- On top of CEO Kirby's transformative one-year reign, BT has added an industry disruptor as new CFO. What does this mean for BT share price?

BT share price extended its upside on Friday, gaining 1% at the time of writing to trade at 222p. The stock rallied more than 10% on Thursday, propelled impressive figures from its Q1FY 2026 trading update. Furthermore, the news was accompanied by the announcement of a new CFO, Patricia Cobian, who is seen as a good complement to CEO Allison Kirby.

Impressive Earnings and New CFO Bring Propulsion

BT Group (LON: BT.A) announced EBITDA of £2.05 billion in the first quarter of fiscal year 2026, in line with analysts’ expectations. Impressively, its Openreach division lost 169,000 customers, substantially lower than the forecast 356,700. Meanwhile, the division’s revenue grew by 15 to £1.56 billion.

Newly appointed CFO, Patricia Cobian (BT’s first female CFO) is currently the CFO at Virgin Media 02, where she has developed a strong reputation for financial discipline and integration success. Her hiring is seen as complimentary to CEO Kirby’s transformation agenda that has helped propel BT share price up by about 60% since her appointment in early 2024.

Kirby’s tenure is marked by operational focus on UK assets, cost cuts and dividend growth. Cobian’s hiring is seen as key to ensuring a smooth transformation as the company targets £3 billion worth of cost cuts and over 40,000 job cuts by 2030. Also, it positions the company on the right track to continue with its £15 billion fiber rollout and merger plans.

BT Share Price Prediction

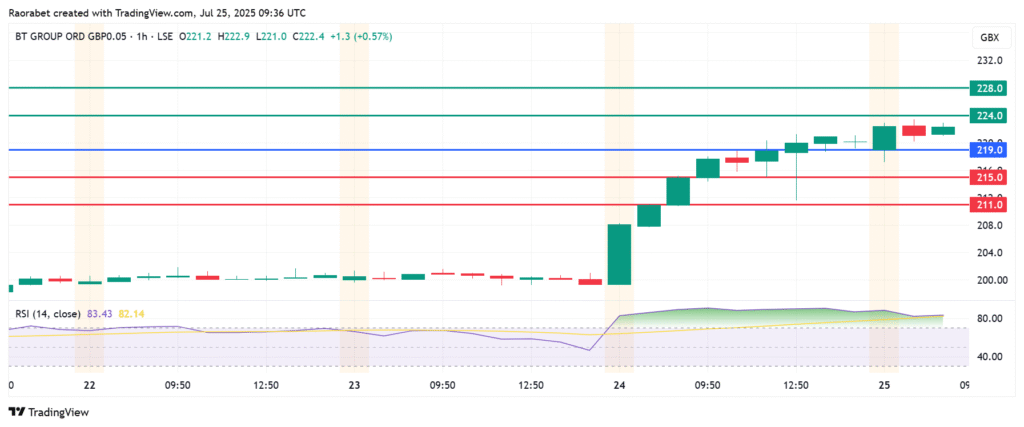

BT share price pivot mark is at 219p and the momentum calls for further upside. The stock will likely meet initial resistance at 224p. However, an extended control by the buyers will break above that level and potentially test 228p.

On the other hand, breaking below 219p will invite sellers to take control. If that happens, the first support will likely be at 215p. The upside narrative will be invalid below that level. Also, a stronger momentum could extend the downside and test 211p.