- Discover essential insights for gold price prediction. Federal Reserve policy updates with upcoming US economic data could influence gold.

Gold prices saw an early correction this morning as profit-taking hit the market, but bullish sentiment remains intact. Traders are now shifting focus to upcoming US GDP data and Federal Reserve signals, looking for fresh clues on interest rate cuts and the metal’s next big move.

Several key factors currently shape gold price prediction. It starts with signals of a potential US interest rate cut from Federal Reserve Chairman Jerome Powell. Another Factor is Donald Trump’s decision to impose 50% tariffs on India, which needs close monitoring. Moreover, Trump has fired Fed Governor Lisa Cook as part of his pressure to lower borrowing costs.

In this article, we’ll break down the major drivers behind the current gold price prediction:

- Federal Reserve policy and updates

- US trade and tariffs

- Dollar index

- Upcoming US economic data

- Gold Price Outlook

- FAQs

Federal Reserve Policy and Updates:

During the Jackson Hole Symposium, Powell noted that a slowdown in the labor sector may require a downward adjustment in rates. Also cited that a weaker two-month data in the July nonfarm payroll report would support a cut in rates.

He added that tariffs are already having an impact, but will likely be short-lived. However, the risk of job losses is growing, leading to more layoffs and higher unemployment.

According to the CME FedWatch tool, there is an 87% possibility of a 25 basis point rate cut at the Fed’s Policy meeting next month. This could help gold prices gain strong bullish momentum.

US Trade and Tariffs:

The US tariff rates of 50% on India became effective from Wednesday. On the other hand, the Swiss Post will temporarily stop sending goods to the US. This decision is due to Trump’s decision to remove a tariff exemption for “deminimis” packages worth $800 or less.

By August 29, these shipments will no longer be exempted, according to the white house. This move adds to market uncertainty, supports gold prices, and puts pressure on the US economy and the US Dollar as well.

Dollar Index:

Today’s early European session, the US Dollar showed a slight rebound, prompting some profit-taking in gold and pushing prices into negative territory. This caused a brief correction before gold resumed its bullish trend.

During the Asian trading, the US Dollar index trades 0.12% lower to near 98.00. The DXY faces slight selling pressure as investors shift their focus to the upcoming US data. Let’s take a look at the upcoming data that needs close watching.

Upcoming US economic data:

- Gross Domestic Product Annualized (Q2) Today’s later, Thursday, August 28.

- The United States (US) Personal Consumption Expenditure Price Index (PCE), scheduled for Friday, August 29.

Based on these upcoming data releases, the market can anticipate the Federal Reserve’s decision, whether it’s likely to cut rates or hold. For now, traders are waiting for these figures, which support gold prices as caution dominates and risk aversion remains high. As a result, liquidity is flowing toward safe-haven assets like gold and silver.

Gold Price Prediction | Gold Price Outlook:

