- Explore our comprehensive gold price predictions and technical insights, along with market news updates to optimize your trading decision.

Gold prices surged this morning during the Asian trading session. It jumped to an all-time high of $3,508. The gold price reached $35,00 once before, on April 22, 2025. But today it surpasses this level for the first time.

Trump’s tariffs fuel gold prices, growing expectations that the Federal Reserve will cut interest rates this month, and escalating geopolitical tensions.

However, gold prices are struggling to gain acceptance above the psychological level of $3,500. The XAUUSD has reached an overbought level. Profit-taking is now setting in, leading to a short-term correction.

Let’s delve into the fundamental drivers of gold price predictions and examine the technical outlook for XAUUSD.

Gold Price Predictions | Key Fundamental Drivers:

The growing risk-averse sentiment has pushed gold prices toward their all-time high. This sentiment is due to several factors outlined below :

- The rising bets that the Federal Reserve will cut interest rates this month pushed gold into a straight up trend for six consecutive days.

- According to the CME Fed-Watch tool, traders are pricing in 90% probability that the Federal Reserve will cut rates by 25 basis points on September 17.

- Moreover, US Treasury Secretary Scott Bessent backed President Trump’s decision to fire Lisa Cook (Fed Governor). Trump criticised Fed chair Jerome Powell for not cutting interest rates. This adds pressure on the U.S. dollar and benefits the yellow metal.

- The escalating conflict between Russia and Ukraine, along with Middle East tensions, continue to raise geopolitical risks, growing risk-averse sentiment among investors, driving money toward safe-haven assets like gold and silver.

- The data released on Friday showed that the U.S. Personal Consumption Expenditures (PCE) index rose by 0,2% on a monthly basis and by 2.6% on an annual basis, in line with expectations.

- On Wednesday, the U.S JOLTS Jon openings will be released, followed by the ADP report on private sector employment and ISM Services PM on Thursday.

- Investors are now looking ahead to the upcoming U.S. non-farm payroll data on Friday to gauge the expected size of the interest rate cut later this month.

With these factors in mind, let’s shift our focus to the technical outlook for gold price predictions, highlighting the key levels to watch.

Gold Price Prediction | Technical Outlook:

As we predicted in our latest analysis on Thursday, 28 August, gold met the expectations and reached $3,500 level. After this uptrend momentum, we may see some short-term correction for profit-taking purposes.

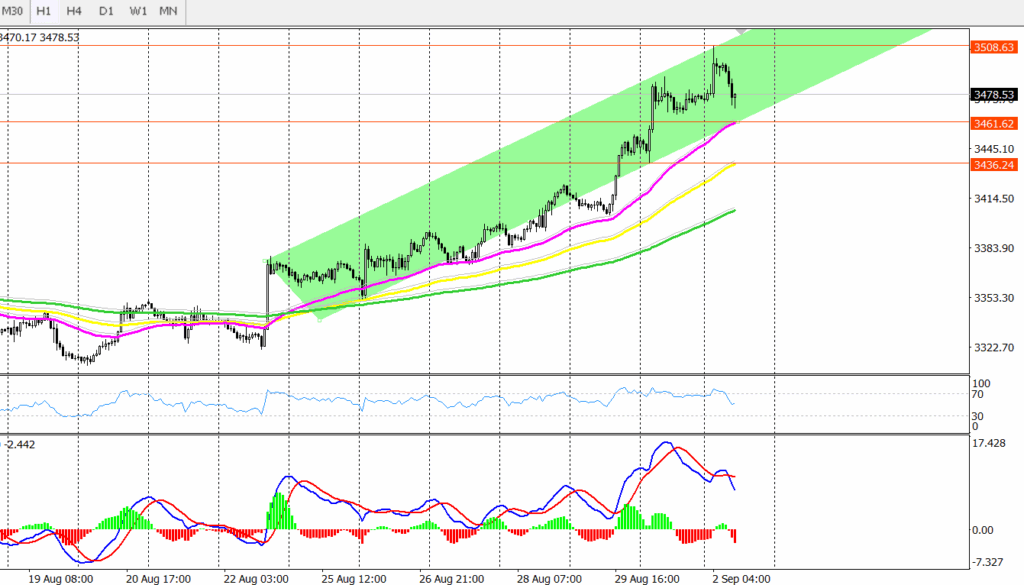

On the 1-hour time frame, the MACD indicator signals bearish momentum. Gold is currently trading around $3475 below its all-time high level of $3,508, which is acting as a resistance level.

The first support level will be at the 50-day moving average level at $3461. A clear close below this level could confirm the bearish scenario in the near short-term, reaching lower levels towards $3436.26, and then $3410. From my prespective it’s not higly recommended to have an overly bearish outlook, as gold remains baised to bullish side over a broad time frame.

