- Discover the key factors affecting the gold price and how the latest announcements by Trump affect XAUUSD's technical outlook.

Gold price retreats on Monday morning after Trump announces that the last appointment to conclude a trade deal with the European Union will be on July 9th. changing his mind about imposing a 50% tariff on European imports by the first of June.

XAUUSD started the week lower than last week, but this drop is partly in response to Trump’s announcement about EU tariffs. So, investors feel more positive but are still not interested enough in the safe-haven metal. The price is not falling sharply because there are other factors affecting the market.

Investors are worried about the worsening US fiscal health and the geopolitical risks, such as the Russia-Ukraine war and the continuous conflicts in the Middle East. On the other hand, the expectation is that the Federal Reserve will lower the borrowing costs, which will lead the US dollar to be bearish and limit the gold losses.

The technical Outlook for the Gold price- XAUUSD:

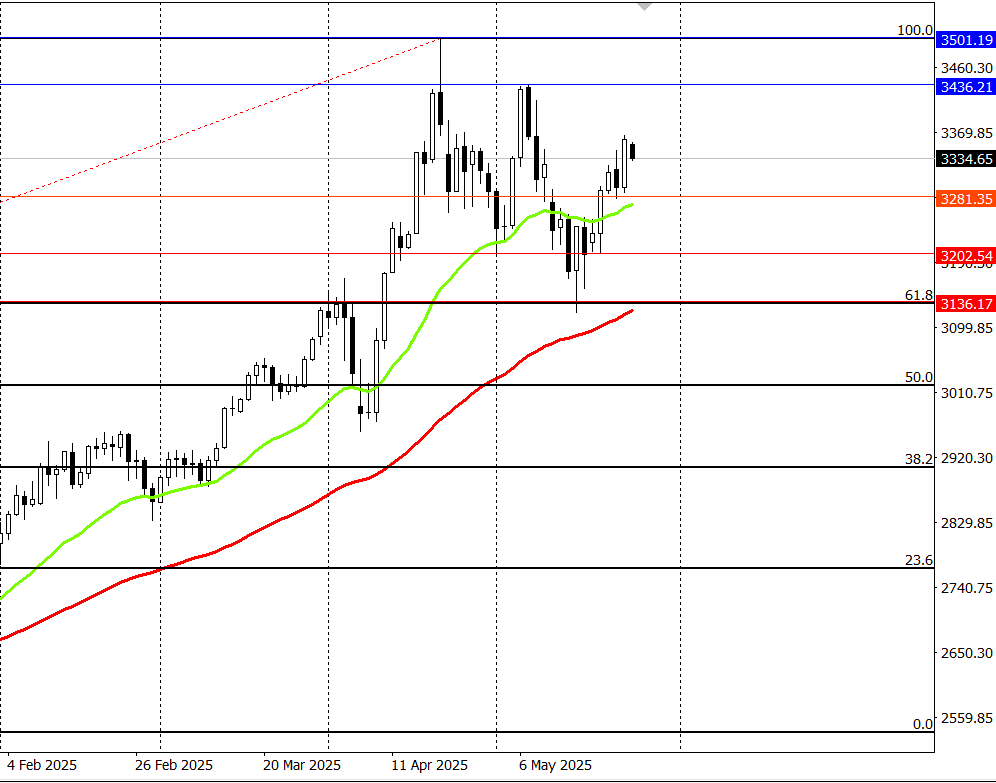

From a technical perspective, the gold price is trading on an ascending trendline, which indicates an overall positive outlook for the gold price. But the price is facing a strong resistance level at $ 3,436. If the price successfully breaks out of this level, we may reach the psychological level at $3,500. However, this needs a piece of strong positive news to allow the price to reach these levels.

On the bearish side, a convincing break below the $3,300 may drag the XAUUD towards a lower level, reaching $3280, $3200, and then $3136.

Key Gold Price Drivers:

- Trump is changing his mind about imposing 50% tariffs on the EU imports and postponing the decision until the 9th of July.

- Investors are worried that the US debt deficit could grow, adding an estimated $4 trillion to the federal primary deficit over the next decade.

- The softer numbers of the US-CPI and PPI were released earlier this week, increasing the bets that the Federal Reserve may cut interest rates by at least 25 basis points this year.

- The waiting data this week: the FOMC minutes and the Durable Goods Orders are on Wednesday. The preliminary GDP and the personal Consumption Expenditure Price Index on Thursday and Friday, respectively.