- The Bank's balance sheet and market fundamentals support further gains despite over 70% YTD gains

- Analysts projections show difficulty in repeating this year's gains in 2026, but some projections are upwards of 10%

Barclays PLC stock (LSE: BARC) has really bounced back, becoming a key story in London’s stock market this winter. Since late November 2025, the stock has jumped over 15%, getting close to its 52-week high of 462p. Is there still room for investors, or is it too late to get in? Let’s check out what’s driving the stock, its value, and what to expect going forward.

Drivers of the Recent Rally

The stock is being pushed up by better operations and good news. Barclays bumped up its expected net interest income for 2024 to £6.5 billion, which made investors more confident, as Forbes noted. They also cut costs by £1 billion, while their return on tangible equity went up to 12.5%, and earnings per share increased by 29%, the company says.

Valuation and Entry Point Considerations

At its current levels, Barclays is trading at a P/E of 11.17 and a forward P/E of 8.50, with a dividend yield of 1.89%. These numbers show the stock is still fairly priced, even after the recent rise, and is cheaper than the sector average. The market value is at £63.5 billion, showing it’s a big player. Even though the quick gains might scare off some, the basics suggest the rise is solid. Buying now could still be a good move if they keep things up, but expect some dips with market changes.

Is It Too Late to Buy?

If you’re looking at the chart and feeling a sense of “FOMO” (fear of missing out), you aren’t alone. However, the valuation metrics suggest the rally might still have legs. Even at current levels, Barclays trades at a Price-to-Book (P/B) ratio of approximately 0.71x, which is still a discount to its net asset value.

Will Barclays Carry the Success in 2026?

Analysts are mostly positive about 2026. Price targets are around 473-483 GBp, meaning a 5-10% increase from where it is now, with some going as high as 525p, as reported by TradingView and TipRanks data.

The optimism is based on keeping costs down, possibly gaining from lower interest rates boosting loan demand, and steady consumer spending. Risks include economic downturns, regulations, or changes in monetary policy. It’s unlikely they’ll repeat the big gains of 70%+ from 2025, as those kinds of returns usually settle down after a good year.

Barclays Stock Chart

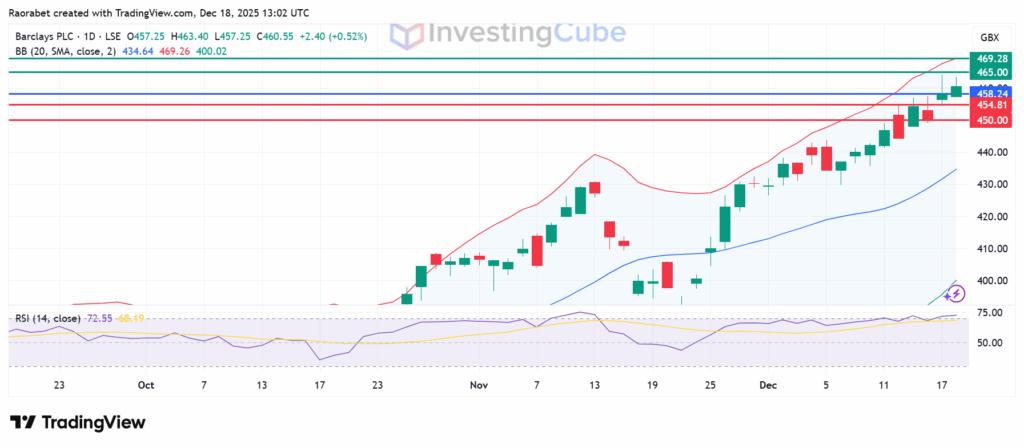

Barclays share price is still going strong. Momentum indicators point to continued buying interest, with the Relative Strength Index at 72.55, showing positive conditions but within overbought territory. Primary resistance is at 465p, beyond which a stronger momentum could test the upper Bollinger Band at 469.28. Key support levels are at 450-454p zone.

Barclays stock price daily chart with key support and resistance levels on December 18, 2025. Created on TradingView

For long-term investors, probably not. The basics look solid, and analysts see a bit of upside to 480p. TipRanks data suggests waiting for a dip could be a smarter move.

Even after gains, Barclays’ Price-to-Book ratio is about 0.71x, lower than the worth of its assets. This shows the stock is still cheap compared to what it used to be.

Probably not a full repeat of those 70% gains. However, analysts predict a 5-10% upside. If rates drop and Barclays keeps doing well, moderate growth is possible, based on what most experts think.