The Unilever share price is under pressure this Thursday and is down 0.54% currently. This downside move comes after the company was sued by the Ben & Jerry’s ice cream brand over the sale of its Israeli business to a local licensee. According to Ben & Jerry’s, the decision is inconsistent with its values to sell ice cream in the occupied territory of the West Bank.

Recall that this sale was reported here last week and had led to a 0.44% gain in the Unilever share price when it was announced on 29 June. The lawsuit has been filed in a District Court in Manhattan, US. It seeks to block the transfer of the business and all trademarks to the local licensee. Unilever insists the transaction is done and dusted, and it retained the right to sell the ice cream business in question.

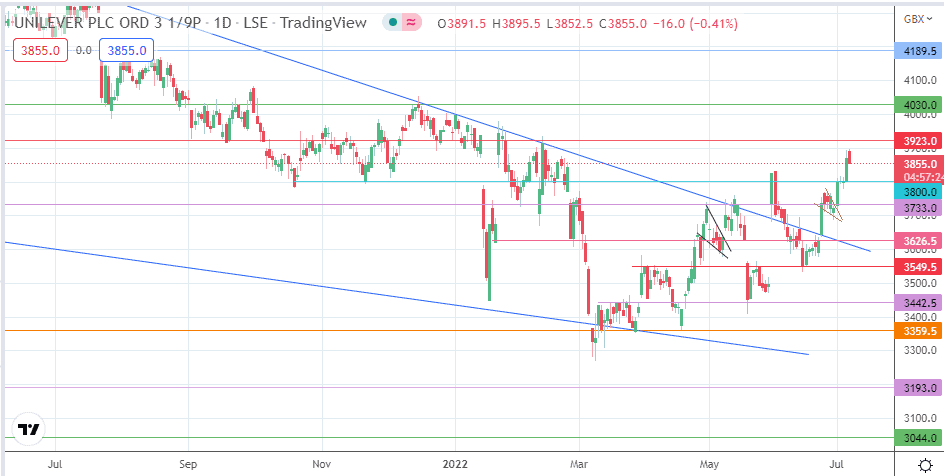

Unilever Share Price Forecast

The 3900.00 high achieved on 6 July marked the end of the bullish pennant’s measured move. This has been followed by the intraday pullback, which targets 3800.00 initially as the primary downside target. A breakdown of this border clears the pathway toward 3733.0 (16 May high and 1 July 2022 low). 3626.5 and 3549.5 (17 June low) form additional targets to the south.

On the flip side, a resumption of the uptrend move will follow the end of the current retracement. A bounce from either 3800.00 or 3733.0 ultimately has to break the 3923.0 price mark to continue the breakout move from the large falling wedge. This move must breach the 4030.0 (23 September 2021 and 10 December 2021 highs) and 4189.5 resistance levels to attain completion at 4372.5 (20 July 2021 high).

ULVR: Daily Chart