- Yes Bank share price upside momentum has taken a pause as investors manage their expectations ahead of earnings. Here's why it could resume.

Yes Bank share price traded downwards for the second session in a row as investors tamed their appetite for the stock ahead of its quarterly earnings release. The bank surged by 2.4% on Tuesday with the market buying into news that Japan’s Sumitomo Mitsui Financial Group (SMFG) intended to buy an additional 5% stake via a $1.1 billion purchase from Carlyle Group.

If approved, the investment could raise SMFG’s stake to 25%. Not only does this signal a strong confidence in the private bank’s growth prospects, but it could also strengthen its financial strength. Furthermore, SMFG could acquire $680 million worth of convertible bonds. The current Yes Bank share price infers a P/E ratio of about 26 and P/B of about 13%, which is largely in line with its mid-size bank peers.

Therefore, the renewed interest by SMFG has created a discount to intrinsic value, which makes Yes Bank (BSE: YESBANK) attractive to investors. Yes Bank share price trades above the 20, 50, 100 and 200 MA levels, affirming bullish control. However, short-term impetus will likely be tethered to its Q2 results set for release on Friday. A better-than-expected report could combine with the SMFG sentiment to bring a stronger upside propulsion, especially if the stock holds above the psychological ₹20 mark.

Yes Bank Share Price Prediction

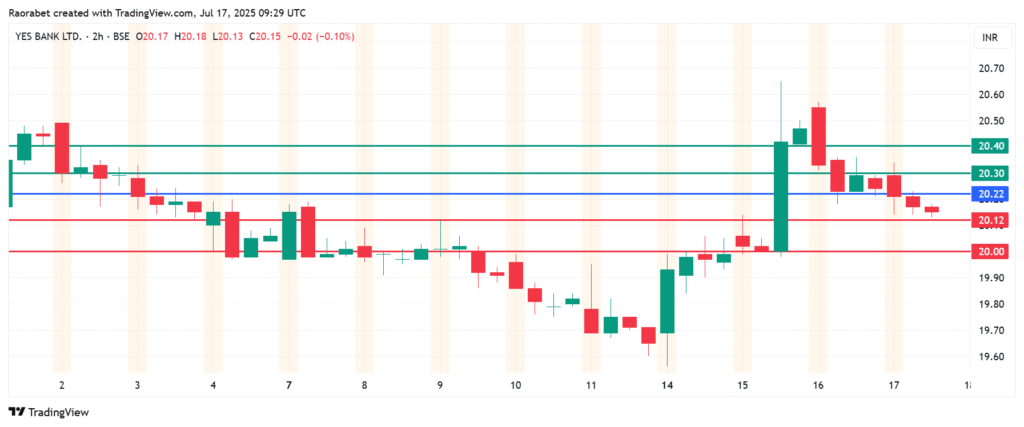

The momentum on Yes Bank share price calls for further downside below ₹20.22. That motion will likely meet the first support at ₹20.12. Breaking below that level will signal a stronger momentum that could extend the downside to test ₹20.00.

On the other hand, action above ₹20.22 will signal control by the sellers. In that case, the first resistance is likely to come at ₹20.30. The downside narrative will be invalid if the price breaks above that level. In addition, an extended control by the buyers could send the action higher and test the second barrier at ₹20.40.