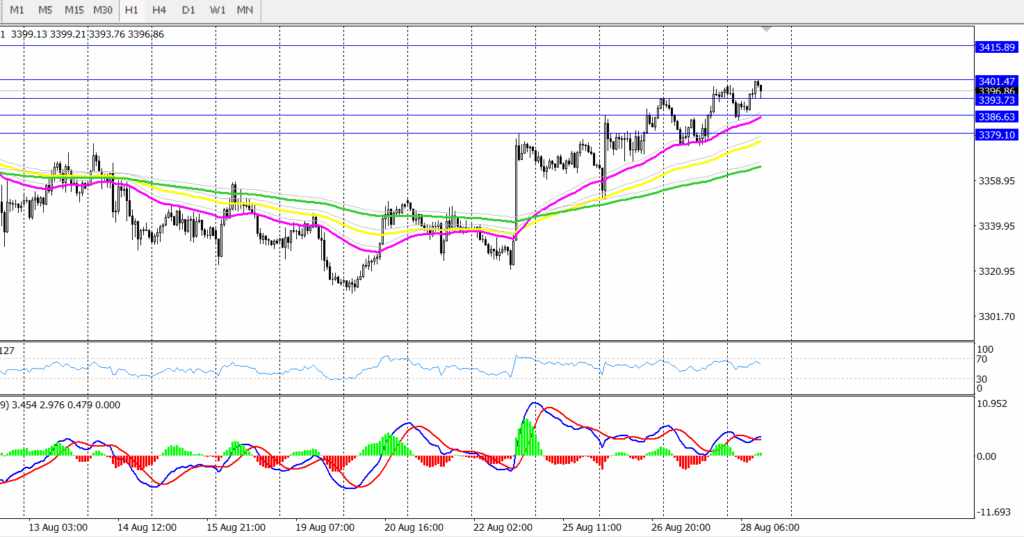

From the technical perspective, the gold prices are trading within an ascending channel on the 1-hour time frame. The price action forms higher highs, indicating that buyers control the market and are creating bullish momentum.

At the time of writing, the gold price is trading near the psychological level of $ 3400. It has consolidated above $3380 level for three consecutive days, successfully breaking key resistance levels, confirming its bullish trend.

Gold broke above $3,386 and $3,393, which were key resistance levels, and are now acting as a short-term support for XAUUSD. Currently, gold is hovering between $3393- $3401 range.

A clear 1-hour close above the psychological level $3401 would open the door for further upside, potentially reaching a new high to $3,408, a level not tested since August 8.

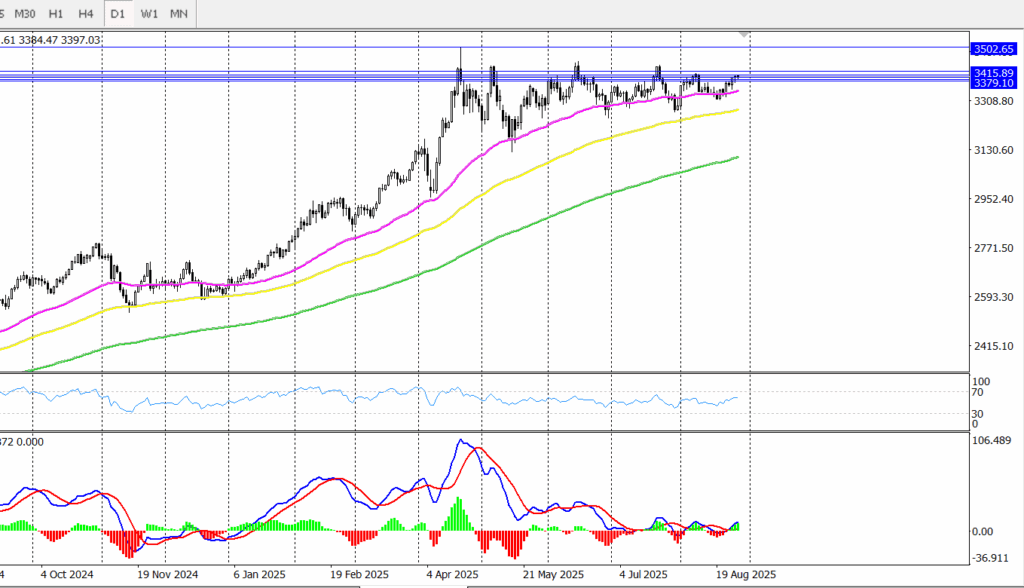

Looking at XAUUSD on the daily chart, price action shows a solid bullish trend. The MACD signaling continued upward momentum. Since the start of the year, gold has remained consolidated above the 200, 100, and 50-day moving averages.

A decisive break above $3,410 could support a move toward $3439, the high of July 23. Further north, gold could target the psychological level of $3,500, last seen on April 22.

It’s highly recommended that gold will continue to rise in Q2 2025, supported by a dovish Federal Reserve. Trump’s tariffs, signs of a weakening U.S. economy, and ongoing geopolitical tension are also providing strong support for gold’s upward momentum.

For long-term traders, it’s a good time to buy gold, as the Federal Reserve is expected to lower interest rates, which will shift the liquidity toward safe-haven assets like gold.