- Discover the latest insights on gold price predictions, key market movers, and technical outlooks for successful trading.

Gold prices are consolidating above $3,600. The price reached a high of $3613.51. This is driven by a high-risk aversion in the markets. The sentiment comes from weaker-than-expected US data and the escalating geopolitical tensions. Moreover, a growing expectation that the Federal Reserve will cut interest rates this month.

In this article, we will cover all the market drivers for gold prices, provide a technical outlook for gold price prediction, and finally, address the most frequently asked questions by traders.

Gold Price Prediction | Key Market Movers:

- The escalating geopolitical tensions are supporting a surge in gold prices.

- The growing expectations of a US Federal Reserve cut put pressure on the US Dollar, supporting the non-yielding metal.

- According to the CME Fed Watch tool, there is a 91.9% probability of an interest rate cut.

- The non-farm payroll data showed a sharp slowdown, as it rose by only 22,000 in August. This was significantly below the expected 75,000.

- The U.S. unemployment rate rose near a four-year high of 4.3%.

- These weakening data raise the bets that the Federal Reserve will cut interest rates by 25 basis points in the upcoming September meeting.

- Central banks are adding to their Gold reserves. China is increasing its gold reserves for the 10th consecutive month.

- Poland’s central bank has proposed a new target for its targets for gold reserves, aiming to increase them from 20% to 30%.

- Gold ETFs hit their highest peak since June 2023, with net long positions over 20,000 contracts.

- Traders are waiting for the upcoming US economic data (Inflation Data) that will be released this week:

- Consumer Price Index (CPI), 11 September.

- Producer Price Index (PPI), 10 September.

- These data figures will be a major indication of whether the Federal Reserve will cut interest rates or remain at the same rates.

- If inflation data shows stronger-than-expected inflationary pressures, this could increase the probability of rate cuts by 25 basis points or more at the Fed’s next meeting.

- Conversely, softer-than-expected inflation data could weigh on the U.S. Dollar index, which would support gold’s rally.

Technical Outlook For The Gold Price Prediction:

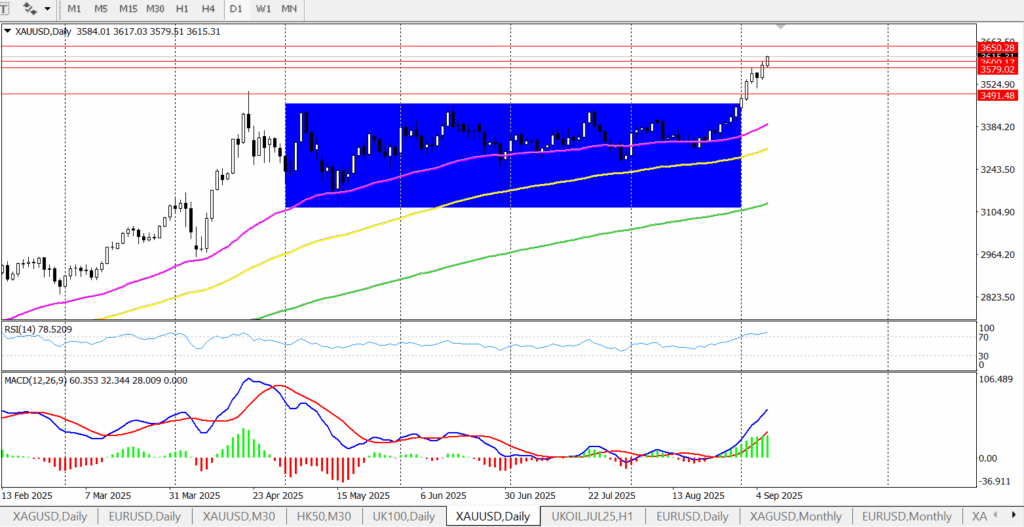

From a technical perspective, the gold price has remained strong above $3,580 since Friday, closing the week above that level. At the start of the day, gold opened higher at $3584.

Gold is currently trading around $3,613. A clear 4-hour close above $3,615 could pave the way to reach new all-time highs towards $3630. A daily close above $3,630 could lead to $3,650 and then $3,700.

On the 1-hour, 4-hour, and daily time frames, the MACD shows bullish momentum with a new bullish crossover. However, the RSI is now above 70, which is a signal that gold is overbought. This could suggest a short-term price correction from profit-taking. Despite this, the main trend remains bullish.

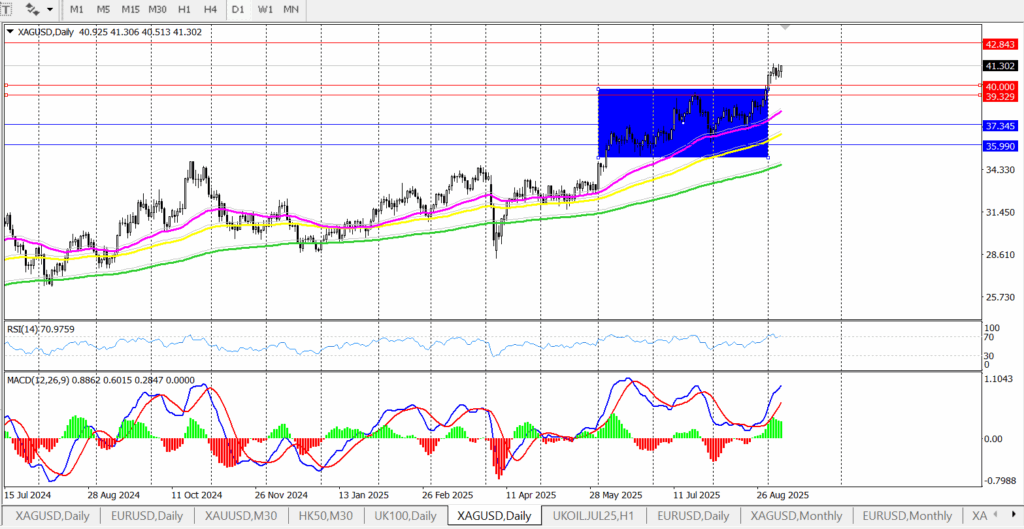

The Gold-Silver ratio is currently trading at 87.70. As we previously noted, a high ratio signals that silver may be undervalued. This is what’s happening now. Silver prices have surged, breaking out above the key resistance level of $40 and reaching $41.20.

A clear daily close above $42.00 could pave the way for higher levels toward $45.00 and then near its all-time highs around $50.00 and $53.00 in the near term. However, the RSI is currently at 70, signaling a potential short-term price correction, but the main trend for silver, like gold, remains bullish.

Several major banks and financial institutions recently anticipate that gold prices could reach $3,700 or even $4,000 or higher. such as Goldman Sachs, which set its targets for gold prices by the year-end 2025 of $3,700 per ounce and for the long term sees potential for gold to reach as high as $5000 per ounce in an extreme scenario.

Goldman Sachs already has anticipated that gold prices could reach $5000 per ounce if Trump’s attempts to undermine Federal Reserve independence encourage investors to fly to quality, which means shift their allocations away from riskier investments such as stocks, bonds, and the U.S. Dollar to safe-haven assets like gold and silver.