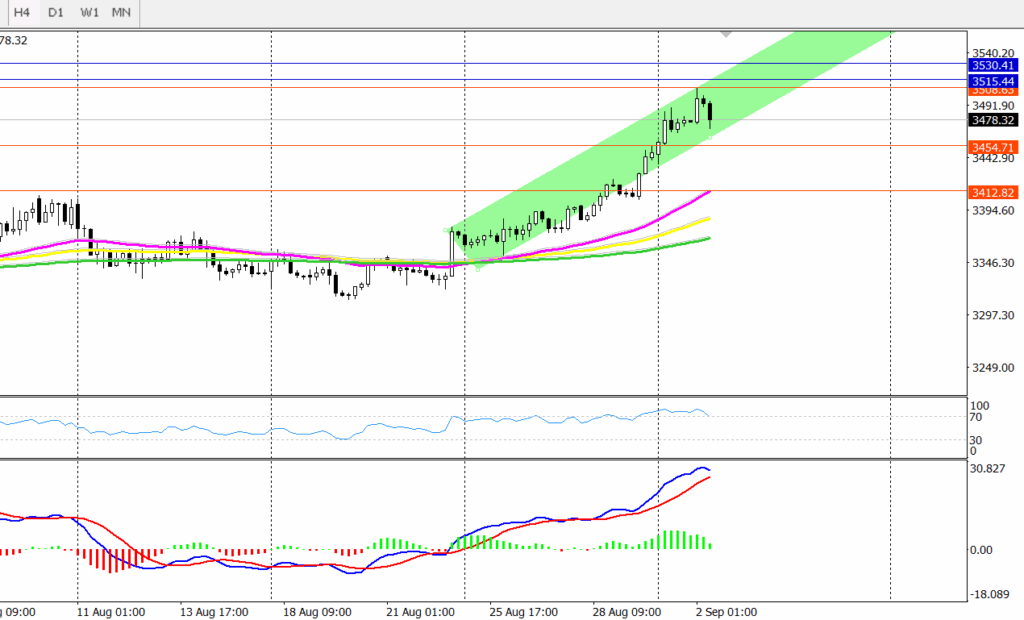

Looking at a broader time frame such as 4-hours or daily time frame, the MACD still signals bullish momentun on both, while RSI indicates overbought conditions. With these signals in mind, we may see corrections in the near short- term. However, a clear 4-hour or daily close above the $3508 level could pave the way for new all time highs toward $3515 and then $3530.

But this depens on the upcoming US economic data and the Federal Reserve’s decision according to interest rates. A Lower interest rate could support gold prices in reaching new all-time highs.

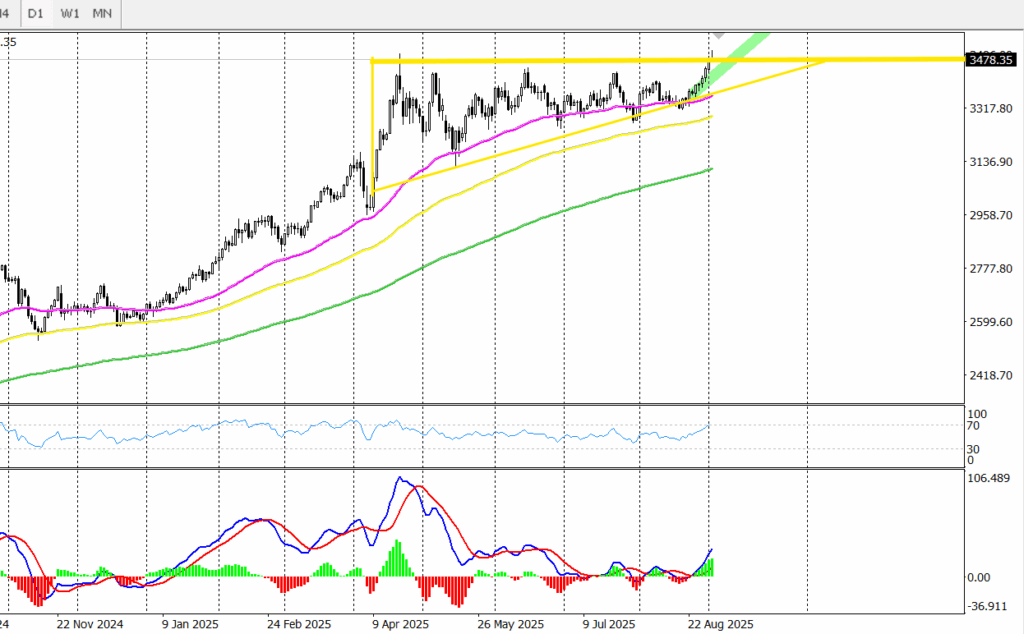

On the daily chart the price action is forming an ascending traingle, which indicates an uptrend contiuation after a clear daily close above $3440 level. you can also check yesterday’s analysis.