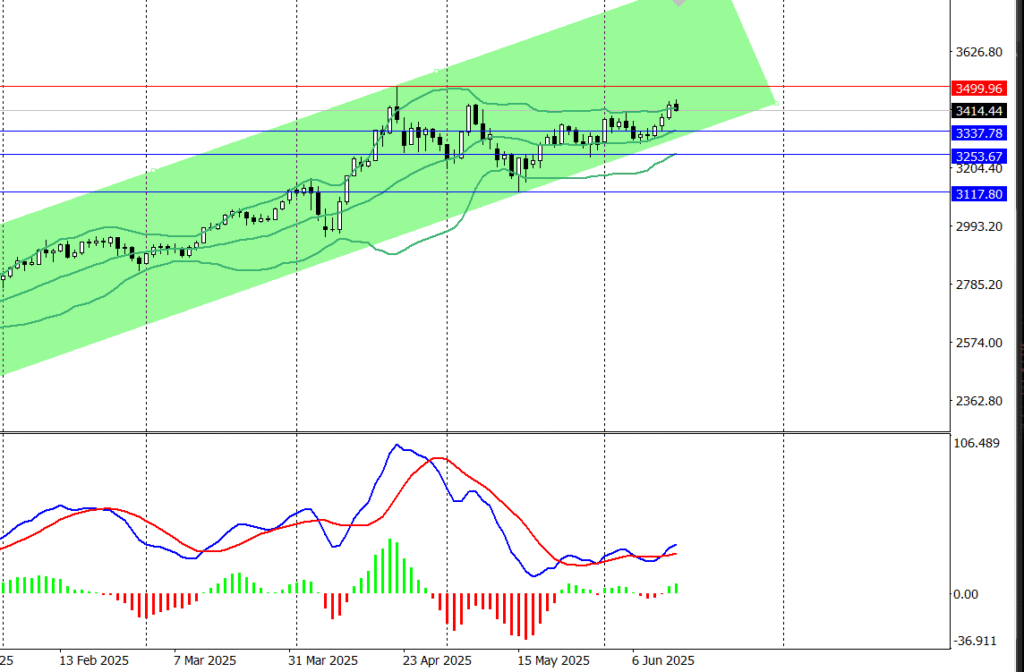

From the technical perspective, the gold prices form an ascending trend channel on the short-term charts, with positive oscillators on the daily chart favoring the XAUUSD bulls. Any further corrections could be seen as a buying opportunity and remain limited.

However, the selling below the $3,400 level may open the door to reach lower levels towards the $3,360 area, where the lower end of the ascending channel. A clear break below the end of the ascending channel would shift the near-term bias in favor of bearish traders.

On the other side, the momentum of the area $3,452 could support gold prices to break out above the psychological level at $3,500 touched in April. This level is represented at the top of the ascending channel; it’s a fresh trigger for bullish traders and paves the way for an uptrend.