- In this article, we discuss why Tesla, Barclays Bank and IAG stock prices will likely be among the top performers amid Middle East ceasefire.

News of a ceasefire has boosted investor confidence across global equities markets. We discuss why Barclays Bank, IAG and Tesla stock prices are likely to be among the top performers today.

Barclays Bank

Barclays Bank stock price upside is supported by strong fundamentals, underlined by a strong balance sheet and an ongoing £10 billion share buyback program. The stock is up by 23% year-to-date and is currently above the middle Bollinger Band on the daily chart, affirming bullish control.

In addition, the momentum on Barclays Bank stock price is supported by its cost-cutting strategy that aims to salvage £2 billion by 2026. Its recent quarterly earnings have also boosted investor confidence in the management’s move to shift focus away from capital-intensive investment banking. Instead, Barclays Bank (LSE: BARC) is putting greater effort in consistent revenue flows from consumer and corporate clients.

Barclays Bank Stock Price Prediction

Pivot: Barclays Bank stock price pivot mark is at 326p and the upside will prevail if action stays above that level.

Resistance: The stock will likely find the first barrier at 331p, beyond which the next hurdle is likely to be at 334p.

Support: The first support will likely be established at 323p. The upside narrative will be invalid below that level. That could clear the path to test 319p.

Tesla

Tesla stock price gained 8.23% on Monday and the upside momentum is likely to continue today. The stock is propelled by a successful robotaxi launch in Austin, Texas, last Sunday, and the positive sentiment around the event is likely to keep investors coming in the near-term.

CEO Elon Musk described the launch as a culmination of a decade of hard work. Tesla (NASDAQ: TSLA) investors are optimistic that this could be the beginning of a shift to a new business model with a substantial revenue stream ranging from AI-driven ride hailing to tech platform subscriptions.

However, on the downside, the US EV maker has had a tough in the vehicle market run since the year begun, with significant sales drops in China and Europe. That will likely limit the Tesla stock price upside in the medium term.

Tesla stock price prediction

Pivot: Tesla stock price pivots at $350. The RSI calls for further upside.

Resistance: First resistance will likely be at $360, second one likely at $366.

Support: Initial support likely at $343. Breaking below that level will invalidate the upside narrative and potentially clear the path to test the second support at $335.

International Consolidated Airlines Group (IAG)

IAG stock price has struggled for upside traction in the last month, declining by 0.5% in that period. However, that is likely to change following the shift in the geopolitical risks in the Middle East. News of an impending ceasefire between Israel and Iran has boosted equities across the board, but airline stocks are particularly greater beneficiaries. High oil prices, flight cancellations and airspace closures translate to losses for airline operators.

IAG stock price is sensitive to geopolitical temperatures as they often disrupt oil prices and air travel. In the case of the Middle East conflict, crude oil prices had recently spiked, with benchmark Brent crude rising by 10% in June. Also, oil-producing Iran incurred damages in some of its oil infrastructure. In addition, an escalation of the war in recent days raised the possibility of closure of the Strait of Hormuz, risking the supply of 20% of the world’s oil.

Furthermore, airspace closures had become part of the equation, with Qatar’s closure of its airways on Monday being the latest disruptor. However, a ceasefire brings a double impact on IAG stock price, with oil prices having dropped by 1.7% as of this writing.

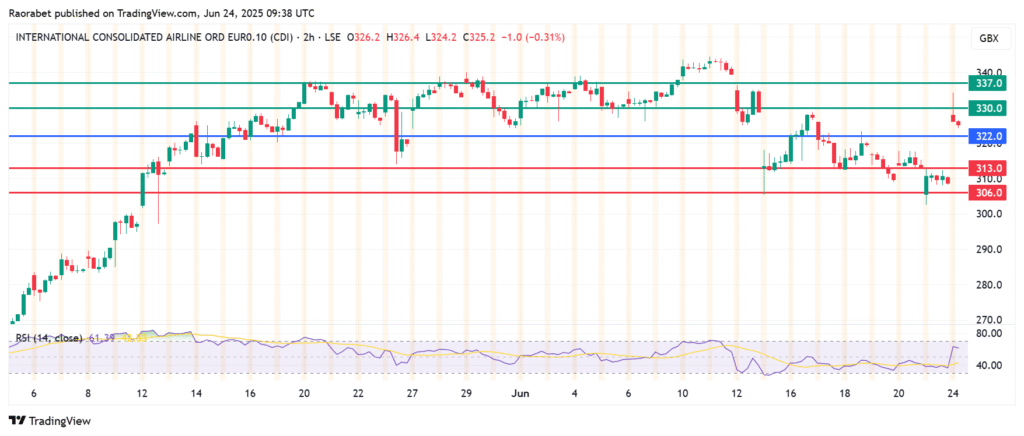

IAG stock price prediction

Pivot: IAG stock price pivots at 322p and the upside will prevail if action stays above that level. Conversely, a break below that level will favour the sellers to take control.

Resistance: Primary resistance is likely to be at 330p. Second hurdle likely at 337p.

Support: First support likely at 313p. A break below that level will invalidate the upside narrative. Second support likely at 306p.